Global| Nov 14 2005

Global| Nov 14 2005October U.S. Budget Deficit Down Y/Y

by:Tom Moeller

|in:Economy in Brief

Summary

The U.S. federal government budget deficit continued lower during the opening month of FY06. The deficit of $47.2B fell 17.6% versus last October, about the same rate of decline as during FY05. As a percentage of GDP the deficit fell [...]

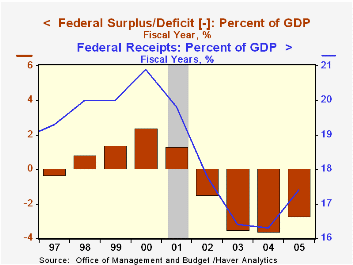

The U.S. federal government budget deficit continued lower during the opening month of FY06. The deficit of $47.2B fell 17.6% versus last October, about the same rate of decline as during FY05.

As a percentage of GDP the deficit fell to 2.6% last fiscal year versus 3.6% in FY04. The latest projection from the Congressional Budget Office is for a further decline to 2.4% in FY06.

Net receipt continued firm 9.2% y/y rate last month, powered by 16.0% growth in individual income tax receipts (44% of total receipts). That growth made up for an October shortfall in corporate income taxes (10% of total receipts) which left them 20.5% last October.

Total receipts accounted for 17.5% of GDP last fiscal year, up from 16.3% the prior year but down from 18.4% during the 1990s.

The improved job market continued to lift employment taxes (36% of total receipts) 6.4% y/y, a slowdown versus 8.8% growth during all of FY 2005 which was the strongest increase since 1988.

U.S. net outlays grew 1.3% y/y last month despite a 28.0% gain in defense (19% of total outlays). Medicare spending (12% of total outlays) fell 11.4% y/y but spending on social security (21% of total outlays) rose 5.7%. Spending on health programs (10% of the total) rose 3.5% while spending on education & training (4% of the total) fell 5.0% y/y after double digit gains during three of the last four fiscal years. Interest expense (8% of the total) grew 13.0% with higher interest rates after a 14.9% gain last fiscal year.

The latest projections from the US Congressional Budget Office are available here.

| US Government Finance | Oct | Sept | Y/Y | FY 2005 | FY 2004 | FY 2003 |

|---|---|---|---|---|---|---|

| Budget Balance | $-47.2B | $35.7B | $-57.3B (10/04) | $-318.6B | $-412.1B | $-377.6B |

| Net Revenues | $149.5B | $151.6B | 9.2% | 14.6% | 5.5% | -3.8% |

| Net Outlays | $196.7B | $216.0B | 1.3% | 7.9% | 6.1% | 7.4% |

by Louise Curley November 14, 2005

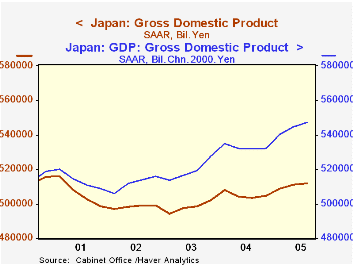

Preliminary data on Japan's Gross Domestic Product was released late last week. Total GDP rose at an annual rate of 1.7% in the third quarter, above the consensus estimate of 1.1%. Although the growth had slowed from 3.25% of the second quarter and the 6.29% of the first quarter, the report was well received by financial analysts and the stock market. The Nikkei 225 Average rose 0.5% or 74 points to 14,155.06 on last Friday, its highest close since May 2001.

On Monday, the stock market gave back more than half of Friday's gains. While the Monday decline has been attributed to a falling off of demand for Japanese stocks by foreign investors, some of the decline may have been the result of different views on deflation expressed by the Governor of the Bank of Japan and the Prime Minister following the release of the GDP data. Toshihiko Fukui, governor of the Bank of Japan, hinted at a possible change in monetary policy. "A shift in policy, conceptually, would be a cut in current account deposits (the liquidity target) followed by very low short-term interest rates and then an adjustment to rates to a level in line with economic conditions." Prime Minister Junichiro Koizumi warned the Bank that it was too early to change its easy monetary policy of fighting deflation. In the first chart the gap between real and nominal GDP, a measure of deflation, has yet to show meaningful signs of decline.

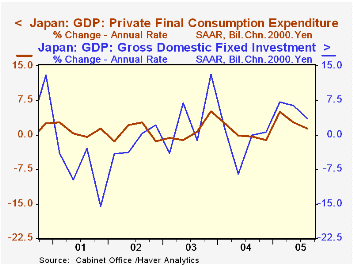

The deceleration in growth was due in part to a decline in net exports as imports, fueled by high oil prices, rose faster than exports. However, both private consumption and gross fixed investment also played a part in the deceleration of growth. The second chart shows the seasonally adjusted annual rate of change in private final consumption and in gross fixed investment. The one sector that showed higher growth was inventories as both public and private inventories rose.

| Japan: Gross Domestic Product |

Q3 2005 % | Q2 2005 % | Q1 2005 % | Q4 2004 % | 2004 % | 2003 % | 2002 % |

|---|---|---|---|---|---|---|---|

| GDP Current Yen | 0.69 | 2.05 | 3.15 | 0.89 | 1.40 | -0.05 | -1.56 |

| GDP 2000 Chn Yen | 1.70 | 3.25 | 6.29 | 0.72 | 2.61 | 1.41 | -0.29 |

| Private Final Consumption | 1.36 | 2.67 | 5.04 | -1.09 | 1.47 | 0.24 | 0.53 |

| Gross Domestic Fixed Investment | 3.66 | 6.42 | 7.10 | 0.62 | 1.34 | 1.05 | -5.67 |

| Exports of Goods & Services | 11.43 | 13.03 | -0.05 | 6.62 | 14.47 | 9.09 | 4.15 |

| Imports of Goods & Services | 16.66 | 9.40 | 0.30 | 10.33 | 8.92 | 3.82 | 1.25 |

| Q3 05 Bil. 2000.Chn Yen |

Q2 05 Bil. 2000.Chn Yen |

Q1 05 Bil.2000.Chn Yen |

Q4 04 Bil. 2000.Chn Yen |

2004 Bil. 2000.Chn Yen |

2003 Bil. 2000.Chn Yen |

2002 Bil. 2000.Chn Yen |

|

| Private Inventory Change | 2261.1 | 2046.3 | 2848.9 | 1128.9 | 839.6 | -108.5 | -983.9 |

| Public Inventory Change | 163.5 | 124.0 | 141.5 | 167.6 | 41.4 | 2.5 | -6.6 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates