Global| Oct 05 2007

Global| Oct 05 2007OECD Indicators Show Moderation in Growth Ahead

Summary

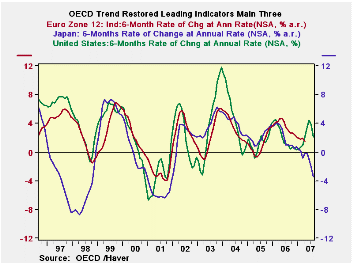

THE OECD leading economic indicators trend adjusted are showing a sharp moderation in the regional key indexes. The US is reversing sharply after embarking on a strong upturn earlier in the year. The Euro area is continuing to show [...]

THE OECD leading economic indicators trend adjusted are showing a sharp moderation in the regional key indexes. The US is reversing sharply after embarking on a strong upturn earlier in the year. The Euro area is continuing to show waning momentum as that index works its way lower from its peak in mid-2006. Japan is sliding lower at a sharp pace that belies the optimism policy officials there embrace.

The OECD prefers to look over six-month horizons on its indicators so the table below arrays them two different ways. The six-month panel at the table bottom shows why the OECD talks of the indicators as pointing to moderation in growth. Only Europe and Japan are declining on the six-month horizon among these three main areas, yet all but the US are decelerating. The OECD area as a whole has its trend restored LEI rising with the index up by 09%.

But the three-month rate of change at the top of the table tells the story that the circumspect OECD does not want to center on. Yes, these are more volatile calculations and they could be reversed. But the shorter three-month trend tells us that all of these regions are pointing to a decline. Unless some stability sets in soon the six-month indexes will soon be reflecting this same sort of weakness and will point to DECLINES as well. On both approaches Japan looks like it is in trouble. These signals are not compatible with central banks hiking rates anytime soon.

| OECD Trend-Restored Leading Indicators | ||||

|---|---|---|---|---|

| Growth Progression-SAAR | ||||

| 3Mos | 6Mos | 12mos | Yr-Ago | |

| OECD | -1.8% | 0.9% | 1.3% | 2.8% |

| OECD 7 | -2.7% | 0.6% | 0.7% | 2.1% |

| OECD.Europe | -3.0% | -0.7% | 0.3% | 2.1% |

| OECD.Japan | -7.6% | -4.3% | -1.9% | 2.3% |

| OECD US | -0.3% | 3.1% | 2.1% | 2.2% |

| Six-Month Readings at 6-Mo Intervals: | ||||

| Recent six | 6Mo Ago | 12Mo Ago | 18MO Ago | |

| OECD | 0.9% | 1.7% | 0.8% | 4.9% |

| OECD 7 | 0.6% | 0.8% | -0.1% | 4.4% |

| OECD.Europe | -0.7% | 1.2% | 2.4% | 1.9% |

| OECD.Japan | -4.3% | 0.7% | 0.2% | 4.4% |

| OECD US | 3.1% | 1.1% | -0.9% | 5.4% |

| Slowdowns indicated by BOLD RED | ||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates