Global| Mar 17 2008

Global| Mar 17 2008Stock Markets Plunge: Commodity Prices Soar

Summary

Stock markets around the world have taken another plunge as a result of the latest turmoil in the financial markets. Peaks and troughs in the stock markets have been successively lower ever since the sub prime crisis erupted last [...]

Stock markets around the world have taken another plunge as a

result of the latest turmoil in the financial markets. Peaks and

troughs in the stock markets have been successively lower ever since

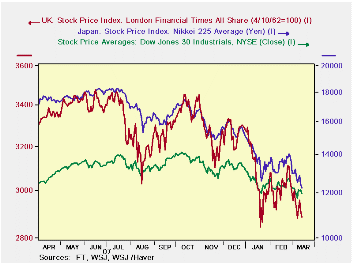

the sub prime crisis erupted last August. The attached chart plots

daily stock price indexes for the United States (the Dow Jones), the

United Kingdom (the Financial Times All Share) and Japan (the Nikkei

225). As of last Friday, the Dow Jones was down 15% from its July 19,

2007 peak of 14,000. The Financial Times All Share was down 17% and the

Nikkei 225, 33% from their peaks of respectively 3,468 and 18,239 on

July 13, 2007. Early indicators suggests further falls today.

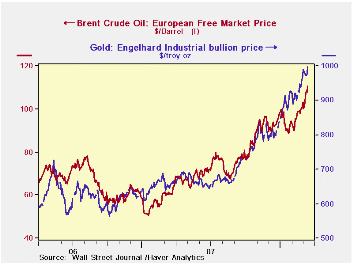

While stock markets been falling, commodity prices have been soaring. In attempts to seek safety, investors have turned to commodities, gold and oil in particular. The second chart shows the run ups in the prices of these commodities. Over the same period that the Dow Jones fell 15%, gold rose 47% and oil 43%.

These daily prices can be found in the Haver Data Base, INTDAILY.

| STOCK PRICE INDEXES | Mar 14,08 | Peak, Jul 07 | % Chg |

|---|---|---|---|

| U. S. Dow Jones | 11951.09 | 14000.41 | -14.64 |

| U.K. Financial Times All Shares | 2886.17 | 3467.92 | -16.78 |

| Japan Nikkei 225 Foreign | 12240.60 | 18238.95 | -32.88 |

| COMMODITY PRICES | |||

| Gold (Engelhard Indus Bullion $ per troy oz.) | 997.34 | 676.26 | 47.78 |

| Oil (Brent Crude $ per bbl.) | 110.75 | 78.33 | 41.39 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates