Global| Oct 10 2007

Global| Oct 10 2007New Bank of England Credit Survey Shows Tightening Availability Amidst Mixed Demand from Borrowers

Summary

Last Friday, we wrote here about the current ECB survey of bank lending policies. A couple of weeks ago, the Bank of England published the first results of a similar, brand new survey of bank and nonbank lenders in the UK. These [...]

Last Friday, we wrote here about the current ECB survey of bank lending policies. A couple of weeks ago, the Bank of England published the first results of a similar, brand new survey of bank and nonbank lenders in the UK. These survey results for Q2 and Q3 were published together on September 26 and they were added to Haver's UK database this past Monday. Survey questions cover secured loans to households and small business, unsecured loans to households and small business and overall lending to corporations, each queried for the lenders' experience over the past three months and their expectations for the coming three months. The Q2 survey was taken between May 21 and June 14 and Q3 between August 20 and September 13. Here is a brief summary of what the survey showed. Keep in mind that there are just two datapoints for each item so far; responses are shown as net balance figures compiled from a 5-point rating scheme: down or negative a lot, down a little, unchanged, up a little and up a lot.

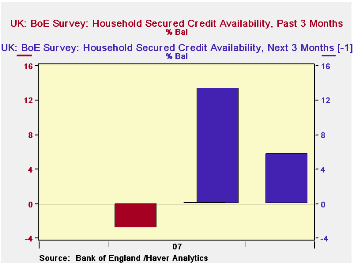

Secured Lending to Households. Lenders reported in June that they had reduced the availability of secured credit to households just slightly during the spring, with a reading of -2.9 on this question. They expected then to increase availability distinctly over the summer, with a "next 3 months" reading of +13.4. However, by the September survey dates, it turns out that this credit supply was basically unchanged, at +0.1, but lenders still expect to be somewhat more liberal in the coming months, at +5.8. Changes in the economic outlook and in the lenders' views on risk are the main factors making secured credit less available than expected in Q3. On the demand side, developments were mixed: demand for credit for house purchase, whether for owner-occupied or "buy-to-let", was stronger (or less weak) than expected in Q3, but demand for "remortgaging" and other secured credit was less than expected. Other survey questions cover pricing, including both spreads and fees and other lending terms.

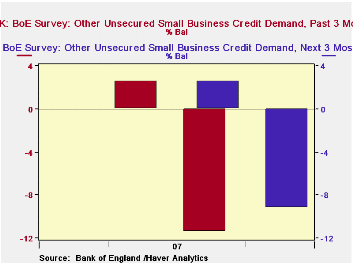

Unsecured Lending to Households. In June, lenders said they had been restrictive on balance in granting unsecured credit to households during Q2, with a reading of -14.3, but they were planning to be more liberal, at +4.9, over the summer. However, as it turned out, they remained restrictive in Q3, again showing a double-digit negative, at -10.2. Further, they expected to remain a little tight in Q4 at -2.9. At the same time, the proportion of loan applications approved has gone up. Compared with the expectation of +5.2, the Q3 outcome was +15.0; both credit card and "other" unsecured loan categories had this general pattern. Demand for this type of borrowing was mildly weaker than expected, showing slightly negative readings in contrast to expectations of small positives. Small business credit demand was more clearly negative than expected. Pricing, i.e., spreads, was more favorable for lending in Q3 than in Q2 and also more favorable than had been expected.

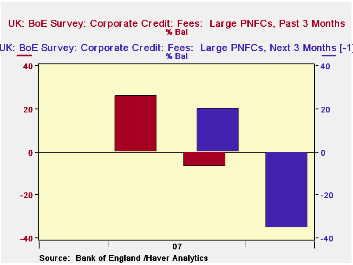

Lending to Corporations. Major business lending policies were significantly more restrictive in Q3 than they had been in Q2 and also than they were expected to be then. Credit availability was +1.8 in Q2 and anticipated to be flat in Q3. Instead, it was -20.2 in Q3 and it is expected to become much more restricted in Q4 at -49.3. All factors on credit supply which are queried on the survey were more negative in the later polling. These include sector-specific risks and pressure from capital markets, as well as more general factors also queried with household lending: economic outlook, appetite for risk, cost and availability of funding and market share objectives. Loan demand from both large and medium-size nonfinancial corporations (PNFCs) became weaker over the summer. That from "other financial corporations" (OFCs) generally went from flat or modestly positive to modestly negative. Balance sheet restructuring and a slowing commercial real estate market are seen as the factors impinging most on the demand shifts.

In our third graph, we show one of the non-price features of lending policy, the lender's fees and commissions. The graph shows the impact of this on credit volume, so the positive bars indicate a reduction in fees and the negative bars show a increase. Thus, these survey results say that lenders had cut their fees in Q2 and expected to do so again in Q3. But instead they raised their fees -- discouraging borrowing -- and intend to do so even more in Q4.

As is evident from these overly terse comments, this survey is comprehensive, covering many of the determinants of credit supply and demand at lending institutions. The Bank of England points out that when data on flows and outstandings are examined, it is not possible to tell whether a change is due to supply or demand factors. This survey will help considerably to assess those developments, and as we see here, they are not uniform over credit sectors, so the three-part survey is a most helpful approach. The present results are too sketchy, though, to compare with actual lending patterns. It will take time to accumulate results that permit matching survey readings, such as a +10 or a -20, with specific loan volumes. We wish we could do that now!

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates