Global| Apr 19 2005

Global| Apr 19 2005More Gloom from Germany

Summary

After becoming slightly more optimistic regarding the German economic outlook six months ahead in each of the first three months of this year, the institutional investors and analysts who respond to the ZEW survey became decidedly [...]

After becoming slightly more optimistic regarding the German economic outlook six months ahead in each of the first three months of this year, the institutional investors and analysts who respond to the ZEW survey became decidedly more pessimistic in April. The excess of optimists over pessimists dropped to 20.1% in April from 36.3% in March and from 59.1% a year ago.

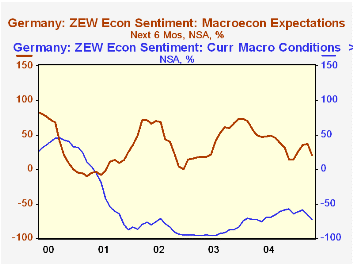

The same but more pessimistic trend is apparent in the respondents' view of current conditions in Germany. In April, the percentage of respondents who considered current conditions bad was 73% greater than those who considered them good. The -73% figure compares with -66% in March and -72.5% in April of last year. In general, pessimistic appraisals of current conditions tend to outweigh the optimistic appraisals, while optimistic appraisals of expectations of future conditions tend to outweigh the pessimistic appraisals, as can be seen in the attached chart. ("Hope springs eternal in the human breast./ Man never is, but always to be, blest.")

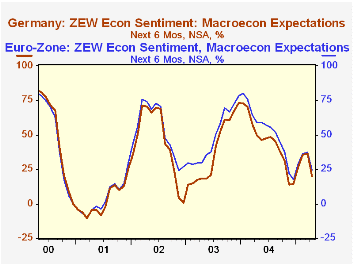

The ZEW survey also covers opinions on current conditions and expectations in the Euro zone as a whole. Since Germany represents such a large part of the Euro zone, it is not surprising that appraisals of current conditions and expectations in the Euro Zone tend to be similar to those of Germany. Expectations of economic conditions in Germany and in the Euro Zone are shown in the second chart.

With their pessimistic outlook for the economy, the institutional investors and analysts see little to cheer about in the profit outlook. There are only three industries, banking, telecommunications and information technology, in which the optimists outweigh the pessimists by more than 50%. The profit expectations for selected industries are shown in the table below.

| GERMANY % | Apr 05 | Mar 05 | Mar 04 | M/M Dif | Y/Y Dif | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|---|---|

| Expectations | 20.1 | 36.3 | 49.7 | -16.2 | -29.6 | 49.6 | 38.4 | 45.3 |

| Current conditions | -73.0 | -66.0 | -42.5 | -7.0 | -0.5 | -67.7 | -92.6 | -83.3 |

| Profit expectations | ||||||||

| Banking | 52.4 | 55.5 | 67.2 | -3.1 | -14.8 | 59.6 | 30.5 | -8.4 |

| Telecommunications | 51.1 | 56.5 | 69.2 | -5.4 | -18.1 | 62.5 | 49.7 | 9.8 |

| Information technology | 52.5 | 59.4 | 71.9 | -6.9 | -19.4 | 63.0 | 45.2 | 17.6 |

| Consumer/trade | -26.9 | -22.6 | -13.7 | -4.3 | -13.2 | -18.2 | -33.7 | -28.9 |

| Machinery | 37.3 | 45.6 | 52.4 | -8.3 | -15.1 | 53.4 | 7.0 | 5.4 |

| Vehicle/automotive | -19.0 | -2.9 | 5.9 | -16.1 | -24.9 | -0.1 | -8.2 | -6.0 |

| EURO ZONE % | ||||||||

| Expectations | 24.6 | 37.3 | 59.1 | -12.7 | -34.5 | 52.1 | 48.9 | 53.1 |

| Current conditions | -32.8 | -24.8 | -55.4 | -5.0 | 21.6 | -41.4 | -78.5 | 67.5 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates