Global| Aug 30 2002

Global| Aug 30 2002Personal Income Weak, Spending Up

by:Tom Moeller

|in:Economy in Brief

Summary

Personal income rose less than expected last month. June's gain was revised slightly higher. Consensus expectations were for a 0.3% gain. A decline in wage and salary disbursements (2.6% AR, YTD), the second this year, was broadly [...]

Personal income rose less than expected last month. June's gain was revised slightly higher. Consensus expectations were for a 0.3% gain.

A decline in wage and salary disbursements (2.6% AR, YTD), the second this year, was broadly based amongst industries.

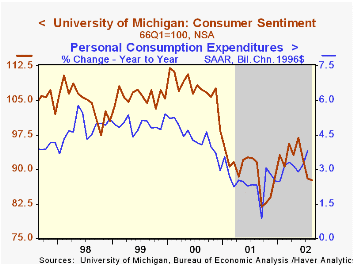

Personal consumption expenditures rose more than expected, reflecting a 3.7% surge in durable goods purchases and 0.6% gains in purchases of nondurables and services.

Disposable income rose 0.2% (10.1% AR, YTD). Personal tax payments fell a sharp 0.8%, the sixth monthly decline this year.

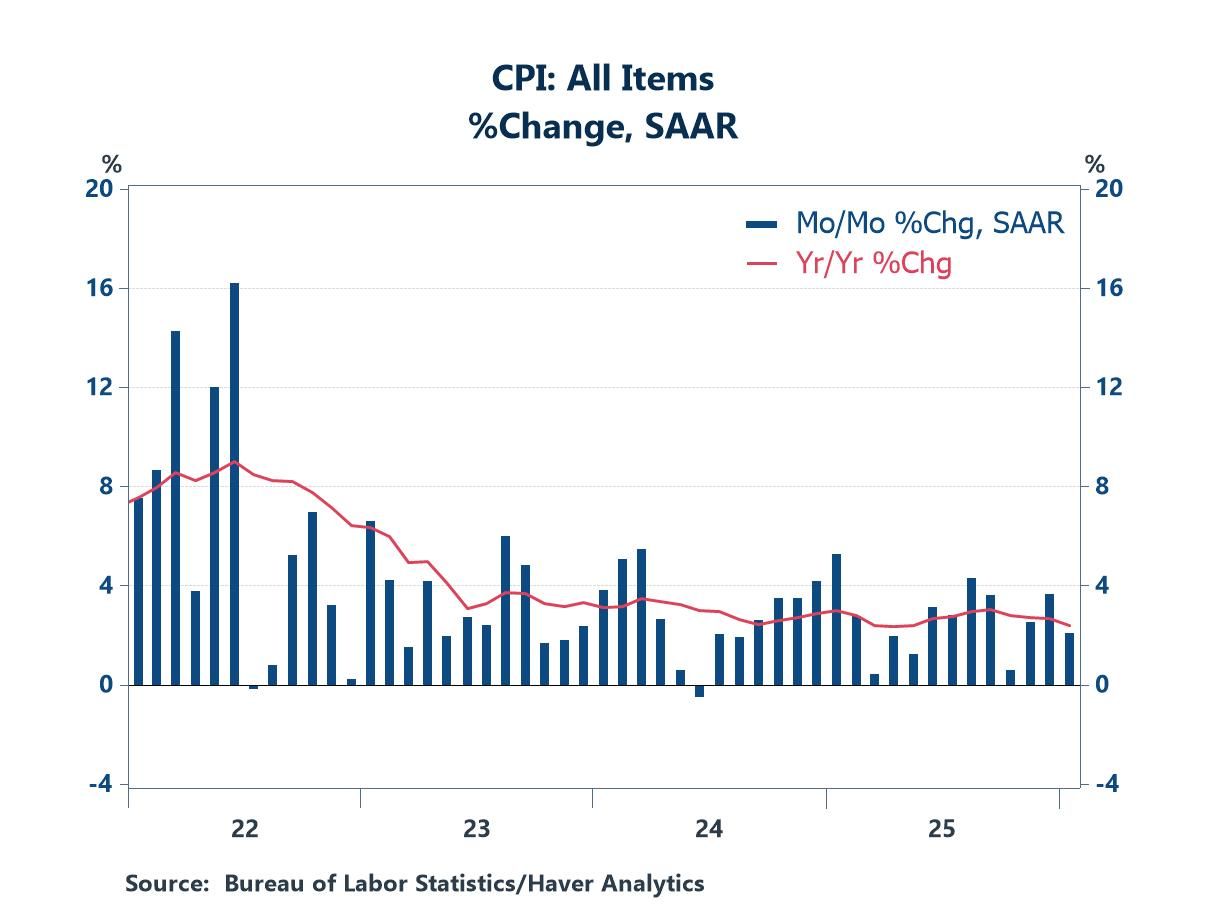

The PCE price deflator rose 0.2% following a 0.1% rise in June. Prices were up 2.1% (AR) year to date. Less food and energy the price deflator rose 0.1% (1.6% AR, YTD) for the third consecutive month.

| Disposition of Personal Income | July | June | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Personal Income | 0.0% | 0.7% | 3.0% | 3.3% | 8.0% | 4.9% |

| Personal Consumption | 1.0% | 0.5% | 5.0% | 4.5% | 7.0% | 6.7% |

| Savings Rate | 3.4% | 4.2% | 3.0% | 2.3% | 2.8% | 2.7% |

| PCE Price Deflator | 0.2% | 0.1% | 1.2% | 2.0% | 2.5% | 1.6% |

by Tom Moeller August 30, 2002

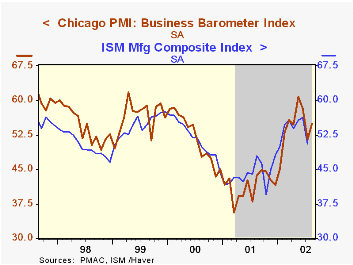

The Chicago Purchasing Manager’s Index of Business activity rose in August. Consensus estimates were for little change or a slight decline.

The indexes of new orders, production, order backlogs and delivery speeds rose. Employment and inventories fell.

The prices paid index fell slightly following a surge in July.

| Chicago Purchasing Managers Index, SA | August | July | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Business Barometer | 54.9 | 51.5 | 43.6 | 41.4 | 51.8 | 56.5 |

| Prices Paid | 63.6 | 64.5 | 41.7 | 50.5 | 65.6 | 57.6 |

by Tom Moeller August 30, 2002

The full month August reading of Consumer Sentiment from the University of Michigan was about as expected, down 0.6% for the third consecutive monthly decline.

Sentiment declined somewhat less month to month than the Conference Board's measure of Consumer Confidence which also fell for the third consecutive month in August.

Both the indexes of consumer expectations and current conditions fell slightly.

The University of Michigan survey is not seasonally adjusted.

| University of Michigan | August | July | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Consumer Sentiment | 87.6 | 88.1 | -4.3% | 89.2 | 107.6 | 105.8 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.