Global| Jan 27 2005

Global| Jan 27 2005Q1 Business Optimism Ebbs in Canada and the UK

Summary

While the factory orders situation in the US seems to be holding up well, those in neighboring Canada and in the UK look to be eroding. We noted here a week ago that the UK's BCC survey for Q4 might be pointing toward slower growth in [...]

While the factory orders situation in the US seems to be holding up well, those in neighboring Canada and in the UK look to be eroding. We noted here a week ago that the UK's BCC survey for Q4 might be pointing toward slower growth in business activity. The CBI industrial trends survey extends this tendency into the new year. The Business Conditions Survey taken by Statistics Canada shows an abrupt drop in assessments from comfortably positive levels to zero or below in Q1.

In Canada, overall production prospects are flat in Q1, as the proportion of manufacturing firms with favorable production prospects decreased from 21% in Q4 to 13%, the lowest reading in exactly three years. Also, firms anticipating negative production developments increased from 10% to 13% of the total. These results are mirrored in the orders segment, which eroded from 13% in Q4 to -1% in Q1, that is, slightly more firms are seeing orders decline rather than rise.

The CBI survey in the UK saw a second quarter of downturn, with the "business optimism" component dropping from -10 to -22, the lowest in seven quarters. Part of this deterioration was reflected in orders, which turned down from +4 to -4. In the BCC survey, the weakening tendency was most visible in domestic ("home") business, with the export outlook actually fairly favorable. In this CBI data, however, both domestic and export prospects experienced erosion.

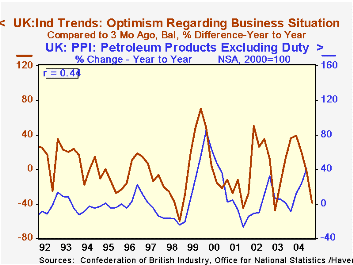

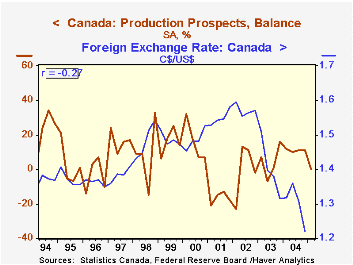

Higher energy costs and persistent strength in currencies, at least relative to the US dollar, might be seen as two reasons for the emerging concerns over manufacturing prospects in the UK and Canada. However, as evident in the first graph, there is only a rough correlation of the CBI business optimism measure and energy prices, and the relationship appears to be positive, not negative. Separately, and not illustrated here, there is virtually no correlation between FX values and the CBI index. In Canada, the energy price situation is the same: modest, positive correlation; the correlation with the currency value varies widely over time spans of different lengths. So the energy and currency factors are not supported by these data as sources of renewed concern over manufacturing in either country.

| 1Q 2005 | 4Q 2004 | 3Q 2004 | 2004 | 2003 | 2002 | 2001 | |

|---|---|---|---|---|---|---|---|

| Canada | 0 | 11 | 11 | 11 | 4 | 0 | -17 |

| Orders Received | -1 | 13 | 8 | 9 | -5 | 1 | -32 |

| UK - CBI | -22 | -10 | 7 | 7 | -17 | -6 | -27 |

| Orders | -4 | 4 | 2 | 9 | -16 | -14 | -4 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.