Global| Oct 21 2008

Global| Oct 21 2008The Global Financial Crisis Hits British Industry

Summary

The Confederation of Business Industry (CBI) released the results of its latest surveys of industrial trends. The quarterly survey gathers the opinions of manufacturers on a number of trends--the general business outlook, trends in [...]

The Confederation of Business Industry (CBI) released the results of its latest surveys of industrial trends. The quarterly survey gathers the opinions of manufacturers on a number of trends--the general business outlook, trends in their own output, orders, including foreign, capital spending, employment, prices and inventories. The monthly survey updates the opinions on trends in orders, inventories, prices and output--past and expected.

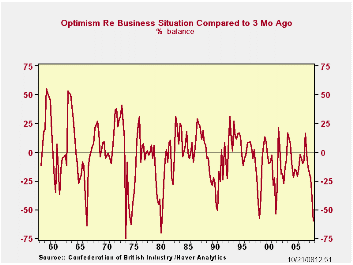

The latest quarterly survey shows that only 4% of the respondents were more optimistic about the general business situation than they had been in the previous survey, while 64% were more pessimistic, resulting in a -60 for the quarter. This was the most pessimistic reading of business confidence measure since the third quarter of 1980 when the excess of pessimists was 70%. The first chart shows the history of the CBI's confidence measure.

Most of the components of the survey showed low points not seen for some time. For example, 31% more of the respondents expected output over the next three months to be lower than those expecting it to be higher. It is necessary to go back to the fourth quarter of 1980 to find as many pessimists on the outlook. A few of the components are shown in the table below together with the date when a comparable figure occurred.

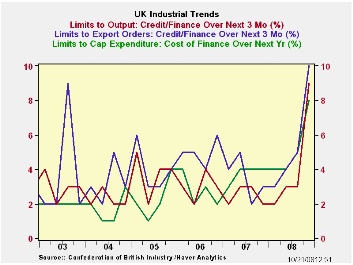

Ian McCafferty, Chief Economic Adviser of CBI remarked that ".....the sharp falls in orders and output show that the slowdown in the UK economy is now spreading to sectors previously resilient to the weakness in the banking and housing sectors. It is also of serious concern that constraints on capital now appear to be affecting manufacturers, in a way that had not been the case earlier." Indeed, there were spikes in the current quarter in the percentage of respondents who said credit or finance might be a factor in their negative appraisal of output, orders and capital spending, as can be seen in the second chart.

| UNITED KINGDOM CBI INDUSTRIAL TRENDS SURVEY | Q4 08 | Q3 08 | Q2 08 | Q1 08 | PRE- VIOUS | DATE |

|---|---|---|---|---|---|---|

| Output over next 3 months | -31 | -7 | 0 | 8 | -31 | 1980:4 |

| Capital Spending Buildings | -44 | -24 | -21 | -21 | -49 | 1996:4 |

| Capital Spending Plant & Equipment | -38 | -24 | -18 | -12 | -46 | 1980:4 |

| Domestic Orders | -42 | -21 | -9 | -3 | -42 | 1991:1 |

| Export Orders | -21 | -8 | 5 | 0 | -34 | 2001:4 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates