Global| Aug 26 2020

Global| Aug 26 2020Transport Drives Strong U.S. Durable Goods Orders

Summary

• Headline durable goods orders jumped 11.2% in July as transport soared 35.6%. • Excluding transportation orders were up a solid 2.4%, with core capital goods growing 1.9%. • Core capital goods orders are just 0.5% from their [...]

• Headline durable goods orders jumped 11.2% in July as transport soared 35.6%.

• Excluding transportation orders were up a solid 2.4%, with core capital goods growing 1.9%.

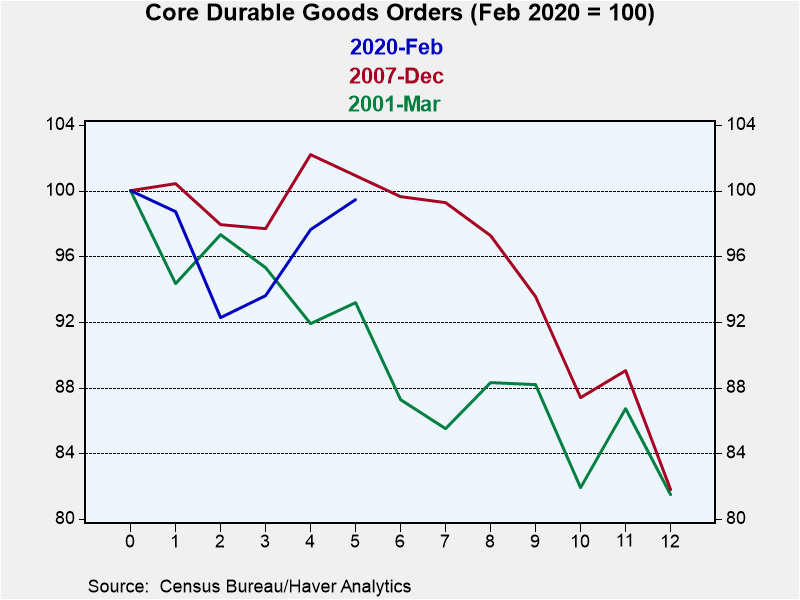

• Core capital goods orders are just 0.5% from their February 2020 level.

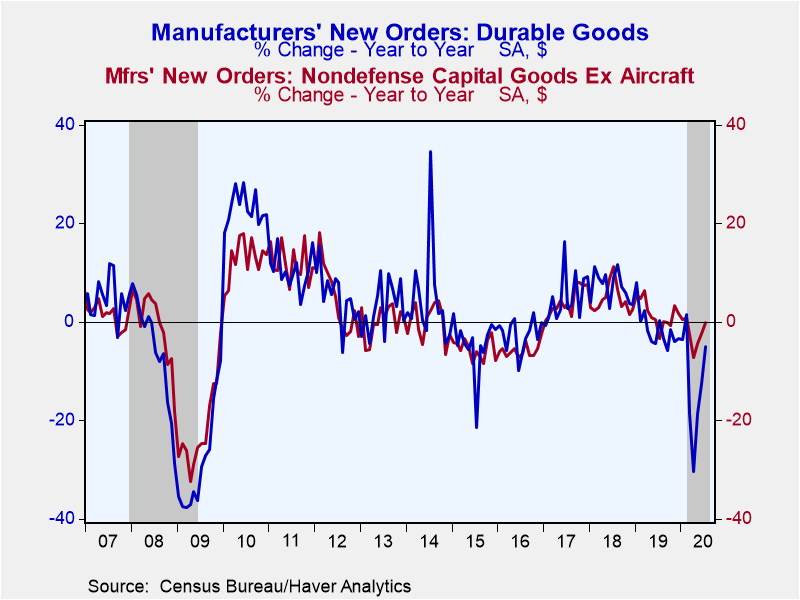

Manufacturers' orders for durable goods jumped a greater than expected 11.2% in July (-5.0% year-on-year) following a slightly upwardly-revised 7.7% gain in June (was 7.6%). The Action Economics Forecast Survey anticipated 4.1% growth. Orders in the transportation sector soared 35.6% (-13.7% y/y) the third consecutive double digit gain. After being down over 70% in April, the sharp rebound in transportation orders now puts transport 15.8% below its February 2020 level. Orders excluding transportation grew 2.4% (-0.9% y/y).

Nondefense capital goods orders less aircraft, which is a forward-looking indicator of capital spending, rose 1.9% (unchanged y/y) and are now down just 0.5% from their February 2020 level. Core orders actually peaked in 2012 and the near-term high occurred in July 2018. Shipments of core capital goods, which is a key component used by the Bureau of Economic Analysis to estimate equipment investment in the GDP report, grew 2.4% in July (-0.5% y/y) and are just 0.4% under their February level (similar to order,s shipments peaked in 2014 with the near-term high in May 2019). In the second quarter GDP report, inflation-adjusted equipment investment dropped at a 37.7% annual rate (-15.5% y/y). This data suggests strong growth in equipment investment in Q3.

The jump in transport orders was supported by motor vehicles which were up 21.9% in July (+5.1% y/y). Meanwhile, aircraft orders continued to show net cancellations, which are reported as a negative order; cancellations have occurred in four out of the last five months. Military shipbuilding, which is not reported in the advanced durable goods report, likely drove transport orders higher. Orders for machinery and fabricated metals, two other large sectors, both grew 2.0% (-3.1% and -6.2% y/y respectively).

Overall shipments of durable goods jumped 7.3% in July (-1.3% y/y). Motor vehicles were up 23.8% (4.8.% y/y) while aircraft eked out a 0.9% gain (-42.9% y/y). Excluding the transportation sector, shipments grew 2.5% (-0.8% y/y).

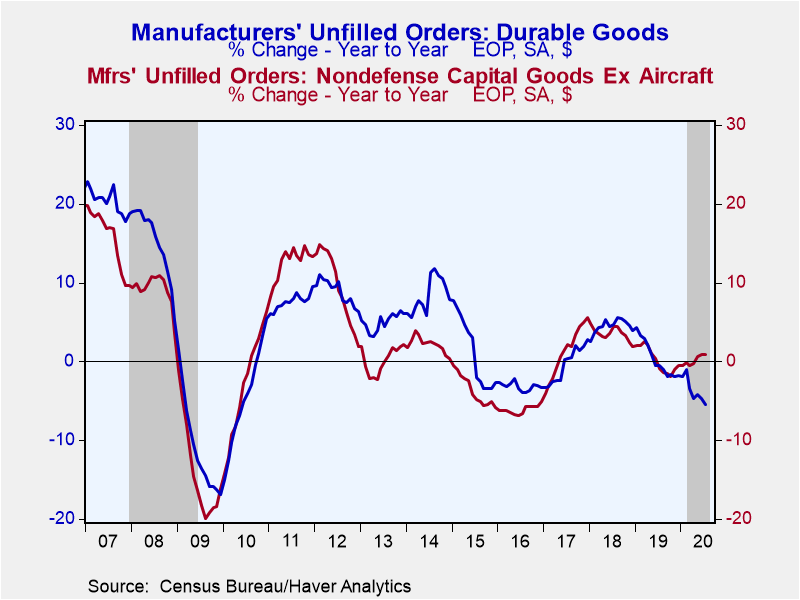

Unfilled orders for durable goods declined 0.8% (-5.5% y/y). Excluding transportation they edged up 0.1% (-0.3% y/y). Inventories of durable goods including and excluding transportation declined 0.5% and 0.7% respectively (+1.4% and -2.6% y/y).

The durable goods figures are available in Haver's USECON database. The Action Economics consensus forecast figure is in the AS1REPNA database.

| Durable Goods NAICS Classification | Jul | Jun | May | Jul Y/Y % | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| New Orders (SA, % chg) | 11.2 | 7.7 | 15.0 | -5.0 | -1.7 | 7.3 | 4.7 |

| Transportation | 35.6 | 19.7 | 78.8 | -13.7 | -5.3 | 9.5 | 4.5 |

| Total Excluding Transportation | 2.4 | 4.0 | 3.4 | -0.9 | 0.3 | 6.0 | 4.8 |

| Nondefense Capital Goods Excl. Aircraft | 1.9 | 4.3 | 1.5 | 0.0 | 1.7 | 4.7 | 3.9 |

| Shipments | 7.3 | 15.2 | 4.1 | -1.3 | 0.6 | 6.8 | 2.3 |

| Nondefense Capital Goods Excl. Aircraft | 2.4 | 3.8 | 1.5 | -0.5 | 2.4 | 5.8 | 0.8 |

| Unfilled Orders | -0.8 | -1.4 | 0.0 | -5.5 | -1.9 | 3.8 | 2.7 |

| Inventories | -0.5 | -0.1 | 0.0 | 1.4 | 4.1 | 5.3 | 3.4 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates