Global| Mar 23 2007

Global| Mar 23 2007Land Values Increase in Japan First Time in 16 Years: Is Long Drought in Japanese Real Estate Finally Over?

Summary

Prices of land in Japan rose 0.4% from January 1, 2006, to January 1, 2007, according to a report issued late Thursday in Japan by the Ministry of Land, Infrastructure and Transport. This is the first increase in land prices since the [...]

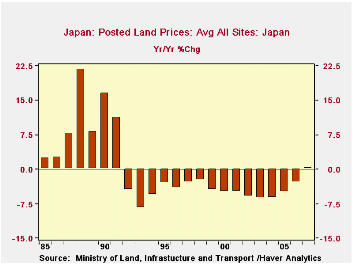

Prices of land in Japan rose 0.4% from January 1, 2006, to January 1, 2007, according to a report issued late Thursday in Japan by the Ministry of Land, Infrastructure and Transport. This is the first increase in land prices since the year to January 1, 1991, that is 16 years. Over that period, land values fell by more than half, by 52.1%, to a level last seen in 1982. The latest increase is, of course, hardly anything, but this long, excruciating decline seems to have ended, in still another sign that the Japanese economy, however haltingly, may be making further progress toward sustained expansion.

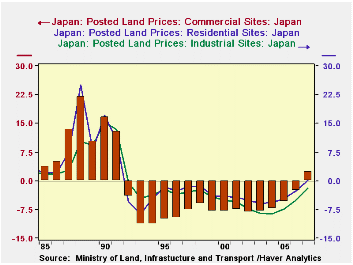

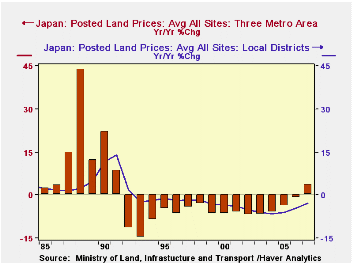

Commercial business sites showed the largest gain, up 2.3%, with a substantial 9.4% rise in the Tokyo market. These prices had also risen last year in Tokyo, by 1.0%. Residential land throughout Japan edged higher in the latest year, this by just 0.1%, with Tokyo up 3.6%, Osaka 1.8% and Nagoya 1.7%. While these three major metropolitan areas are seeing renewed strength, prices of residential sites in "local districts" were still down, by 2.7% on average. Values of so-called "prospective housing land" were also still weak, down 4.3%, implying that not much enthusiasm for new housing development has emerged. And industrial building sites, too, are still declining in value, although the decrease of 1.8% to January 1, 2007, is the smallest reduction since 1992; these values did increase in the latest reading for the three main metro areas that the Land Ministry reports. Further, property values for light industry, or "quasi-industry", did rise, also due to gains in the big cities.

Back in the 1980s, land prices were skyrocketing, and owing to the organization of Japanese real estate holdings, it was thought that the "tradable" supply of land was so small and demand for land in the vibrant Japanese economy so large that property prices might never fall. But the tight money policies in 1989 and 1990, meant to curb stock speculation as well as that in real estate, did result in a downturn in land values. Over time, it seemed the persistent cuts in property values would then, ironically, never end. But apparently they have. This is uneven, as we have seen, and has yet to pick up in the outlying, "local districts". But the first forward steps have been taken.

| JAPAN: % Change as of January 1 |

2007 | 2006 | 2005 | Average, 2000-2004 | Average, 1995-1999 |

|---|---|---|---|---|---|

| All Sites: Japan | 0.4 | -2.8 | -5.0 | -5.7 | -3.4 |

| Tokyo | 4.6 | -0.7 | -3.2 | -6.2 | -5.6 |

| Residential: Japan | 0.1 | -2.7 | -4.6 | -5.0 | -2.2 |

| Tokyo | 3.6 | -0.9 | -3.2 | -5.8 | -4.1 |

| Commercial: Japan | 2.3 | -2.7 | -5.6 | -7.8 | -8.4 |

| Tokyo | 9.4 | 1.0 | -2.5 | -7.1 | -12.8 |

| Industrial: Japan | -1.8 | -4.9 | -7.4 | -7.0 | -3.1 |

| Tokyo | 0.9 | -4.1 | -7.4 | -9.6 | -6.0 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates