Global| Nov 28 2007

Global| Nov 28 2007The German Condition...

Summary

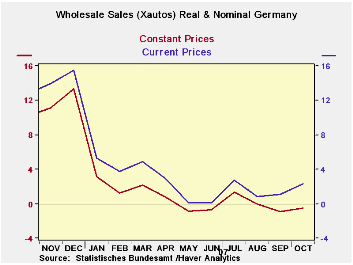

German wholesale sales growth is lagging in new quarter. Real ex-auto sales remain challenged. Europe has been spinning out mixed economic signals. While there has been a lot of angst exhibited over the strong euro, the German finance [...]

German wholesale sales growth is lagging in new quarter. Real

ex-auto sales remain challenged.

Europe has been spinning out mixed economic signals. While

there has been a lot of angst exhibited over the strong euro, the

German finance minister has embraced the strength and ECB members say a

strong currency is ‘the right sort of problem to have,’ better than the

other one.

In the wake of this strength EMU economic reports have become

uneven. While orders have showed weakness across countries, other

reports have showed some resilience, notably the IFO survey in Germany

and an INSEE morale survey for industry in France. The most recent

German consumer sentiment reading from GFK shows a weaker December is

in store. But there has been no full scale weakening.

German wholesalers fit not the mixed mode. Overall sales are

withering in the new quarter down by 0.1% Q/Q for an annual rate drop

of 0.7% and lower from the year ago three month period by 1.6% in real

terms. Ex autos sales are still eroding. The German VAT tax hike has

wreaked havoc with German retail/wholesale trends so far this year. Now

with the euro soaring, a new challenge is in gear. The strong euro does

not appear to have knocked the wind out of the German economy but it

has been added to list of headwinds that the economy faces. Labor

unrest and possibly more ECB rate hikes, especially in the wake of such

strong ongoing money and loan growth in EMU, also are on that list.

Despite it all German wholesale sales are only moderately weak.

| One Month of Quarter Complete | |||

|---|---|---|---|

| Quarterly showing | |||

| %Q/Q | %-Saar | %Q/Yr Ago | |

| Nominal | 1.1% | 5.5% | -19.8% |

| Real | -0.1% | -0.7% | -1.6 |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates