Global| Aug 21 2020

Global| Aug 21 2020The PMI Flash Surge Is Gone in a Flash

Summary

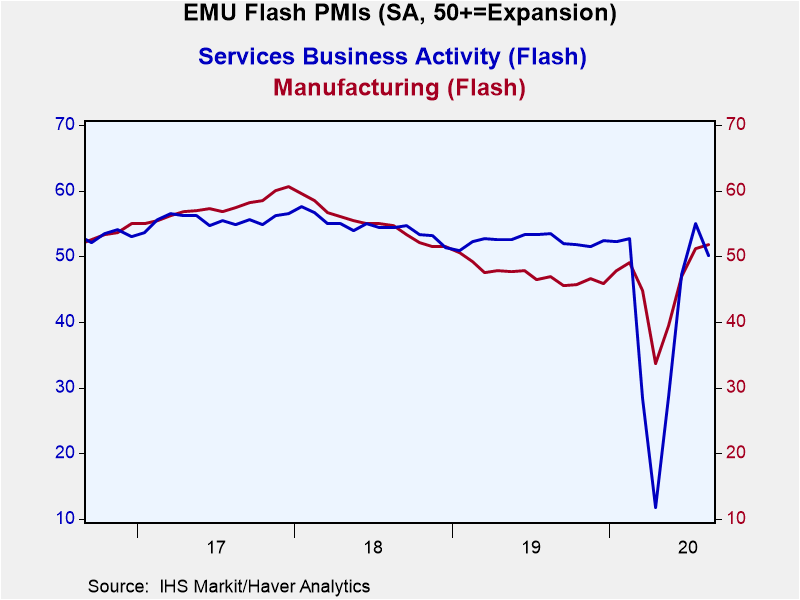

The flash PMIs from Markit show a widespread step back in August from the surge made in July. Of course, the gain in PMI values, accomplished in July, remain mostly in place. But the backtracking in the month-to-month gain casts doubt [...]

The flash PMIs from Markit show a widespread step back in August from the surge made in July. Of course, the gain in PMI values, accomplished in July, remain mostly in place. But the backtracking in the month-to-month gain casts doubt on the state of momentum.

The flash PMIs from Markit show a widespread step back in August from the surge made in July. Of course, the gain in PMI values, accomplished in July, remain mostly in place. But the backtracking in the month-to-month gain casts doubt on the state of momentum.

France shows the largest step back among this group in August. The United Kingdom and the United States show the greatest gains on the month; the U.K. has the highest raw diffusion score and its highest score of the period led by the rebound in services. The U.K. also has the highest queue standing score at its 98th percentile. The U.S. ranks next at its 74th percentile.

Still, PMI gauges are about the breadth of a gain over a period of time. These indexes measure month-to-month changes We treat gains in the indexes in breadth as if they are gains in strength which is not actually true. Despite some high valued PMI readings that persist this month, we must remember that unemployment rates are still quite elevated and output is not back to normal. The PMIs give a false sense of security on the extent of the rebound that is in progress.

Manufacturing lags behind services everywhere as a standing in the percentile of its historic range. But in queue percentile terms, the standing in its range for manufacturing relative to the service sector is mixed. Manufacturing has a stronger rank than services except for France, the U.K. and the U.S.

The EMU shows an overall 27.8 percentile standing with manufacturing at a 44.4 percentile standing and services at a 7.4 percentile standing. Notice that these rankings are markedly different even though their respective raw diffusion index values are quite similar. The service sector generally is lagging except in the U.S. and the U.K. France has a better performing service sector than manufacturing sector, but both sectors have rank standings well below their respective medians.

The month's results suggest that improvement is continuing; however, the initial strength is abating. Japan continues to contract with little actual change in conditions on the month. The French manufacturing sector is contracting. But PMI sector rankings show ALL sector standings are below their respective medians (a rank standing of 50%) except in the U.S. and the U.K. where both sectors reside above their respective medians. Japan in contrast sports extremely low rank standings for both sectors.

Japan is the 'odd-man out- of the recovery process. The U.K. and the U.S. look like 'recovery winners' especially in view of the relatively balanced growth. The French manufacturing sector has a very weak ranking while the German service sector has a very weak ranking. The EMU metrics seem more affected by the German services weakness, but clearly there is more to it than that. Even though recovery is progressing, there are many risks including the risk of more substantial backtracking and an uneven recovery across the goods and services sectors. We will watch the U.S. and U.K. cases closely to see if they can maintain their recovery edge and their balance.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates