Global| Oct 07 2008

Global| Oct 07 2008Odd Man Out: Bank Indonesia Raises its Interest Rate

Summary

With calls for lower interest rates in the Euro Area, the United States and the United Kingdom and yesterday's steep cut of one percent in Australia's base rate, the action of the Bank Indonesia in raising its key interest rate [...]

With

calls for lower interest rates in the Euro Area, the United States and

the United Kingdom and yesterday's steep cut of one percent in

Australia's base rate, the action of the Bank Indonesia in raising its

key interest rate twenty-five basis points to 9.5% seems perverse at

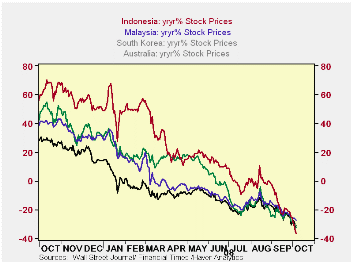

first glance. The stock market in Indonesia has suffered the same steep

declines that have occurred in most other countries. The first chart

shows the year- over- year change in Indonesian stock prices compared

with some of its neighbors: Australia, South Korea and

Malaysia. The latest figures show Indonesia lower than the

other three. · Perhaps the stock market is

just not that important in Indonesia. Using the ratio of

stock market capitalization to annual gross domestic as a measure of

the importance of the stock market in an economy, Indonesia comes out

pretty low.

With

calls for lower interest rates in the Euro Area, the United States and

the United Kingdom and yesterday's steep cut of one percent in

Australia's base rate, the action of the Bank Indonesia in raising its

key interest rate twenty-five basis points to 9.5% seems perverse at

first glance. The stock market in Indonesia has suffered the same steep

declines that have occurred in most other countries. The first chart

shows the year- over- year change in Indonesian stock prices compared

with some of its neighbors: Australia, South Korea and

Malaysia. The latest figures show Indonesia lower than the

other three. · Perhaps the stock market is

just not that important in Indonesia. Using the ratio of

stock market capitalization to annual gross domestic as a measure of

the importance of the stock market in an economy, Indonesia comes out

pretty low.

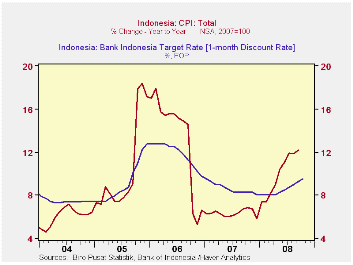

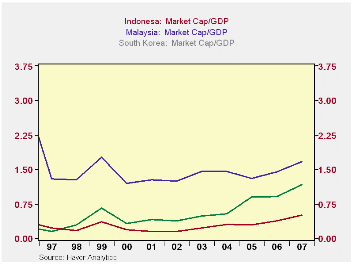

The second chart shows the ratio of market capitalization to GDP for South Korea, Malaysia and Indonesia. Indonesia's market capitalization was half its GDP in 2007, compared with a market capitalization of 1.7 times GDP in Malaysia and 1.2 times GDP in South Korea.· What is important to Bank Indonesia is the rate of inflation. The rate has been rising steadily since the beginning of this year and in September was just over 12%. The average rate of inflation for the nine months has been 9.9% compared with a target of 5% + or -1% for the year. The third chart shows the rate of inflation and Bank Indonesia's official interest rate.

| Indonesia | Malaysia | South Korea | Australia | |

|---|---|---|---|---|

| Stock Prices Y/Y % (Oct 7, 20 08) | -36.4 | -27.2 | -32.2 | -31.2 |

| Indonesia | Malaysia | South Korea | ||

| Market Cap/GDP (2007) | 0.50 | 1.67 | 1.16 | -- |