Global| May 27 2010

Global| May 27 2010Some Bad News From Europe…

Summary

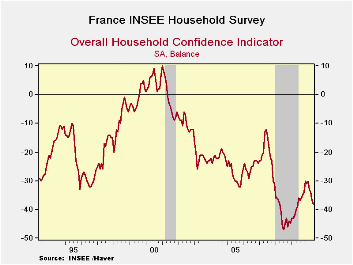

The Insee index of household confidence has dropped again marking the fourth straight month of decline. This is not some garden variety slippage in confidence from France. The four month drop marks a cumulative drop of eight points in [...]

The Insee index of household confidence has dropped again marking the

fourth straight month of decline. This is not some garden variety

slippage in confidence from France. The four month drop marks a

cumulative drop of eight points in the index which is the 12th largest

four month decline in the series history. That makes the drop a top 5%

event. This not exactly what Europe is looking for in May.

The Insee index of household confidence has dropped again marking the

fourth straight month of decline. This is not some garden variety

slippage in confidence from France. The four month drop marks a

cumulative drop of eight points in the index which is the 12th largest

four month decline in the series history. That makes the drop a top 5%

event. This not exactly what Europe is looking for in May.

Until quite recently most European reports had been upbeat. But now there are some signs of erosion. The GFK German confidence index for June edged slightly lower on expectations decay. The UK CBI distributive trades index also reported today plunged sharply in May. Now in France the household confidence index that has been slipping has continued on that path.

Until now we had seen a fairly steady and strong recovery of economic data in the wake of the financial crisis. The MFG sector has been rebounding in Europe particularly strongly. The service sector has lagged. And the household sector has lagged even further. But in France it’s not a case of lagging but of the sector declining, backtracking.

The European economy is fighting off the remnants of recession and financial crisis with a new layering of financial crisis stemming from Greece’s problems, the knock effects to banks that hold European debt (substantially French and German banks) and the adverse market sentiment stemming from the need for fiscal austerity in Europe including France. It looks like the French consumer has figured out that the recovery will not be a bed of roses and maybe even that sector wide strikes that make such great theater in France will serve no purpose this time. The French consumer appears to be going down without a fight.

| INSEE Household Monthly Survey | |||||||

|---|---|---|---|---|---|---|---|

| Since Jan 1990 | |||||||

| May-10 | Apr-10 | Mar-10 | Feb-10 | Percentile | Rank % | Mean | |

| Household Confidence | -38 | -37 | -34 | -33 | 15.8 | 5.7 | -19 |

| Living Standards | |||||||

| past 12 Mos | -67 | -68 | -68 | -67 | 13.3 | 10.2 | -41 |

| Next 12-Mos | -53 | -48 | -43 | -37 | 9.2 | 4.1 | -22 |

| Unemployment: Next 12 | 62 | 63 | 63 | 58 | 77.3 | 83.7 | 33 |

| Price Developments | |||||||

| Past 12Mo | -20 | -18 | -25 | -26 | 30.8 | 56.7 | -16 |

| Next 12-Mos | -26 | -31 | -34 | -37 | 37.0 | 82.4 | -35 |

| Savings | |||||||

| Favorable to save | 14 | 17 | 18 | 20 | 43.2 | 19.2 | 22 |

| Ability to save Next 12 | -10 | -10 | -8 | -10 | 44.8 | 49.8 | -9 |

| Spending | |||||||

| Favorable for major purchase | -24 | -26 | -23 | -24 | 31.0 | 25.3 | -14 |

| Financial Situation | |||||||

| Current | 16 | 16 | 16 | 16 | 61.9 | 82.9 | 12 |

| Past 12 MOs | -25 | -25 | -24 | -25 | 35.5 | 13.9 | -17 |

| Next 12-Mos | -19 | -16 | -13 | -12 | 11.8 | 3.7 | -2 |

| Number of observations in the period | 245 | ||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates