Global| Jan 04 2008

Global| Jan 04 2008Service Sector Still Pummeled in Europe…France Excepted

Summary

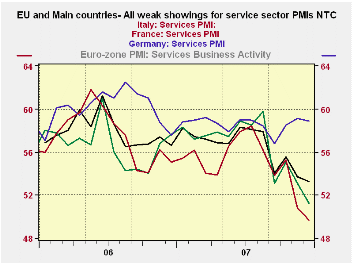

The chart tells a clear story of malaise and decline in Europe’s service sector. Survey readings for services industries in the overall community are weak. Individual countries are weak across the board with the exception of France [...]

The chart tells a clear story of malaise and decline in

Europe’s service sector. Survey readings for services industries in the

overall community are weak. Individual countries are weak across the

board with the exception of France which bucked the trend last month by

rising when other countries’ indices fell hard. This month France’s

service sector index has edged lower but it is vastly stronger than in

most other major EMU nations. The UK, an EU member, is also showing

pronounced sector weakness.

If we position the current readings in their respective ranges

of values since May of 2000 we find all are below their range midpoints

except France which stands in its 60th percentile. Germany and the

overall EMU measure are in their respective 44th to 45th percentiles.

Spain, Ireland and Italy are roughly in the bottom third of their

respective ranges with Italy even weaker than that.

The service sector is an important engine of job growth in

Europe as it is in the US. And concerns over the euro’s strength and

the fallout from the financial sector problems in the US are problems

that are in play. The MFG sector in Europe has actually bounced from

its lows over the past two months in the face of such pressures.

Services however, continue to weaken. The ECB is on the spot with

another strong inflation reading in December that defies it to take

anti-inflation steps as oil prices spurt and while the euro is

screaming to stronger values. The actual weakness in the economy may

seem to make the ECB’s job that much harder, but in fact actual

weakness makes ECB temperance less of an act of bravado. Its failure to

hike rates in the face of inflation and spare the euro further stress

is easier if the economy is showing some real weakness up front. The

service sector is giving the ECB a real excuse for playing the waiting

game- right or wrong.

| NTC Services Indices for EU/EMU | |||||||

|---|---|---|---|---|---|---|---|

| Dec-07 | Nov-07 | Oct-07 | 3-Mo | 6-Mo | 12-Mo | Percentile | |

| Euro-13 | 53.14 | 54.14 | 55.81 | 54.36 | 55.62 | 56.58 | 43.5% |

| Germany | 51.24 | 53.09 | 55.08 | 53.14 | 55.12 | 56.49 | 44.9% |

| France | 58.89 | 59.15 | 58.48 | 58.84 | 58.44 | 58.60 | 60.4% |

| Italy | 49.71 | 50.77 | 55.27 | 51.92 | 54.04 | 54.86 | 15.7% |

| Spain | 50.99 | 50.69 | 52.45 | 51.38 | 52.72 | 54.45 | 31.1% |

| Ireland | 53.53 | 52.81 | 56.48 | 54.27 | 55.13 | 57.18 | 36.7% |

| EU only | |||||||

| UK | 52.36 | 51.95 | 53.08 | 52.46 | 54.78 | 56.25 | 42.5% |

| percentile is over range since May 2000 | |||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates