Global| Dec 13 2007

Global| Dec 13 2007RICS House Prices Sag Badly

Summary

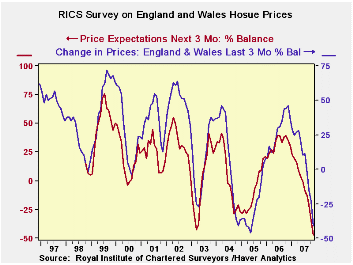

The RICs survey presents as its metric a net balance reading as surveys respond by saying house prices are higher or lower. Both series show a larger progressive trend lower that is represented by sequentially lower peaks in the [...]

The RICs survey presents as its metric a net balance reading

as surveys respond by saying house prices are higher or lower. Both

series show a larger progressive trend lower that is represented by

sequentially lower peaks in the various cycles and, for the most part,

sequentially lower troughs as well. Beyond this longer term trend

decline in this metric is the sharp plunge in both prices over the past

three months and expected prices in the next three months. The price

expectations series gives off useful signals at the peaks since it

peaks at a lower level than the past three month series but it is

usually too pessimistic at the troughs. The look-ahead series is

looking for even deeper declines in the next three months than in the

last three months at this time. Look for the actual data to turn more

positive ahead of the expectations series. But, for the moment, both

show bleak readings and both are on their respective lowest readings

since 1999.

| RICS: House prices and expectations for prices and sales | |||||||

|---|---|---|---|---|---|---|---|

| Nov-07 | Oct-07 | Sep-07 | 3-Mo Avg | 6-Mo Avg | 12-Mo Avg | Range Percentile |

|

| Prices | -41 | -23 | -15 | -26 | -10 | 9 | 0.0% |

| Price Expectations | -47 | -35 | -21 | -34 | -21 | -2 | 0.0% |

| Sales expectations | -8 | -6 | -9 | -8 | -5 | 6 | 2.2% |

| New Sales | -36 | -33 | -28 | -32 | -24 | -11 | 0.0% |

| Range percentile takes range back to 1999 | |||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates