Global| Jun 18 2020

Global| Jun 18 2020More QE from the BoE

by:Andrew Cates

|in:Economy in Brief

Summary

The Bank of England’s (BoE) decision to expand its quantitative easing programme today by Ł100bln was not a big surprise for financial market participants. The incoming dataflow in recent days has offered an unambiguously bleak [...]

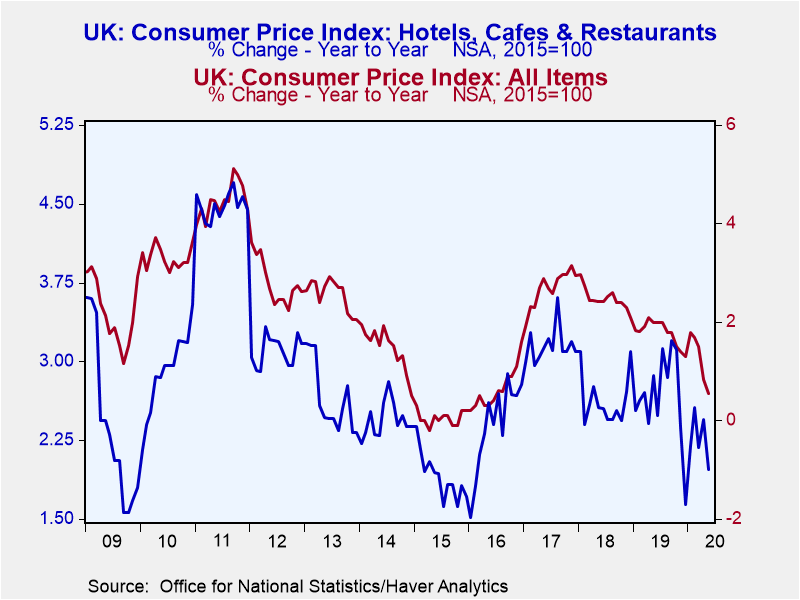

The Bank of England’s (BoE) decision to expand its quantitative easing programme today by £100bln was not a big surprise for financial market participants. The incoming dataflow in recent days has offered an unambiguously bleak picture of the UK economy. For example, in the labour market the claimant count measure of unemployment rate spiked up to 7.8% in May, that's more than double the rate of 3.5% recorded in March. And this combined with another big fall in private sector wages which are now down by some 4% since the start of the year (see first chart). Household income generation will be key to how any economy recovers from the Coronavirus in the coming months. While the UK government's recent decision to extend its job retention scheme – designed to support firms and laid-off workers – to October has been welcomed, the underlying weakness of the labour market and the impact this has had so far on wage formation are clearly a concern.

The Bank of England’s (BoE) decision to expand its quantitative easing programme today by £100bln was not a big surprise for financial market participants. The incoming dataflow in recent days has offered an unambiguously bleak picture of the UK economy. For example, in the labour market the claimant count measure of unemployment rate spiked up to 7.8% in May, that's more than double the rate of 3.5% recorded in March. And this combined with another big fall in private sector wages which are now down by some 4% since the start of the year (see first chart). Household income generation will be key to how any economy recovers from the Coronavirus in the coming months. While the UK government's recent decision to extend its job retention scheme – designed to support firms and laid-off workers – to October has been welcomed, the underlying weakness of the labour market and the impact this has had so far on wage formation are clearly a concern.

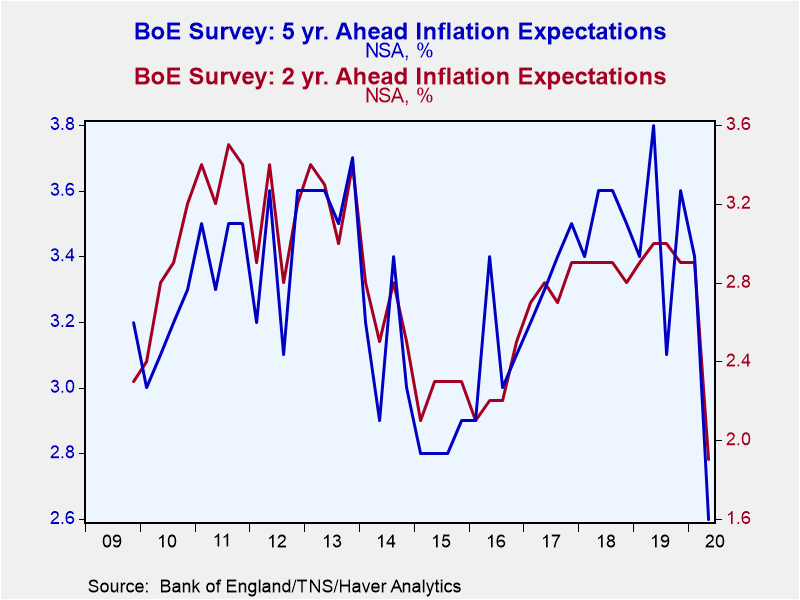

This week's news on the broader inflation front may also have been greeted with some disquiet by BoE officials. The headline CPI print, for example, fell from 0.8% in April to 0.5% in May and with underlying details that suggest weaker demand and excess capacity are taking their toll (see second chart). There are admittedly some good reasons for being a little circumspect about some of this inflation data. Hotels and catering – sectors which have naturally been severely affected by the UK's lockdown - took a big slice off core inflation in May, for example. Yet there are big problems in how statisticians are collecting and recording price data from sectors such as these at present.

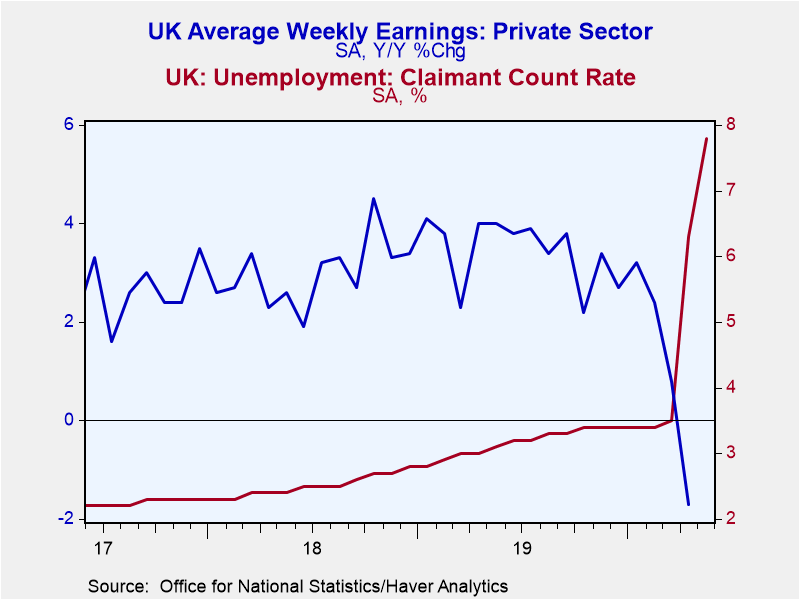

Nevertheless what's harder to dispute is how the UK's economic plight is generating a sizeable retreat in the public's inflation expectations. This week's survey from the BoE showed the biggest decline in longer-term inflation expectations on record as well as an outsized decline in 2 year ahead expectations (see third chart). The heightened risk that those expectations unhinge further to the downside was clearly one important reason why the BoE acted to shore up the economy with further asset purchases.

In other UK news this week non-essential shops re-opened. Plans for the leisure and hospitability sector to re-open in early July in the meantime remain intact. Combined with the sizeable degree of fiscal and monetary policy stimulus that's already been enacted there are some good reasons for believing the incoming growth (and inflation) data will improve from here. Still, as already articulated, household income generation arguably holds the key and a return to normality in the labour market remains difficult to foresee in the immediate months ahead.

Andrew Cates

AuthorMore in Author Profile »Andy Cates joined Haver Analytics as a Senior Economist in 2020. Andy has more than 25 years of experience forecasting the global economic outlook and in assessing the implications for policy settings and financial markets. He has held various senior positions in London in a number of Investment Banks including as Head of Developed Markets Economics at Nomura and as Chief Eurozone Economist at RBS. These followed a spell of 21 years as Senior International Economist at UBS, 5 of which were spent in Singapore. Prior to his time in financial services Andy was a UK economist at HM Treasury in London holding positions in the domestic forecasting and macroeconomic modelling units. He has a BA in Economics from the University of York and an MSc in Economics and Econometrics from the University of Southampton.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates