Global| Sep 20 2013

Global| Sep 20 2013Lethargy Marks Italian Trade Trends

Summary

Italy's trade picture has improved relatively sharply. Its trade position has been moving strongly into surplus over more than a year now. Over the last two months, however, the improvement in the trade trend has abated somewhat as [...]

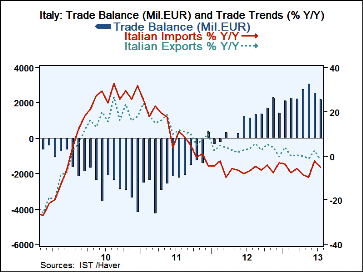

Italy's trade picture has improved relatively sharply. Its trade position has been moving strongly into surplus over more than a year now. Over the last two months, however, the improvement in the trade trend has abated somewhat as the size of the trade surplus has been withering.

Italy's trade picture has improved relatively sharply. Its trade position has been moving strongly into surplus over more than a year now. Over the last two months, however, the improvement in the trade trend has abated somewhat as the size of the trade surplus has been withering.

On the face of it, the emergence of the surplus may appear to be an indication of improved competitiveness on the part of Italy in the wake of its austerity programs and other economic reforms.

However, a closer inspection of the reason that the surplus has arisen, shows us that the driving force behind trade improvement is persistently weaker imports compared to exports. The most significant influence that austerity has had an improving the Italian trade surplus, has been in restraining domestic demand, keeping the economy weak, and in suppressing imports. That's not exactly the way we like to see it done. It certainly isn't the configuration of trade flows that suggests Italy has improved its competitiveness in any way. There has been a slight bump up in import growth compared export growth over the past couple of months and that's responsible for the recent diminishing of the reported monthly trade surpluses.

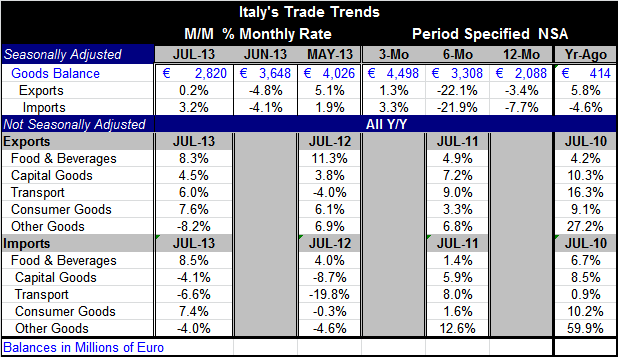

The sticking point is that growth rates do not show much life in Italian exports. If competitiveness is improved we should see it in exports. The aggregate data are seasonally adjusted. Exports are growing at a 1.3% annual rate over three months which is better than the 22.1% annual rate decline over six months and it is improved from the 3.4% decline over 12 months. However, three-months is still a short period of time and the growth rate over that span, while positive, is still weak. The three-month growth is not certain enough especially after the pronounced weakness in the previous three months (since exports are falling by 22% over three-months at an annual rate) to call that 1.3% gain `a trend.' The same is true of imports, which picked up, with 3.3% growth rate over three months after falling at a 21.9% annual rate over six-months and being down 7.7% over 12-months.

The commodity composition of trade shows a little bit more life. We calculate these details from not seasonally adjusted data and use year-over-year calculations to combat the fact that the monthly data are not seasonally adjusted. Exports on this basis show growth that extends from a low -8.2% for `other' goods to a high of 8.3% for food and beverages. For the most part the growth in the export flows is moderate. Compared to the year-over-year values in the same month one year ago, the experience this month is mixed. Imports on the same basis show growth rates that span -6.6% for transportation goods year-over-year to +8.5% for food and beverages year-over-year. There are a few more negative trends on the import side than on the export side. However, when we compare year-over-year growth rates to those same trends of one year ago, imports are showing an improvement for every category. Even those categories that are showing year-over-year declines are showing smaller declines in they did one year ago.

The message in these flows seems to be that competitiveness has not been substantially repaired because we simply don't see it in Italian exports. In imports we see pronounced weakness persisting but some improvement from year ago that suggests that it may be domestic demand is beginning to improve. This has been a theme across the Eurozone.

The recent data in Italian industrial orders (released today) show that, for July, orders fell by 0.7% led by a 2.6% drop in domestic orders with foreign orders up by 1.8%. While some of the PMI data may suggest that the Italian economy is recovering, doestic industrial orders are falling by 2.6% in July and industrial sales are off by 0.8%. Foreign orders are up by 1.8%. The foreign sector seems to be providing some driving force to Italian industry even though Italian exports don't really show much lift.

Part of this though may be volatility. although at the moment a look at broader trends doesn't exactly clear the view. Over three months domestic orders are up by 2.4% while foreign orders are up by 4.5%. Over six months foreign orders are stronger up by 7.2% while domestic orders are dropping at a 5% annual rate. Over 12 months foreign orders are net-positive rising by 1.2% while domestic orders are lower by 8.3%. It's really hard to find a theme that says good things about the Italian domestic economy.

Although, the trend for industrial sales shows a trend of improvement. Over three-months the growth of sales is at a 0.4% annual rate compared to -2.4% over six months and -3.6% over 12 months. Sales suggest that there some ongoing improvements in the domestic economy. Domestic orders echo that sense of progress, even though domestic orders trends continue to lag behind foreign trends (except over three months). Domestic orders are improving from -8.3% growth over 12-months to -5% over six-months to +2.4% over 3-months. That's a clear trend, it is positive, and it echoes the similar pattern in domestic sales.

The bottom line for Italy is that the economy is still quite lethargic and while there may be some improving trends, improvement is definitely a relative phenomenon; any assessment of the absolute state of the economy still quite negative.

Of course when the economy is quite weak this is sort of transition that will have to occur before the economy restores itself to outright positive conditions. Still, improvement in Italy is very slow and it seems to be erratic and it still too soon to be too sure of how improved in the Italian economy will be. What we see most strongly in these data is that the domestic economy is beginning to stir more than that competitiveness has been restored. And for the Mediterranean countries this is going to continue to be an ongoing issue. Growth is needed, but improved competiveness will be the key to keeping improved growth on track.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.