Global| Jan 18 2013

Global| Jan 18 2013State Unemployment Rates Are Lower But Range From 3.2% To 10.2%

by:Tom Moeller

|in:Economy in Brief

Summary

Throughout the United States, the unemployment rate has fallen to some degree from the recession high. While not down much in New Jersey, New York and Connecticut, rates are nonetheless down sharply elsewhere. The problem in the labor [...]

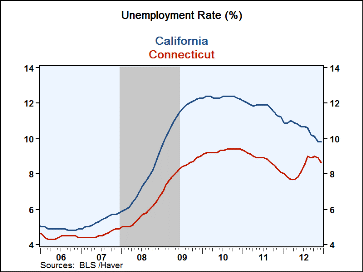

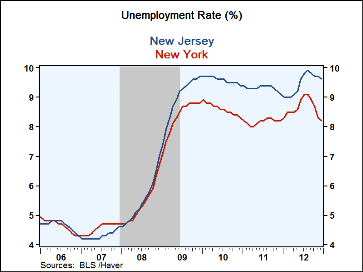

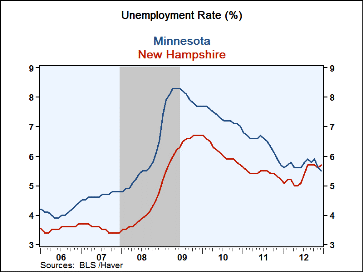

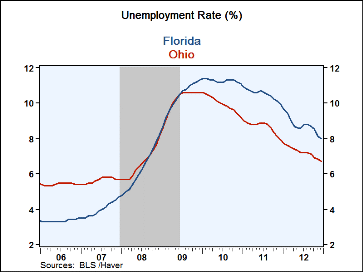

Throughout the United States, the unemployment rate has fallen to some degree from the recession high. While not down much in New Jersey, New York and Connecticut, rates are nonetheless down sharply elsewhere. The problem in the labor market overall, however, is that unemployment rates remain roughly two or more times higher than at their lowest levels in 2007. The accompanying tables indicate the unemployment rates in large and small states.

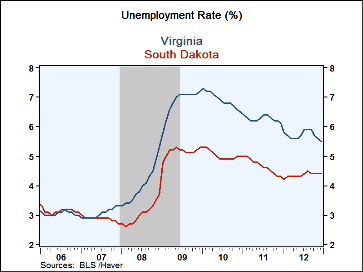

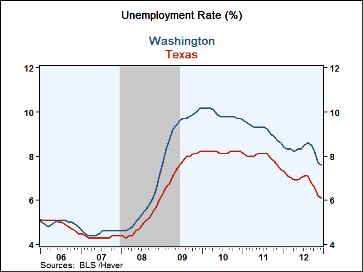

In the two largest states, California and Texas, unemployment rates have declined by roughly two percentage points from their peaks. However, the unemployment rate in California remains one of the highest in the country and nearly four percentage points higher than in Texas. The unemployment rates in the least populated states, including the Dakotas, Nebraska and Iowa, remain the lowest in the country.

Without strong momentum in the country's rate of economic growth, state unemployment rates should remain high and perhaps just as divergent as they are now. The forecast from the National Association for Business Economics is for economic growth of 3.0% or less through the end of this year and an unemployment rate of 7.6% at yearend.

State unemployment figures are available in Haver's EMPLR database.

| State Unemployment Rate | December | November | 2012 | 2011 | 2010 | Labor Force |

|---|---|---|---|---|---|---|

| Total U.S. | 7.8% | 7.8% | 8.1% | 8.9% | 9.6% | 155.1 mil. |

| Ten States With Highest Jobless Rate | ||||||

| Nevada | 10.2 | 10.8 | 11.7 | 13.6 | 13.7 | 1.4 |

| Rhode Island | 10.2 | 10.4 | 10.8 | 11.3 | 11.7 | 0.6 |

| California | 9.8 | 9.8 | 10.5 | 11.8 | 12.3 | 18.4 |

| New Jersey | 9.6 | 9.7 | 9.5 | 9.3 | 9.6 | 4.6 |

| North Carolina | 9.2 | 9.1 | 9.5 | 10.5 | 10.9 | 4.7 |

| Mississippi | 8.6 | 8.5 | 9.0 | 10.7 | 10.5 | 2.3 |

| Georgia | 8.6 | 8.5 | 8.9 | 9.8 | 10.2 | 4.8 |

| Connecticut | 8.6 | 8.9 | 8.3 | 8.8 | 9.3 | 1.9 |

| South Carolina | 8.4 | 8.3 | 9.0 | 10.3 | 11.2 | 2.1 |

| New York | 8.2 | 8.3 | 8.6 | 8.2 | 8.6 | 9.6 |

| States With Lowest Jobless Rate | December | November | 2012 | 2011 | 2010 | Labor Force |

|---|---|---|---|---|---|---|

| Virginia | 5.5% | 5.6% | 5.7% | 6.3% | 6.9% | 4.3 mil. |

| Minnesota | 5.5 | 5.6 | 5.7 | 6.4 | 7.3 | 3.0 |

| New Hampshire | 5.7 | 5.6 | 5.4 | 5.4 | 6.1 | 0.7 |

| Utah | 5.2 | 5.1 | 5.7 | 6.7 | 8.0 | 1.3 |

| Vermont | 5.1 | 5.2 | 5.0 | 5.6 | 6.4 | 0.4 |

| Wyoming | 4.9 | 5.1 | 5.3 | 6.0 | 7.0 | 0.3 |

| Iowa | 4.9 | 4.9 | 5.2 | 5.9 | 6.3 | 1.7 |

| South Dakota | 4.4 | 4.4 | 4.3 | 4.7 | 5.0 | 0.4 |

| Nebraska | 3.7 | 3.7 | 3.9 | 4.4 | 4.7 | 1.0 |

| North Dakota | 3.2 | 3.1 | 3.1 | 3.5 | 3.8 | 0.4 |

| Jobless Rate In Other Selected Large States | December | November | 2012 | 2011 | 2010 | Labor Force |

|---|---|---|---|---|---|---|

| Florida | 8.0% | 8.1% | 8.7% | 10.5% | 11.3% | 9.3 mil. |

| Washington | 7.6 | 7.7 | 8.2 | 9.2 | 9.9 | 3.5 |

| Tennessee | 7.6 | 7.6 | 8.0 | 9.2 | 9.8 | 3.1 |

| Indiana | 8.2 | 8.0 | 8.2 | 9.0 | 10.1 | 3.1 |

| Arizona | 7.9 | 7.8 | 8.3 | 9.5 | 10.5 | 3.0 |

| Colorado | 7.6 | 7.7 | 7.9 | 8.3 | 8.9 | 2.7 |

| Ohio | 6.7 | 6.8 | 7.2 | 8.6 | 10.0 | 5.8 |

| Wisconsin | 6.6 | 6.6 | 6.9 | 7.5 | 8.4 | 3.1 |

| Maryland | 6.6 | 6.6 | 6.7 | 7.1 | 7.8 | 3.1 |

| Texas | 6.1 | 6.2 | 6.8 | 7.9 | 8.2 | 12.6 |

| Louisiana | 5.5 | 5.8 | 6.9 | 7.3 | 7.5 | 2.1 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates