Global| Jan 15 2008

Global| Jan 15 2008No Surprise: Sentiment Among German Investors and Analysts Falls

Summary

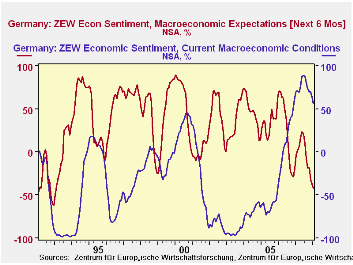

Continued strength of the euro and now fears of recession in the United States are taking their toll on the confidence of German institutional investors and financial analysts as shown by the ZEW's (Center for European Research at [...]

Continued strength of the euro and now fears of recession in the

United States are taking their toll on the confidence of German

institutional investors and financial analysts as shown by the ZEW's

(Center for European Research at Mannheim) Indicator of Economic

Sentiment. The indicator measures the percent difference between those

who expect improvement and those who expect a deterioration in the six

months' outlook and current conditions.

The excess of pessimists over optimists regarding the outlook for

the next six months rose 4.4 points to 41.6% in January from 37.2% in

December and is now at the lowest point since the early nineties. The

excess of optimists over pessimists regarding current conditions

declined 6.9 points to 56.6% from 63.5% in December. This suggests

that, although they are losing confidence in the current conditions,

the financial community still believes that current conditions in

Germany are much better than they have been in some time. The ZEW

indicators for the six months' outlook and current conditions are shown

in the first chart.

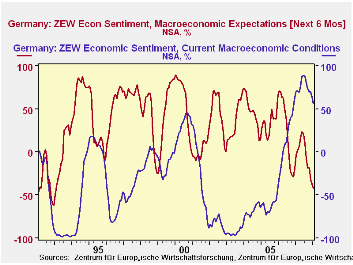

In addition to its Indicator of Economic Sentiment, the ZEW also

publishes its participants' profit expectations for the next six months

for selected

industries. These profit expectations give some

insight into the specific concerns underlying the general pessimism of

the participants. In the latest survey, for example, participants

expected some of the biggest declines in profits in the vehicle

(automotive), machinery and chemicals/pharmaceuticals industries--all

dependent on overseas demand that is threatened by the strong euro and

consumption and trade, dependent on the German consumer, whose

propensity to consume remains lackluster. Profit expectations in these

industries are shown in the second chart.

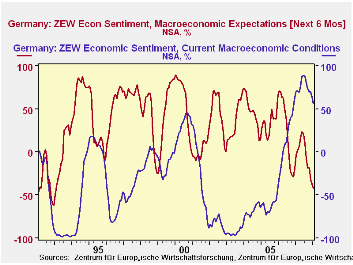

Participants in the January survey apparently expected some slight

improvement in the profits of the depressed financial and insurance

sectors and in the volatile construction industry. The only industry

where profit expectations increased in the month and were above January

2007 was the service industry. The improvement in profit expectations

in these four industries, shown in the third chart, was not large

enough to offset the deterioration in the profit expectations in the

other industries.

| ZEW (CENTER FOR EUROPEAN ECONOMIC RESEARCH) | Jan 08 | Dec 07 | Jan 07 | M/M % Dif | Y/Y % Dif |

|---|---|---|---|---|---|

| Indicator of Economic Sentiment (% balance) | |||||

| Current Conditions | 56.6 | 63.5 | 70.6 | -6.9 | -14.0 |

| Outlook 6 Months Ahead | -41.6 | -37.2 | -3.6 | -4.4 | -38.0 |

| Profit Expectation 6 Months Ahead | |||||

| Utilities | 29.3 | 22.9 | 7.6 | 6.4 | 21.7 |

| Construction | -17.9 | -20.3 | 32.8 | 2.4 | -50.7 |

| Banking | -56.8 | -61.0 | 38.7 | 4.2 | -95.5 |

| Insurance | -23.2 | -30.8 | 38.1 | 7.6 | -61.3 |

| Vehicles (automotive) | -30.7 | -16.0 | 6.6 | -14.7 | -37.3 |

| Machinery | 26.6 | 33.5 | 57.7 | -6.9 | -30.9 |

| Consumer/Trade | -9.1 | 2.9 | -2.0 | -12.0 | -7.1 |

| Chemical/Pharmaceutical | 17.2 | 20.8 | 33.3 | -3.6 | -16.1 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates