Global| Feb 06 2003

Global| Feb 06 2003Productivity Fell in 4Q, Annual Gain Strongest Since 1950

by:Tom Moeller

|in:Economy in Brief

Summary

Nonfarm labor productivity last quarter fell for the first quarter since 2Q01. Consensus estimates were for a rise of 1.0%. The annual gain of 4.7% in productivity was the strongest since 1950. The slowdown in output growth to 0.8% [...]

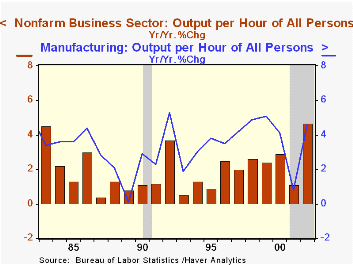

Nonfarm labor productivity last quarter fell for the first quarter since 2Q01. Consensus estimates were for a rise of 1.0%. The annual gain of 4.7% in productivity was the strongest since 1950.

The slowdown in output growth to 0.8% from 5.2% in 3Q accounted for most of the decline in productivity. Hours worked rose 1.0% following six consecutive quarters of decline.

Unit Labor costs rose more than expectations for a 3.0% gain. The annual decline in unit costs was the first since 1983. Compensation growth moderated slightly from 3Q and for the year was just about equal to 2001 despite faster productivity growth.

Manufacturing sector productivity grew 0.7% following the strong 5.5% 3Q gain. The annual gain in factory sector productivity of 4.6% was the fastest since 1999 despite a 1.0% annual decline in output. Unit labor costs surged 4.6%, the strongest gain since 2Q01. For the year, unit labor costs in the factory sector fell 0.7%.

Analysis by the New York Federal Reserve detecting improvement in trend productivity growth can be found here.

| Nonfarm Business Sector (SAAR) | 4Q '02 Prelim | 3Q '02 Final | Y/Y | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| Output per Hour | -0.2% | 5.5% | 3.8% | 4.7% | 1.1% | 2.9% |

| Compensation | 4.6% | 5.4% | 4.2% | 2.8% | 2.7% | 7.0% |

| Unit Labor Costs | 4.8% | -0.1% | 0.3% | -1.8% | 1.6% | 3.9% |

by Tom Moeller February 6, 2003

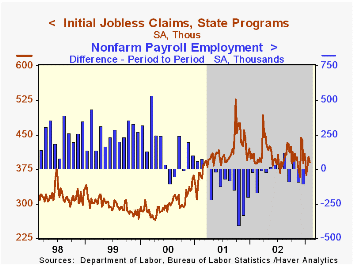

Initial claims for unemployment insurance were about as expected last week. Claims fell 2.7% from the prior week's level which was revised up.

The four-week moving average of initial claims fell slightly to 384,750 (-4.1% y/y), the lowest level since late November.

Continuing claims for unemployment insurance rose 1.8% and the prior week's level was revised up.

The insured rate of unemployment was stable at 2.6% for the fourth consecutive week.

| Unemployment Insurance (000s) | 2/01/03 | 1/25/03 | Y/Y | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| Initial Claims | 391.0 | 402.0 | 0.5% | 405.0 | 405.8 | 299.8 |

| Continuing Claims | -- | 3,353 | -1.7% | 3,588 | 3,021 | 2,114 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.