Global| Jun 17 2002

Global| Jun 17 2002Liquidity Improved in May

by:Tom Moeller

|in:Economy in Brief

Summary

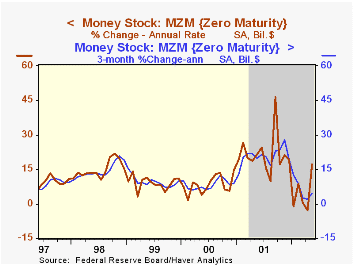

Growth in the monetary aggregates, both broad and narrow, surged last month. The surge, however, was only back to a monthly rate of growth often observed through 2001. Earlier in 2002, growth in monetary aggregates slowed [...]

Growth in the monetary aggregates, both broad and narrow, surged last month. The surge, however, was only back to a monthly rate of growth often observed through 2001.

Earlier in 2002, growth in monetary aggregates slowed dramatically. Therefore, on a three-month basis, liquidity growth remained depressed.

The surge in May was due mostly to a shift in "other checkable deposits" which had dropped sharply in April but resumed growing in May. That added to a surge in retail money funds and savings deposits.

| Money Supply | May | April | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| M2 | 1.2% | -0.3% | 7.9% | 8.8% | 6.1% | 7.6% |

| M3 | -0.9% | -0.2% | 7.8% | 11.5% | 9.4% | 8.7% |

| MZM | 1.3% | -0.2% | 14.0% | 15.9% | 8.1% | 12.4% |

by Tom Moeller June 17, 2002

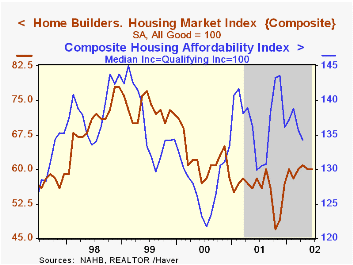

The Nat'l Association of Home Builders index of new home sales remained unchanged in June versus May, which was revised down slightly.

The index components for both current and expected new home sales have been flat-to-lower for most of this year.

During the last fifteen years there has been a 70% correlation between the annual percent change in the NAHB Index and the change in new home sales.

| June | May | Y/Y | 2001 | 2000 | 1999 | |

|---|---|---|---|---|---|---|

| Housing Market Index | 60 | 60 | 58 | 56 | 62 | 73 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates