Global| Oct 26 2009

Global| Oct 26 2009South Korea Reports 3Q GDP

Summary

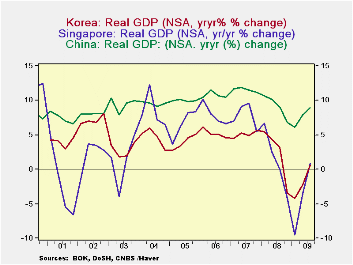

South Korean joins China and Singapore among the emerging economies of the Pacific Rim to report third quarter GDP. GDP growth in the three countries is shown in the first chart. The declines in the economies of Korea and Singapore [...]

South Korean

joins China and Singapore among the emerging economies of the Pacific

Rim to report third quarter GDP. GDP growth in the three

countries is shown in the first chart. The declines in the

economies of Korea and Singapore have been much more severe than those

in China. China has not experienced a year to year decline in

GDP, merely a deceleration of growth. At their low points in

the first quarter of this year, GDP in Singapore was 9.5% below the

year ago figure and GDP in Korea, 4.3% below.

South Korean

joins China and Singapore among the emerging economies of the Pacific

Rim to report third quarter GDP. GDP growth in the three

countries is shown in the first chart. The declines in the

economies of Korea and Singapore have been much more severe than those

in China. China has not experienced a year to year decline in

GDP, merely a deceleration of growth. At their low points in

the first quarter of this year, GDP in Singapore was 9.5% below the

year ago figure and GDP in Korea, 4.3% below.

Korea reported that GDP grew 2.9% in the third quarter on a seasonally adjusted basis, compared with 2.7% in the second quarter. On a seasonally unadjusted basis, GDP was 0.6% above the year ago figure, the first positive figure since the third quarter of 2008.

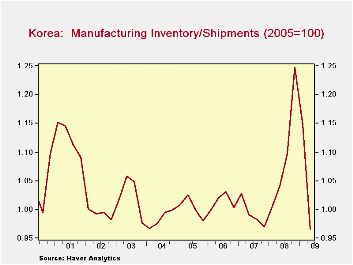

A swing in inventories from a liquidation of 4,506 million won* in the

second quarter to an accumulation of 6,486 won in the third quarter was

the main factor in the third quarter strength. However, this

should not be a cause of concern at this point in the business

cycle. The rise follows three successive quarters of big

liquidations, beginning in the fourth quarter of 2008--7,290 million

won 6,788 million won and 4,506 million wan. The inventory to

shipments ratio for manufacturing at the end of the second quarter was

.97 down from 1.25 at the end of 2008. As can be seen in the

second chart, the I/S ratio for manufacturing was somewhat below normal

at the end of the second quarter so that a build up in the third

quarter is not unexpected.

A swing in inventories from a liquidation of 4,506 million won* in the

second quarter to an accumulation of 6,486 won in the third quarter was

the main factor in the third quarter strength. However, this

should not be a cause of concern at this point in the business

cycle. The rise follows three successive quarters of big

liquidations, beginning in the fourth quarter of 2008--7,290 million

won 6,788 million won and 4,506 million wan. The inventory to

shipments ratio for manufacturing at the end of the second quarter was

.97 down from 1.25 at the end of 2008. As can be seen in the

second chart, the I/S ratio for manufacturing was somewhat below normal

at the end of the second quarter so that a build up in the third

quarter is not unexpected.

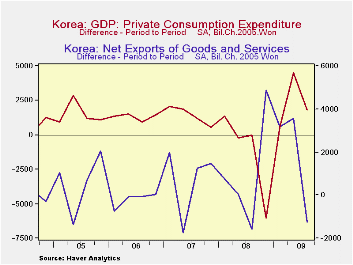

The performance of the other components of

GDP was generally typical of that seen in the early stages of

recovery--some increases and some retrenchments. The one

notable exception was a greater decline in exports of goods and

services, than that in imports of goods and services, with the result

that the balance on goods and services declined from 20.3 billion won

in the second quarter to 19.1 billion won . In the past,

exports have been a dynamic element in the growth of the Korean economy

and generally quick to respond to improvements in the world economy.

Private consumption increased by 3,524.7 million won in the third

quarter compared with an increase of 1,367.1, this could be an sign

that Korea is beginning to shift away from its policy of export led

growth but it is probably not too wise to base a conclusion on one

quarter's evidence. See the third chart. There were small

declines in construction, fixed investment in intangible

assets and government consumption and the change in business investment

in plant and equipment was essentially unchanged at 1,778 million won

in the third quarter, compared with a rise of 1,846 million won in the

second quarter.

The performance of the other components of

GDP was generally typical of that seen in the early stages of

recovery--some increases and some retrenchments. The one

notable exception was a greater decline in exports of goods and

services, than that in imports of goods and services, with the result

that the balance on goods and services declined from 20.3 billion won

in the second quarter to 19.1 billion won . In the past,

exports have been a dynamic element in the growth of the Korean economy

and generally quick to respond to improvements in the world economy.

Private consumption increased by 3,524.7 million won in the third

quarter compared with an increase of 1,367.1, this could be an sign

that Korea is beginning to shift away from its policy of export led

growth but it is probably not too wise to base a conclusion on one

quarter's evidence. See the third chart. There were small

declines in construction, fixed investment in intangible

assets and government consumption and the change in business investment

in plant and equipment was essentially unchanged at 1,778 million won

in the third quarter, compared with a rise of 1,846 million won in the

second quarter.

*The won in all cases is the 2005 chained won.

| SOUTH KOREA | Q3 09 | Q2 09 | Q1 09 | Q4 08 | Q3 08 | Q2 08 | Q1 08 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|---|---|

| GDP | |||||||||

| Q/Q Change (SA) | 2.93 | 2.65 | 0.12 | -5.07 | 0.22 | 0.43 | 1.00 | 2.22 | 5.11 |

| Y/Y Change (NSA) | 0.58 | -2.16 | -425 | -3.40 | 3.11 | 4.35 | 5.46 | 2.22 | 5.11 |

| Change in New Exports (Mil. 2005 Chained Won) | -1263 | 3572 | 3175 | 4876 | -1590 | 48 | 756 | 10019 | 6577 |

| Change in Inventory Change " | 6487 | -4506 | -6788 | -7290 | 1396 | 467 | 2004 | 7752 | -2815 |

| Change in Private Consumption " | 3525 | 1367 | -880 | -3189 | 1648 | -3364 | -25 | 4703 | 24655 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates