Global| Feb 27 2017

Global| Feb 27 2017Texas Factory Sector Activity Approaches 2006 High

by:Tom Moeller

|in:Economy in Brief

Summary

The Federal Reserve Bank of Dallas indicated in its Texas Manufacturing Outlook Survey that the General Business Activity Index increased to 24.5 during February, the strongest reading since April 2006. Improved readings for [...]

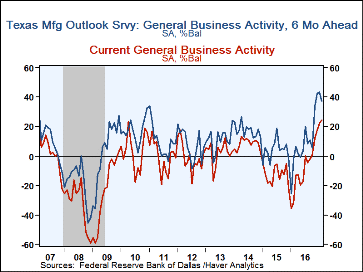

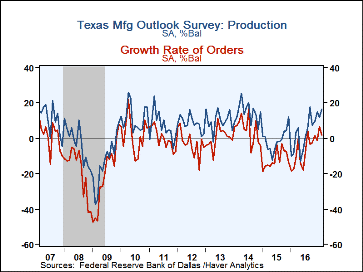

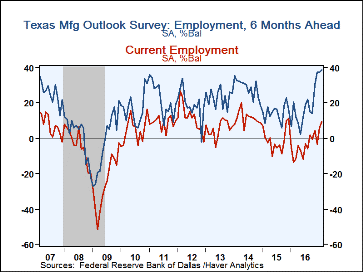

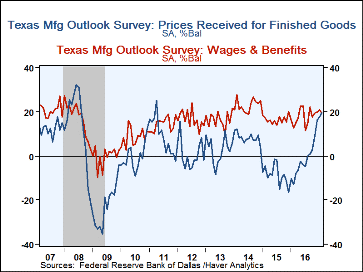

The Federal Reserve Bank of Dallas indicated in its Texas Manufacturing Outlook Survey that the General Business Activity Index increased to 24.5 during February, the strongest reading since April 2006. Improved readings for production, employment and the delivery times index led the total higher. Another labor indicator, the wages & benefits series, remained firm. As for inflation, the finished goods prices paid indicator surged to the highest level since April 2011, and the raw materials prices index also strengthened to its 2011 high.

The General Business Activity, Six Months Ahead Index backed away from its 13-year high. Expected production, new orders and shipments all eased. Expected employment and wages & salaries, however, strengthened significantly.

Each index is calculated by subtracting the percentage reporting a decrease from the percentage reporting an increase. When all firms report that activity has increased, an index will register 100. An index will register -100 when all firms report a decrease. An index will be zero when the number of firms reporting an increase or decrease is equal. Items may not add up to 100% because of rounding. Data for the Texas Manufacturing Outlook can be found in Haver's SURVEYS database.

| Texas Manufacturing Outlook Survey (SA, % Balance) | Feb | Jan | Dec | Feb'16 | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|

| Current General Business Activity Index | 24.5 | 22.1 | 17.7 | -31.4 | -8.8 | -12.5 | 8.4 |

| Production | 16.7 | 11.9 | 14.8 | -8.5 | 2.4 | -1.0 | 14.5 |

| Growth Rate of Orders | 2.0 | 6.7 | -1.1 | -17.6 | -7.3 | -11.8 | 4.7 |

| Number of Employees | 9.6 | 6.1 | -3.4 | -13.3 | -4.9 | -0.4 | 11.5 |

| Prices Received for Finished Goods | 19.5 | 17.7 | 16.2 | -12.7 | -1.6 | -8.5 | 8.3 |

| General Business Activity Index Expected in Six Months | 37.0 | 43.7 | 42.5 | -1.5 | 8.9 | 4.1 | 17.4 |

| Production | 46.4 | 53.9 | 54.8 | 33.4 | 35.8 | 31.1 | 42.7 |

| Growth Rate of New Orders | 39.9 | 48.4 | 36.0 | 18.5 | 24.3 | 20.7 | 31.5 |

| Wages & Benefits | 45.0 | 42.5 | 43.6 | 28.0 | 34.8 | 33.2 | 43.1 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates