Global| Jan 09 2007

Global| Jan 09 2007Mostly Positive News from Germany

Summary

Recent data from Germany are generally positive. Exports, while still strong, declined slightly in November from 80.9 billion euros in October to 80.5 billion euros--the result perhaps of the strong euro. However, imports declined by [...]

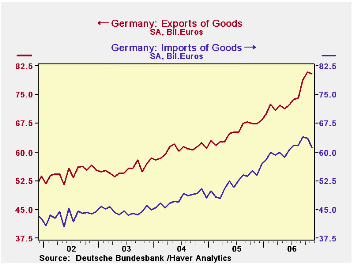

Recent data from Germany are generally positive. Exports, while still strong, declined slightly in November from 80.9 billion euros in October to 80.5 billion euros--the result perhaps of the strong euro. However, imports declined by an even greater amount from 63.6 billion euros in October to 61.2 billion euros in November with the result that the trade balance increased to !9.3 billion euros from 17.3 billion euros in October. The first chart shows German exports and imports of goods.

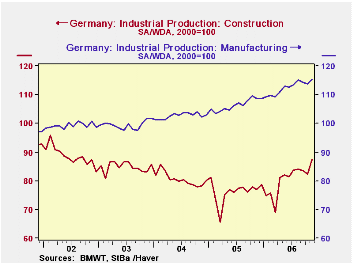

Industrial production in November increased 1.8% from October and was 6.1% above November, 2005. Construction, which, earlier this year, appeared to have bottomed out, was particularly strong--up 6.2% in November and 13.4% above November, 2005--due in part to the unseasonally warm weather. Production in manufacturing, however, also increased 1.5% from October and 6.2$ from November, 2005. The second chart shows German industrial production in construction and manufacturing.

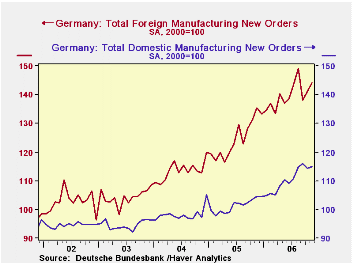

In spite of the deceleration in exports in November, the value of foreign manufacturing new orders increased 2.1% in November and were 6.4% above November, 2005. Domestic new orders increased only 0.6% in November from October, but were 9.9% above November, 2005. In the third chart, showing domestic and foreign new manufacturing orders, it can be seen that domestic new orders began to strengthen back in mid 2005 and to accelerate in the second quarter of 2006.

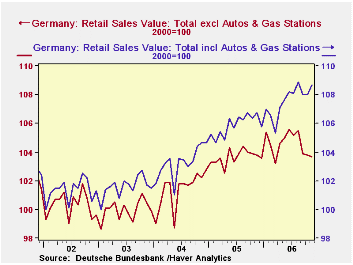

Retail sales have been the soft spot in the German economy. In view of the increased employment, noted earlier by Carol Stone, and the increase in the Value Added Tax on January 1, 2007, expectations had been for strong retail sales in the final months of 2006. Retail sales excluding autos and related stores, however, declined 1.5% in September, 0.1% in October and 0.1% again in November. Sales including autos and related stores did not fare much better. They were, respectively, -0.8%, 0.0% and 0.7%. The fourth chart shows retail sales excluding and including autos and related stores. The widening gap between the two series in recent months suggests that the impending increase in the VAT may have had at least stimulated purchases of autos.(We have rebased the retail sales from 2003=100 to 2000=100 to facilitate comparisons with the Industrial Production and New Orders data.)

| GERMANY | Nov 06 | Oct 06 | Nov 05 | M/M % | Y/Y % | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|---|---|

| Exports (Bil Euro) | 80.46 | 80.87 | 67.33 | -0.51 | 19.50 | 783.62 | 727.41 | 666.78 |

| Imports (Bil Euro) | 61.17 | 63.58 | 52.82 | -3.79 | 13.66 | 625.87 | 572.60 | 535.83 |

| Balance on Goods (Bil Euro) | 19.29 | 17.29 | 13.51 | 2.00* | 5.78* | 157.75 | 154.81 | 130.95 |

| Industrial Production (2000=100) | 112.0 | 110.0 | 105.6 | 1.82 | 6.06 | 103.7 | 100.8 | 98.4 |

| Manufacturing | 115.4 | 113.7 | 108.7 | 1.50 | 6.16 | 106.4 | 102.7 | 99.5 |

| Construction | 87.9 | 82.3 | 72.1 | 6.20 | 13.36 | 76.7 | 80.6 | 84.9 |

| Mfg New Orders Value (2000=100) | 128.0 | 126.3 | 118.3 | 1.35 | 8.20 | 111.7 | 105.0 | 99.0 |

| Domestic | 115.0 | 114.3 | 104.6 | 0.61 | 9.94 | 101.4 | 98.3 | 94.6 |

| Foreign | 144.2 | 141.3 | 135.5 | 2.05 | 6.42 | 124.6 | 113.5 | 104.4 |

| Retail Sales excl autos, etc (2000=100) | 103.7 | 103.8 | 103.8 | -0.10 | -0.10 | 103.7 | 101.4 | 100.0 |

| Retail Sales incl autos, etc (2000=100) | 107.2 | 106.5 | 105.3 | 0.66 | 1.80 | 104.4 | 101.9 | 100.2 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates