Global| Apr 25 2011

Global| Apr 25 2011Preliminary Indicators of the Economic Effects of Japan's March Earthquake and Tsunami

Summary

It is not yet possible to quantify the damage to Japan's economy from the March Earthquake, Tsunami and the subsequent damage to its nuclear facilities. There are plenty of descriptions of the devastation and warnings of potential [...]

It is not yet possible to quantify the damage to Japan's economy from the March Earthquake, Tsunami and the subsequent

damage to its nuclear facilities. There are plenty of descriptions of the devastation and warnings of potential nuclear dangers,

but little up-to-date hard data on the economy. The latest information on industrial production, retail and industrial sales, orders,

exports and imports of commodities is, for example, for February, roughly half a month before the disaster. Relevant data will not be

forthcoming for another month or so. In the meantime, however, data indicative of the reactions of consumers and businesspersons

are available and more are beginning to appear.

It is not yet possible to quantify the damage to Japan's economy from the March Earthquake, Tsunami and the subsequent

damage to its nuclear facilities. There are plenty of descriptions of the devastation and warnings of potential nuclear dangers,

but little up-to-date hard data on the economy. The latest information on industrial production, retail and industrial sales, orders,

exports and imports of commodities is, for example, for February, roughly half a month before the disaster. Relevant data will not be

forthcoming for another month or so. In the meantime, however, data indicative of the reactions of consumers and businesspersons

are available and more are beginning to appear.

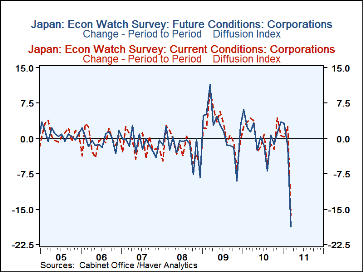

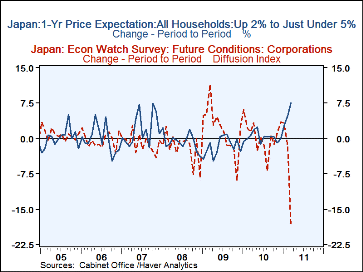

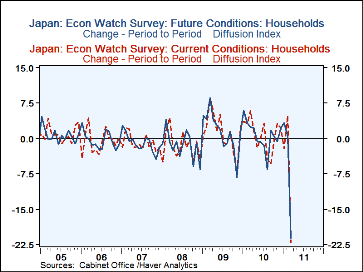

The Economy Watchers Survey reported on April 8 that the consumers' balance of opinion on current conditions fell by 22.0 percentage points from February to March and the balance on future conditions fell by 21.2 percentage points. The balance of opinion of corporations on current conditions fell 16.3 point and on future conditions, fell by 18.7 points in the same period. These were the biggest one month declines in the history of these series as can be seen in first two charts.

The consumer confidence index for all households released on April 19 showed a more moderate decline in March--2.4 percentage points and confidence remains well above the low point reach in the recent recession. Households increased their price expectations in March. Twenty-eight and eight tenths percent expect prices to rise between 2% and 5% over the next year, up 7.5 points from 21.3% in February and 16.6% expect prices to rise more than 5%, up 6.9 points from 9.7% in February. The third chart show consumer confidence and price expectations of between 2% and 5% over the next year for all households.

The initial reaction to the March 11 disaster was felt in the stock market where the average price on the Nikkei 225 fell from 10434.38 on March 10 to 8605.15 on March 15, a drop of 1829.32 points. The latest reading of the Nikkei 225 is 9671.96, up 1066.81 points from the March 15 low and is shown in the fourth chart. The recovery in stock prices suggests that the financial community has become somewhat less pessimistic concerning the outlook.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates