Global| Feb 20 2008

Global| Feb 20 2008New Industrial Orders in December Sag in Italy and in France

Summary

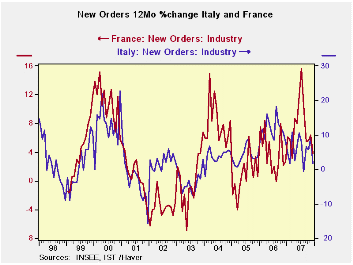

French and Italian orders have shown some consistency in recent years in their oscillations. Currently Italy’s trends are a bit flatter and the French trends are still a bit stronger but both saw clear evidence of losing momentum as [...]

French and Italian orders have shown some consistency in recent years in their oscillations. Currently Italy’s trends are a bit flatter and the French trends are still a bit stronger but both saw clear evidence of losing momentum as 2008 approaches.

Over the last three months Italy’s orders are off at a 13.1% pace; French orders are off at a 0.3% pace for the same period. Italy’s foreign orders are off over 12, 6 and 3 months and are showing progressively worse results. French foreign orders are up weakly over 12 months and are lower over 6 months but have made a minor rebound in the recent three months. So while French foreign order trends are better than Italian trends they are still not solid…For the fourth quarter, French orders are dropping at a 3.8% pace Q/Q while Italy’s orders are dropping at a 3.3% annual pace. France’s foreign orders are holding up better with a mere 4% drop annualized in Q4 compared to Italy where the annual rate of decline for foreign orders is 15%.

The Euro Area is now showing some signs of growth erosion and we cannot tell if it is the strong euro at work or the effects of financial distress and lowered expectations that are having the largest impact. But France and Italy are showing signs of wear on tear in their respective industrial sectors.

| Italy Orders | ||||||

|---|---|---|---|---|---|---|

| Saar exept m/m | Dec-07 | Nov-07 | Oct-07 | 3-mo | 6-mo | 12-mo |

| Total | -5.4% | 2.9% | -1.1% | -14.1% | -8.8% | 1.6% |

| Foreign | -8.1% | 3.9% | -5.8% | -34.6% | -23.1% | -0.6% |

| Domestic | -4.1% | 2.5% | 1.5% | -0.7% | 0.2% | 2.7% |

| Memo | ||||||

| Sales | -2.7% | 0.2% | -0.7% | -12.0% | -4.0% | -2.8% |

| French Orders | ||||||

| Saar exept m/m | Dec-07 | Nov-07 | Oct-07 | 3-mo | 6-mo | 12-mo |

| Total | -2.0% | -0.3% | 2.2% | -0.3% | -7.0% | 3.8% |

| Foreign | -1.0% | 1.1% | 0.5% | 2.5% | -9.3% | 3.5% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.