Global| Nov 11 2009

Global| Nov 11 2009JOLTS: U.S. Job Openings Improved While Hiring Remains Steady

by:Tom Moeller

|in:Economy in Brief

Summary

The Bureau of Labor Statistics reported in its Job Openings & Labor Turnover Survey (JOLTS) that job availability improved during September by 2.4% from August. The rise in the number of job openings followed a 0.6% August uptick that [...]

The Bureau of Labor Statistics reported in its Job Openings

& Labor Turnover Survey (JOLTS) that job availability improved

during September by 2.4% from August. The rise in the number

of job openings followed a 0.6% August uptick that was

revised from the initial report of a slight decline. Despite these

improvements, however, openings were off 25.9% from September of last

year. The series dates back to December 2000.

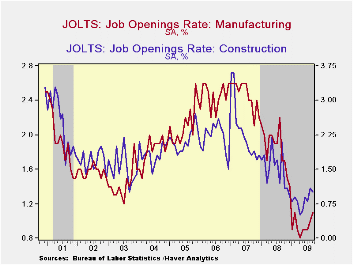

Factory sector job openings rose sharply for the second

consecutive month but they

remained down 42.4% y/y. The recent rise in the actual

number of construction sector job openings paused last month. Though

still down 59.2% y/y in September, openings were roughly double the

series' low reached in February. The

level of professional & business services job openings posted

its second consecutive monthly gain (-25.2% y/y) and education

& health sectors job openings (-12.3% y/y) reversed most of an

August decline. Openings in retail trade have risen slightly from their

April low (-9.8% y/y) while government sector job openings reflected

reduced tax revenues and fell to a new series' low (-38.1% y/y.

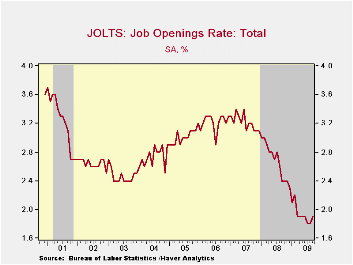

The job openings rate rose slightly from the series' low reached this summer to 1.9%. These rates were down from more than 3% in 2007. Recent gains have been led by the factory & construction sectors. The job openings rate is the number of job openings on the last business day of the month as a percent of total employment plus job openings.

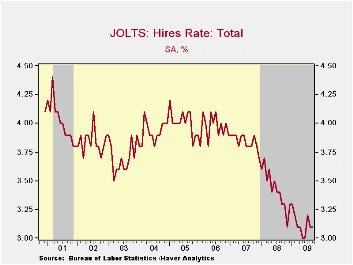

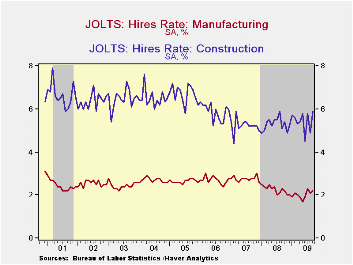

The hires rate held steady at 3.1%, up slightly from the May-June low of 3.0%, and still was nearly the lowest in the series' short eight year history.The hires rate is the number of hires during the month divided by employment.The actual number of hires also was off its low but was still down by 11.0% year-to-year. Factory sector hiring recently has picked up slightly but remains off 14.1% y/y while construction sector hiring has moved sideways since the winter (-3.3% y/y). Leisure & hospitality industry jobs fell 6.0% to a new series' low (19.8%) as did retail sector hiring (-19.1%). In the professional & business services industry hires slipped after two strong monthly gains (-11.2% y/y) while jobs in the education & health services jobs gave back the July increase but remained up 3.6% y/y.

The job separations rate remained at the

series' low of 3.3% with the actual number of separations off 11.2%

year-to-year. Separations include quits, layoffs, discharges,

and other separations as well as retirements.

The job separations rate remained at the

series' low of 3.3% with the actual number of separations off 11.2%

year-to-year. Separations include quits, layoffs, discharges,

and other separations as well as retirements.

The JOLTS survey dates only to December 2000 but has followed the movement in nonfarm payrolls, though the actual correlation between the two series is low.

A description of the Jolts survey and the latest release from the U.S. Department of Labor is available here and the figures are available in Haver's USECON database.

| JOLTS (Job Openings & Labor Turnover Survey) | September | August | Sept. '08 | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|

| Job Openings, Total | ||||||

| Rate (%) | 1.9 | 1.8 | 2.4 | 2.3 | 3.1 | 3.3 |

| Total (000s) | 2,480 | 2,423 | 3,346 | 3,224 | 4,382 | 4,606 |

| Hires, Total | ||||||

| Rate (%) | 3.1 | 3.1 | 3.3 | 41.1 | 46.1 | 47.6 |

| Total (000s) | 4,010 | 4,040 | 4,505 | 56,486 | 63,666 | 64,879 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.