Global| Oct 26 2009

Global| Oct 26 2009National Association For Business Economics Indicates Demand, Profits and Employment Improved

by:Tom Moeller

|in:Economy in Brief

Summary

The National Association For Business Economics (NABE) indicated in its latest Industry Survey that U.S. economic conditions showed broad-based improvement during the last three months. That gain was paced by improvement in unit [...]

The National Association For Business Economics (NABE) indicated in its latest Industry Survey that U.S. economic conditions showed broad-based improvement during the last three months. That gain was paced by improvement in unit demand and profit margins.

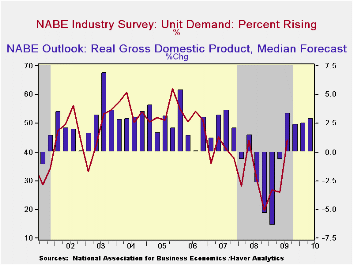

The net percentage of firms reporting higher demand rose to

23.4% which was the highest level in over one year. The improvement

came as 44.2% of firms indicated higher demand but only 20.8% showed

demand falling during 3Q. That was down from nearly half reporting

lower demand at the end of last year. Overall economic growth

through the end of next year is expected to average 3%.

The net percentage of firms reporting higher demand rose to

23.4% which was the highest level in over one year. The improvement

came as 44.2% of firms indicated higher demand but only 20.8% showed

demand falling during 3Q. That was down from nearly half reporting

lower demand at the end of last year. Overall economic growth

through the end of next year is expected to average 3%.

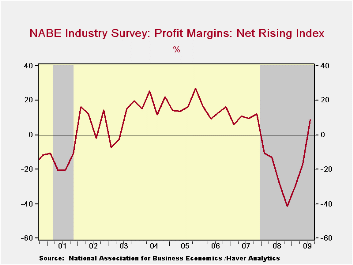

Higher net-profit margins were indicated by firms for the

first time since the fourth quarter of 2007. Thirty-six percent of

firms indicated higher margins, up from 10% during 4Q08, while a

reduced 27% reported lower margins.

Higher net-profit margins were indicated by firms for the

first time since the fourth quarter of 2007. Thirty-six percent of

firms indicated higher margins, up from 10% during 4Q08, while a

reduced 27% reported lower margins.

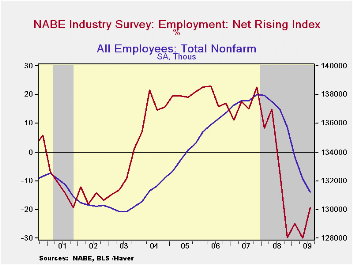

While still negative, net-employment improved materially as 12% of firms reported higher employment, double the low of last quarter, and a much-reduced 31% reported lower hiring.

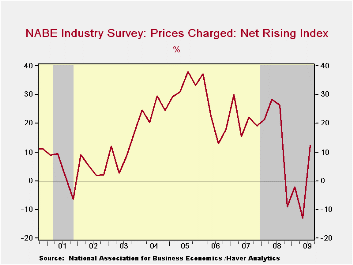

With the improvement in economic conditions, NABE indicated

that pricing power improved. The net-reading of 12% was the highest

level in one year as 23% reported higher prices and a reduced 11%

reported lower prices. Rising capital spending was indicated by firms

for the first time in one year as 26% showed higher spending while a

reduced 22% reported lower spending.

With the improvement in economic conditions, NABE indicated

that pricing power improved. The net-reading of 12% was the highest

level in one year as 23% reported higher prices and a reduced 11%

reported lower prices. Rising capital spending was indicated by firms

for the first time in one year as 26% showed higher spending while a

reduced 22% reported lower spending.

The NABE Industry Survey can be found in Haver's SURVEYS

database.

| Nat'l Assn. For Business Economics 3Q Industry Survey (Net Rising Index, %) | 3Q09 | 2Q09 | 1Q09 | 4Q08 |

|---|---|---|---|---|

| Unit Demand | 23.4 | -5.0 | -14.3 | -27.5 |

| Profit Margins | 8.7 | -17.0 | -30.4 | -41.2 |

| Employment | -19.2 | -30.0 | -25.0 | -29.8 |

| Prices Charged | 12.2 | -12.9 | -2.0 | -9.0 |

| Capital Spending | 4.2 | -23.6 | -15.8 | -26.0 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates