Global| Jan 26 2021

Global| Jan 26 2021Positive Scarring

by:Andrew Cates

|in:Economy in Brief

Summary

Many commentators have been focusing on some of the negative longer-term effects of the coronavirus crisis on the world economy. These include higher levels of debt, higher long-term unemployment, weaker world trade growth and [...]

Many commentators have been focusing on some of the negative longer-term effects of the coronavirus crisis on the world economy. These include higher levels of debt, higher long-term unemployment, weaker world trade growth and possibly weaker investment. But lurking beneath the surface in recent economic (and financial market) data are some trends that speak more positively about the global economic outlook. They concern the recent take-off in global demand for information and communications technology products (ICT), the renewed focus among companies to invest in those products, and the evidence that suggests that demand and that focus will remain in vogue even as the coronavirus crisis comes to an end. Insofar as these trends should confer longer-term productivity advantages there are clearly some offsets to some of those negatives that we cited above.

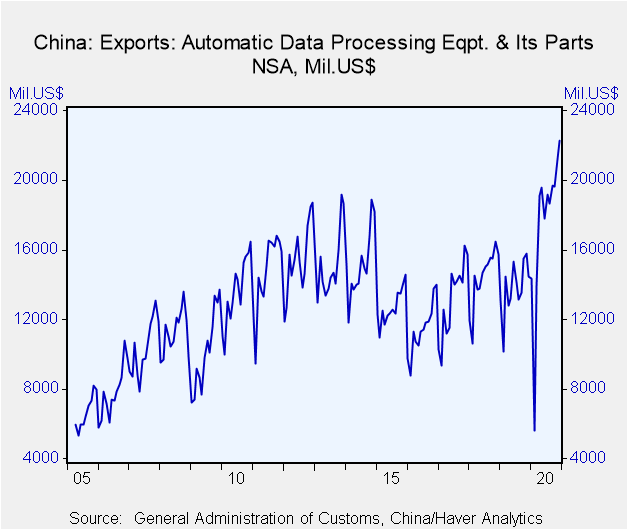

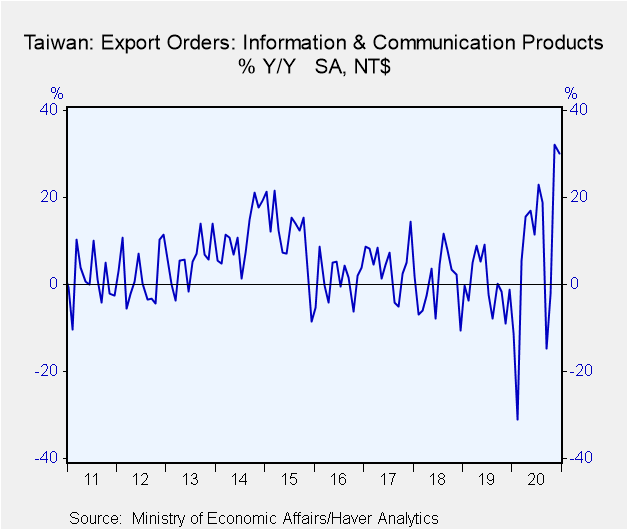

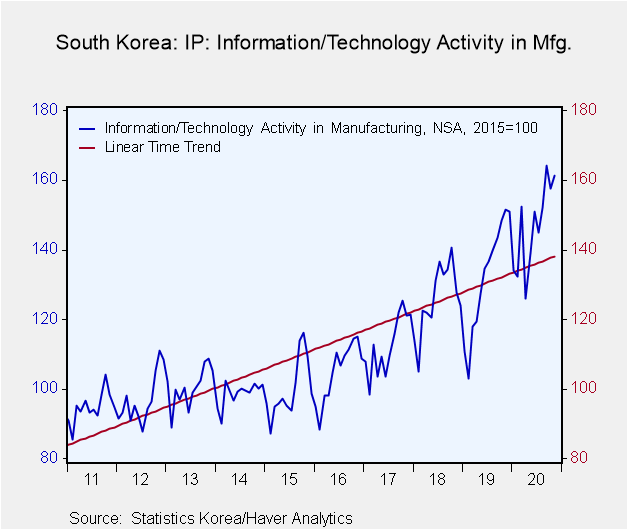

On the global demand front the evidence for this concerns the outperformance of industrial production growth in Asian countries that specialise in ICT. Asia in fact was the only region of the world that saw its industrial production activity exceed its pre-COVID levels toward the end of last year. And a principal reason for this concerns the comparative advantage it enjoys in high-tech production. The charts below give some further colour on this via the ICT export trends from China (figure 1), in the export orders growth from Taiwan (figure 2) and in the high-tech production activity from South Korea (figure 3).

Figure 1: Exports of data processing equipment and parts from China

Figure 2: Export orders of information and communications technology products in Taiwan

Figure 3: Industrial production of information technology products in South Korea

Of course much of this increase in demand could be temporary, and a function of shifting work and consumption patterns that have been triggered by COVID-induced lockdowns. That more people are working from home and entertaining themselves from home has inevitably led to a spike in demand for ICT goods that can facilitate those efforts. When the pandemic comes to an end it’s possible that these trends toward firmer ICT consumption (and away from services consumption) will reverse themselves.

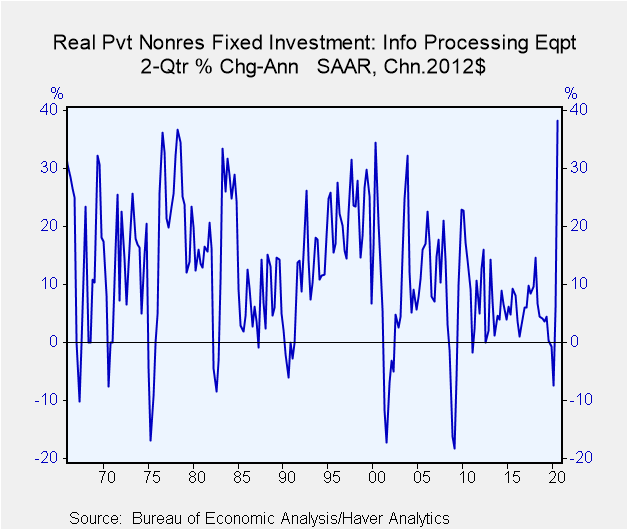

However, there are grounds for believing that a more permanent shift could be underway. For example, US companies lifted their investment in information processing equipment by 36% at an annual rate in Q2 and Q3 2020, the fastest pace of growth in a six month period for over 60 years (see figure 4).

Figure 4: US capital investment volume in information processing equipment

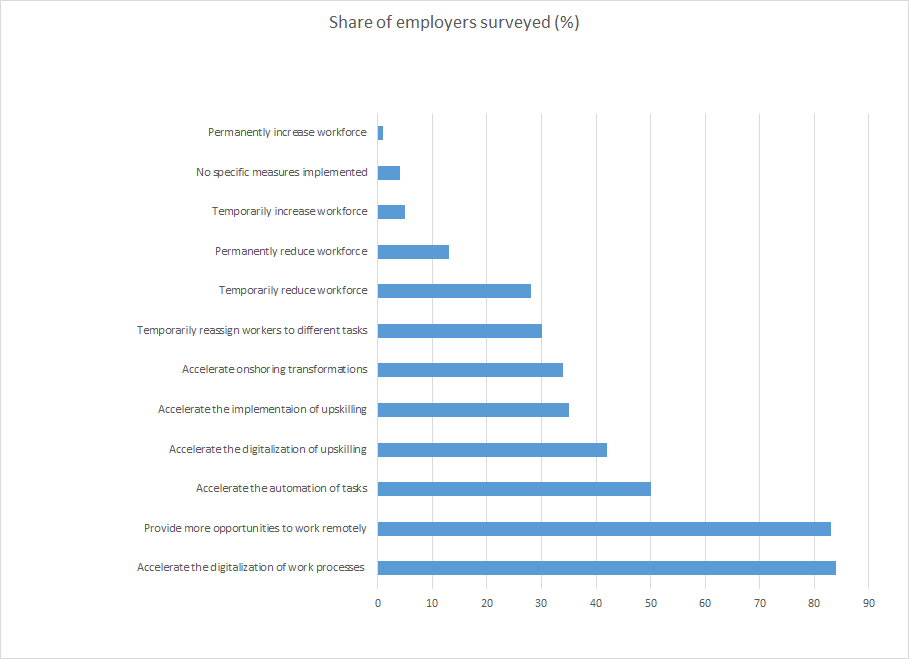

Again it’s possible that this is an ephmerable trend that will fade alongside the virus. But let’s not be too hasty. A recent survey from the World Economic Forum found that more than 80% of employers are accelerating their automation of work processes and expanding their use of remote work. A significant 50% also indicate they are set to acclerate the automation of jobs in their companies (see figure 5). Additional evidence within the report suggested a significant increase in the number of firms expecting to adopt robots and artificial intelligence and a continued high priority toward investment in cloud computing , big data and ecommerce. While all this will undoubetdly generate workforce disruption it ought to also help drive up productvity growth as well as to increase the demand for new job roles and new skill sets.

Figure 5: Planned business adaptation in response to COVID-19

Source: Future of Jobs Survey 2020, World Economic Forum

Viewpoint commentaries are the opinions of the author and do not reflect the views of Haver Analytics.Andrew Cates

AuthorMore in Author Profile »Andy Cates joined Haver Analytics as a Senior Economist in 2020. Andy has more than 25 years of experience forecasting the global economic outlook and in assessing the implications for policy settings and financial markets. He has held various senior positions in London in a number of Investment Banks including as Head of Developed Markets Economics at Nomura and as Chief Eurozone Economist at RBS. These followed a spell of 21 years as Senior International Economist at UBS, 5 of which were spent in Singapore. Prior to his time in financial services Andy was a UK economist at HM Treasury in London holding positions in the domestic forecasting and macroeconomic modelling units. He has a BA in Economics from the University of York and an MSc in Economics and Econometrics from the University of Southampton.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates