Global| Dec 14 2016

Global| Dec 14 2016Rise in U.S. Producer Prices Much Larger than Expected In November

by:Sandy Batten

|in:Economy in Brief

Summary

The headline Final Demand Producer Price Index jumped 0.4% m/m (1.3% y/y) in November after having been unchanged in October. The Action Economics Forecast Survey had looked for a 0.1% m/m rise. This was the highest y/y rate of [...]

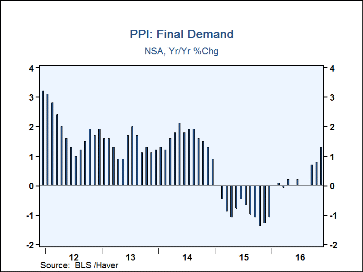

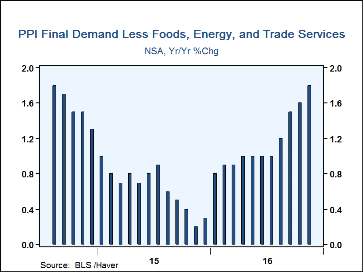

The headline Final Demand Producer Price Index jumped 0.4% m/m (1.3% y/y) in November after having been unchanged in October. The Action Economics Forecast Survey had looked for a 0.1% m/m rise. This was the highest y/y rate of increase since November 2014. The PPI excluding food and energy prices (a popular measure of core producer price inflation) also jumped 0.4% m/m (1.6% y/y) in November against an expected 0.2% m/m increase. This was the highest y/y rate of increase since January 2015.

Given the volatility and difficulty interpreting changes in prices of trade services, both the financial markets and the BLS are shifting their view of "core" PPI inflation to final demand prices excluding food, energy, and trade services prices from the historical "core" measure (that is, excluding only food and energy prices). This "new" core measure rose a more modest 0.2% m/m in February, versus a 0.1% m/m decline in October, to stand 1.8% higher than a year earlier. This y/y rate was the highest in this series' short history (back to August 2014). Prices of trade services jumped 1.3% m/m in November after having declined in each of the four previous months. While this jump is very difficult to interpret, this price measure is supposed to reflect profit margins in retail and wholesale trade. So, taken at face value, a jump in retail and wholesale margins could be pointing to a vibrant holiday selling season.

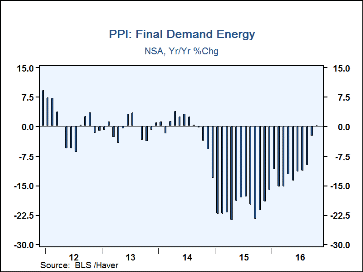

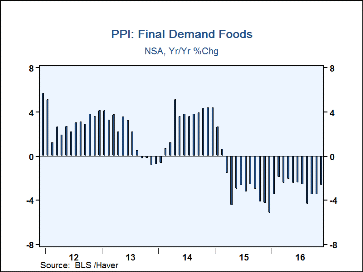

Prices of final demand goods rose 0.2% m/m in November (0.6% y/y), reflecting a rise in food prices and a decline in energy prices, versus a 0.4% m/m rise in October and a 0.7% m/m jump in September. The y/y increase was the second consecutive positive reading following 22 consecutive months in which goods prices had fallen from a year earlier.

Prices of final demand services rebounded in November, rising 0.5% m/m (1.5% y/y) after having fallen 0.3% m/m in October. This was the largest monthly increase since January 2016. A quarter of the November increase in final demand services prices was attributable to margins for apparel, jewelry, footwear and accessories retailing, which soared 4.2% m/m.

Final demand construction prices edged up 0.1% m/m in November, the fourth consecutive monthly increase, following a 0.7% m/m jump in October. Compared to a year ago, construction prices were up 0.8%.

Prices of processed goods for intermediate demand rose 0.3% m/m in November, their third consecutive monthly increase, and were 0.2% higher than a year earlier - their first foray into positive y/y territory since October 2014.

The PPI data are contained in Haver's USECON database with further detail in PPI and PPIR. The expectations figures are available in the AS1REPNA database.

| Producer Price Index (SA, %) | Nov | Oct | Sep | Nov Y/Y | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|

| Final Demand | 0.4 | 0.0 | 0.3 | 1.3 | -0.9 | 1.6 | 1.4 |

| Excluding Food & Energy | 0.4 | -0.2 | 0.2 | 1.6 | 0.8 | 1.7 | 1.5 |

| Excluding Food, Energy & Trade Services | 0.2 | -0.1 | 0.3 | 1.8 | 0.6 | 1.2 | -- |

| Goods | 0.2 | 0.4 | 0.7 | 0.6 | -4.3 | 1.3 | 0.8 |

| Foods | 0.6 | -0.8 | 0.5 | -2.7 | -2.6 | 3.2 | 1.7 |

| Energy | -0.3 | 2.5 | 2.5 | -0.1 | -20.6 | -0.9 | -0.8 |

| Goods Excluding Food & Energy | 0.2 | 0.1 | 0.3 | 1.5 | 0.4 | 1.5 | 1.1 |

| Services | 0.5 | -0.3 | 0.1 | 1.5 | 0.9 | 1.8 | 1.6 |

| Construction | 0.1 | 0.7 | 0.1 | 0.8 | 1.9 | 2.9 | 1.8 |

| Intermediate Demand - Processed Goods | 0.3 | 0.3 | 0.5 | 0.2 | -6.9 | 0.6 | 0.0 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates