Global| May 15 2006

Global| May 15 2006NAHB Housing Market Index Lowest Since 1995

by:Tom Moeller

|in:Economy in Brief

Summary

The National Association of Home Builders' (NAHB) reported that the May Composite Housing Market Index dropped 11.8% from April to the lowest level since June 1995. The figure was quite a bit weaker than Consensus expectations for [...]

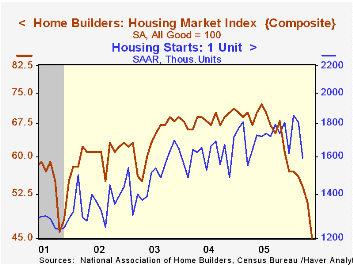

The National Association of Home Builders' (NAHB) reported that the May Composite Housing Market Index dropped 11.8% from April to the lowest level since June 1995. The figure was quite a bit weaker than Consensus expectations for stability at 50 and was one-third below the level of May 2005.

During the last twenty years there has been an 82% correlation between the y/y change in the annual composite index and the change in single family housing starts and there has been a 75% correlation between the current sales index and new single family home sales.

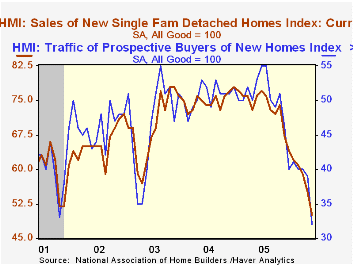

The sub indexes covering current sales of single family homes (-34.2% y/y) and sales in six months (-29.9% y/y) both fell roughly 9% month-to-month.

An index of the traffic of prospective home buyers plunged 17.9% m/m, also to more than a ten year low (-39.6% y/y).

Housing markets around the country weakened in May with the index for the Northeast off 6.0% (-32.9% y/y) and in the Midwest it fell 6.3% (-40.0% y/y). Out West the housing market index dropped 11.6% (-27.4% y/y) and in the South it fell 10.5% (-32.0% y/y).

The NAHB index is a diffusion index based on a survey of builders. Readings above 50 signal that more builders view conditions as good than poor.

Visit the National Association of Home Builders.

| Nat'l Association of Home Builders | May | April | May '05 | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|

| Composite Housing Market Index | 45 | 51 | 70 | 67 | 68 | 64 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.