Global| Sep 12 2006

Global| Sep 12 2006More Signs of Trouble Ahead for the Japanese Economy

Summary

Yesterday we reported a fall in Japanese machine orders in July. Today's releases of a rise in corporate goods prices (formerly wholesale prices) and a slight deterioration in consumer confidence in August are two more indicators that [...]

Yesterday we reported a fall in Japanese machine orders in July. Today's releases of a rise in corporate goods prices (formerly wholesale prices) and a slight deterioration in consumer confidence in August are two more indicators that suggest that the outlook for Japan's economy is becoming less sanguine.

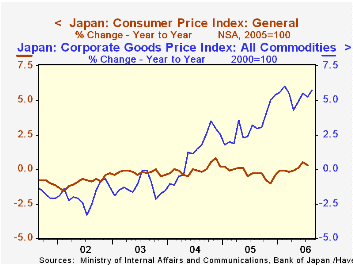

Corporate goods prices rose 0.6% from July to August and were 5.8% above August, 2005. The principal cause of the rise in the total index has been the prices of imported goods, particularly petroleum and metals. Prices of Chemicals and Related Goods rose 2.8% in the month of August and were 13.6% above August, 2005. The comparable figures for Metals and Related Products were 0.1% and 25.2%. The year to year increases in the total Corporate Goods Prices Index and the year to year increases in the price index of imported Metals and Related products is shown in the first chart.

Apparently, Japanese businessmen have had trouble passing their rising costs on to the consumer. The second chart compares the year to year price increases in the Corporate Goods Price Index with those of the Consumer Price Index. It is clear that the increases in corporate prices have had little impact on the consumer prices. The inability to pass on higher costs will affect corporate profits negatively.

Consistent data on consumer confidence in Japan are available only from April, 2004 when the Economic and Social Research Institute of the Cabinet integrated the Consumer Confidence Survey, the Monthly Consumer Confidence Survey, and the One-person household Consumer Confidence Survey into the current survey. Consumer confidence is based on consumers' appraisals of their overall livelihood, income growth, employment, and willingness to purchase durable goods and is expressed in a diffusion index. Ever since the inception of the series, the index has remained below the 50 level, suggesting that, on balance, pessimists outweigh optimists. The index was 47.8 in August, down from 48.6 in July and from 48.4 in August, 2005. The available data are plotted in the third chart. It appears that the improvement in confidence that began in early 2005.may be at an end.

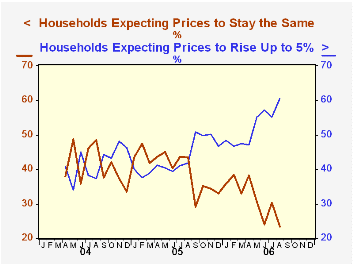

Although business seems to have trouble passing on its increased cost to consumers, a majority of consumers now expect prices to rise year from now. As shown in the third chart almost 60% of the households expect prices to rise up to 5% over the next year and 23.4% expect prices to remain unchanged. A year ago, in August, 2005, 41.8% expected prices to rise up to 5% and 43.4% expected prices to remain unchanged. In the chart we have added the percent of households expecting prices to rise up to 2% and those expecting prices to rise by more than 2%, but less than 5% and compared this series with the percent of households expecting prices to remain the same.

| Japan | Aug 06 | Jul 06 | Aug 05 | M/M% | Y/Y% | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|---|---|

| Corporate Goods Prices (2000=100) | 106.6 | 106.0 | 100.8 | 0.87 | 5.75 | 100.1 | 97.1 | 96.0 |

| Domestic Prices | 101.5 | 101.3 | 98.2 | 0.20 | 3.36 | 97.7 | 96.1 | 94.9 |

| Export Prices | 104.0 | 103.3 | 98.4 | 0.68 | 5.69 | 98.3 | 95.4 | 97.8 |

| Import Prices | 143.1 | 140.2 | 120.8 | 2.07 | 18.46 | 118.0 | 104.3 | 100.1 |

| Chemical & Related Prices | 141.0 | 137.2 | 124.1 | 2.77 | 13.62 | 123.5 | 114.7 | 104.1 |

| Metals & Related Prices | 195.1 | 193.2 | 155.8 | 0.98 | 25.22 | 153.6 | 130.3 | 110.3 |

| Consumer Confidence (Diffusion Index) | 47.8 | 48.6 | 48.4 | -1.65 | -1.24 | 47.3 | n.a. | n.a. |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates