Global| Dec 15 2009

Global| Dec 15 2009Rising Exports Fuel Rise in Japanese Industrial Production

Summary

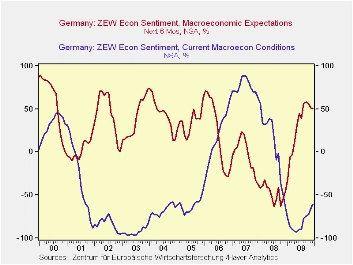

The ZEW indicator of investors sentiment in Germany declined for the third month in December. The percent balance of opinion on macro expectations six months ahead is now at 50.4%, down 7.3 percentage points from the peak of 57.7% in [...]

The ZEW

indicator of investors sentiment in Germany declined for the third

month in December. The percent balance of opinion on macro

expectations six months ahead is now at 50.4%, down 7.3 percentage

points from the peak of 57.7% in September. The

current level, however, is well above the long term average

of 27.0%. Although the balance between those respondents who

view current conditions negatively over those who view them positively

is still high at 60.6%, it declined five percentage points in December

and is well below the peak, 92.8%, reached in May of this year when it

was hard to find any optimists. The first chart shows the

percent balances for current conditions and the macro expectations over

the next six months.

The ZEW

indicator of investors sentiment in Germany declined for the third

month in December. The percent balance of opinion on macro

expectations six months ahead is now at 50.4%, down 7.3 percentage

points from the peak of 57.7% in September. The

current level, however, is well above the long term average

of 27.0%. Although the balance between those respondents who

view current conditions negatively over those who view them positively

is still high at 60.6%, it declined five percentage points in December

and is well below the peak, 92.8%, reached in May of this year when it

was hard to find any optimists. The first chart shows the

percent balances for current conditions and the macro expectations over

the next six months.

The survey is based on the opinions of 277

investors and analysts and took place from November 30 through December

14. During that period, data on new orders, industrial

production and retail sales for October were announced.

Industrial Production was down 1.86%, new orders for manufacturing were

down 2.57%, motor vehicle sales were down 1.37% and retail sales,

excluding motor vehicle sales, were flat. These data

suggested that the economic expansion might be somewhat slower than

earlier expectations and may have dampened some of the optimism of the

participants.

The survey is based on the opinions of 277

investors and analysts and took place from November 30 through December

14. During that period, data on new orders, industrial

production and retail sales for October were announced.

Industrial Production was down 1.86%, new orders for manufacturing were

down 2.57%, motor vehicle sales were down 1.37% and retail sales,

excluding motor vehicle sales, were flat. These data

suggested that the economic expansion might be somewhat slower than

earlier expectations and may have dampened some of the optimism of the

participants.

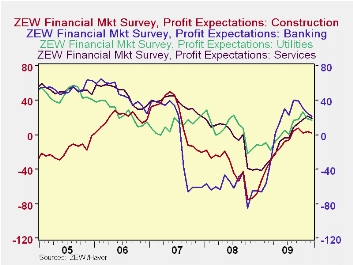

In spite of the decline in the overall outlook,

participants in the survey are still relatively optimistic regarding

the profit outlook. There are only four industries out of the

thirteen industries surveyed where the current balance of opinion is

for lower profits. These are: banking, construction,

utilities and services. They are shown in the second

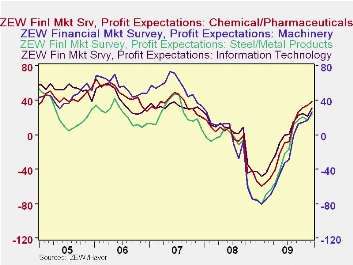

chart. Of the remaining industries--insurance,

chemicals/pharmaceuticals, steel/metal, electronics, machinery,

telecommunications, information technology--the balance of opinion is

for higher profits; and for vehicles/automotive and consumption/trade,

the balance of opinion is for smaller losses. The balance of

opinion for higher profits has risen significantly for the information

technology, machinery, steel/metal and chemicals/pharmaceuticals

industries, as can be seen in the third chart.

In spite of the decline in the overall outlook,

participants in the survey are still relatively optimistic regarding

the profit outlook. There are only four industries out of the

thirteen industries surveyed where the current balance of opinion is

for lower profits. These are: banking, construction,

utilities and services. They are shown in the second

chart. Of the remaining industries--insurance,

chemicals/pharmaceuticals, steel/metal, electronics, machinery,

telecommunications, information technology--the balance of opinion is

for higher profits; and for vehicles/automotive and consumption/trade,

the balance of opinion is for smaller losses. The balance of

opinion for higher profits has risen significantly for the information

technology, machinery, steel/metal and chemicals/pharmaceuticals

industries, as can be seen in the third chart.

| Dec 09 | Nov 09 | Oct 09 | Sep 09 | Aug 09 | Jul 09 | Jun 09 | May 09 | April 09 | |

|---|---|---|---|---|---|---|---|---|---|

| Current Conditions | -60.6 | -65.6 | -72.2 | -74.0 | -77.2 | -89.3 | -89.7 | -92.8 | -91.6 |

| Macro Expectations (6 Months Ahead) | 50.4 | 51.1 | 56.0 | 57.7 | 56.1 | 39.5 | 44.8 | 31.1 | 13.0 |