Global| May 31 2002

Global| May 31 2002Robust 1Q Productivity Revised Little

by:Tom Moeller

|in:Economy in Brief

Summary

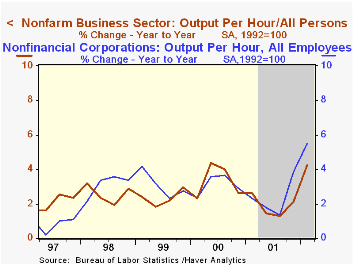

Nonfarm labor productivity in 1Q02 was little revised from the preliminary report. Expectations were for a slight downward revision based on the lowered GDP estimate. Both output and hours worked were revised down slightly. [...]

Nonfarm labor productivity in 1Q02 was little revised from the preliminary report. Expectations were for a slight downward revision based on the lowered GDP estimate.

Both output and hours worked were revised down slightly.

Compensation growth was revised up slightly and that lessened the decline in unit labor costs.

In the nonfinancial corporate sector, productivity rose at a 6.9% (5.5% y/y) rate following an 11.0% 4Q surge. Nonfinancial sector output is based on the income figures from the national accounts.

Inflation in the nonfarm business sector was revised up to -0.7% (AR) from -1.0%.

Manufacturing sector productivity growth was revised slightly lower to 9.4% from 9.7%.

| Nonfarm Business Sector (SAAR) | 1Q '02 Revised | 1Q '02 Prelim. | 4Q '01 | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|---|

| Output per Hour | 8.4% | 8.6% | 5.5% | 4.2% | 1.9% | 3.3% | 2.3% |

| Compensation | 2.9% | 2.6% | 2.3% | 3.4% | 5.8% | 6.6% | 4.4% |

| Unit Labor Costs | -5.0% | -5.3% | -3.0% | -0.8% | 3.8% | 3.1% | 2.0% |

by Tom Moeller May 31, 2002

The Chicago Purchasing Manager’s Index of Business activity was surprisingly strong in May, rising to the highest level since March 2001.

Indexes of new orders, production and employment all rose strongly.

The prices paid index rose to the highest level since March of last year. The vendor delivery speed index rose sharply.

| Chicago Purchasing Managers Index, SA | May | April | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Business Barometer | 60.8 | 54.7 | 39.2 | 41.4 | 51.8 | 56.5 |

| Prices Paid | 58.3 | 55.4 | 55.8 | 50.5 | 65.6 | 57.6 |

by Tom Moeller May 31, 2002

Manufacturing inventories fell for the fifteenth consecutive month in April. March decumulation was unrevised.

Inventory decumulation continued strong across industries. Only inventories of transportation equipment rose as a result of an increase in the automobile category. Furniture & related products fell after a sharp downward revision to March.

Shipments rose a sharp 2.4% (-1.5% y/y), the fifth gain in seven months.

| Inventories | April | Mar | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Mfg Inventories | -0.2% | -0.6% | -8.6% | -7.5% | 4.3% | 2.2% |

by Tom Moeller May 31, 2002

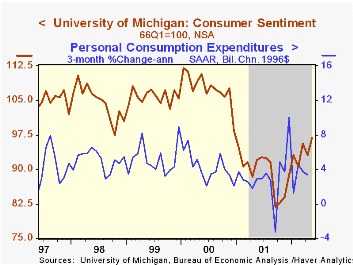

The May reading of Consumer Sentiment from the University of Michigan rose to the highest level since December 2000, adding slightly to the increase reported in the mid-month report.

The rise in sentiment reflected higher readings for expectations and current conditions.

The University of Michigan survey is not seasonally adjusted.

During the past five years there has been a 37% correlation between the level of consumer sentiment and the 3-month % change in real PCE.

| Univ. of Michigan | May | April | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Consumer Sentiment | 96.9 | 93.0 | 5.3% | 89.2 | 107.6 | 105.8 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates