Global| Jul 18 2006

Global| Jul 18 2006More German Investors Confident about Current Conditions but Many More Wary of the Future

Summary

The ZEW institute of economic research polls some 300 institutional investors and analysts regarding their views of the current situation and their expectations of activity six months in the future. The excess of optimists over [...]

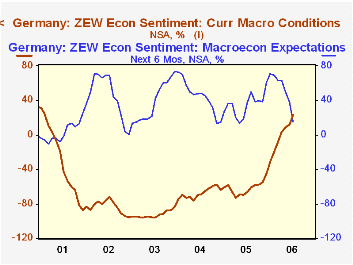

The ZEW institute of economic research polls some 300 institutional investors and analysts regarding their views of the current situation and their expectations of activity six months in the future. The excess of optimists over pessimists among the participants appraising the current situation rose to 23.3% from 11.8% in May. A year ago, in July, 2005, there was an excess of pessimists over optimists of 61.8%. There has been a steady improvement in the appraisal of current conditions since mid 2005.

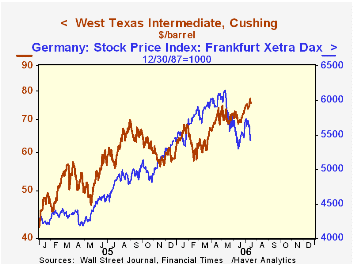

While the participants have become more positive about current economic conditions, they have become less positive about the outlook six months ahead as can be seen in the first chart. The excess of optimists over pessimists dropped 22.7 percentage points from 37,8% in June to 15.1% in July, the biggest drop since August,2002. For the first time, the six month horizon extends to 2007, when the value added tax (VAT) is scheduled to increase from 16% to 19% and health care contributions will be increased. In addition, the latest poll was conducted between June 26 and July 17. Towards the end of this period, the crisis in the mid east erupted leading to a jump in oil prices and a fall in stock market prices. The daily prices of the German Dax stock index and the prices of spot Brent crude oil are shown in the second chart. During the period June 26 to July 17, 2006, the oil price rose from an low of 69.69 on June 26 to just over 8% on July 17th. The stock market fell 5.5% from its high to July 17th.

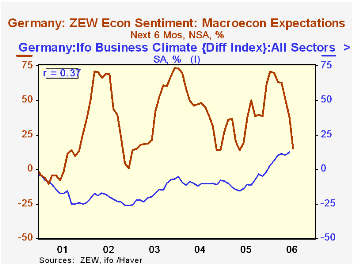

The ZEW indicator is sometimes thought to be a good indicator of the broader IFO Institute's survey, which usually comes out 10 to 15 days later. In fact there is little correlation between the two series as shown in the third chart. The third chart suggests that different temperaments of the participants in the two surveys may account for some of the divergence. The financial community whose opinions color the ZEW results, tend to be more volatile than those of the business community whose opinions are reflected in the IFO survey.

| ZEW Survey | Jul 06 | Jun 06 | Jul 05 | M/M Dif | Y/Y Dif | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|---|---|

| Current Conditions % bal | 23.3 | 11.9 | -66.9 | 11.2 | 90.0 | -61.7 | -67.7 | -92.3 |

| Expectations 6 Mo Ahead | 15.1 | 37.8 | 32.0 | -22.7 | -21.9 | 34.8 | 44.6 | 38.4 |

| Change in Stock Prices and Oil | 7/17 | High or Low 6/27-7/17 | % Change | -- | -- | -- | -- | -- |

| German Stock Price DAX 12/30/87=1000) | 5416.96 | 5729.01H | -5.45 | -- | -- | -- | -- | -- |

| Spot Price of Oil-Brent $per bbl | 75.30 | 69.69L | 8.05 | -- | -- | -- | -- | -- |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates