Global| Feb 01 2018

Global| Feb 01 2018TTTTT

by:Sandy Batten

|in:Economy in Brief

Summary

The ISM composite index of business activity in the factory sector fell to 54.1 during December after rising to 59.3 in November. It was the lowest reading since November 2016. A level of 57.8 had been expected in the Action Economics [...]

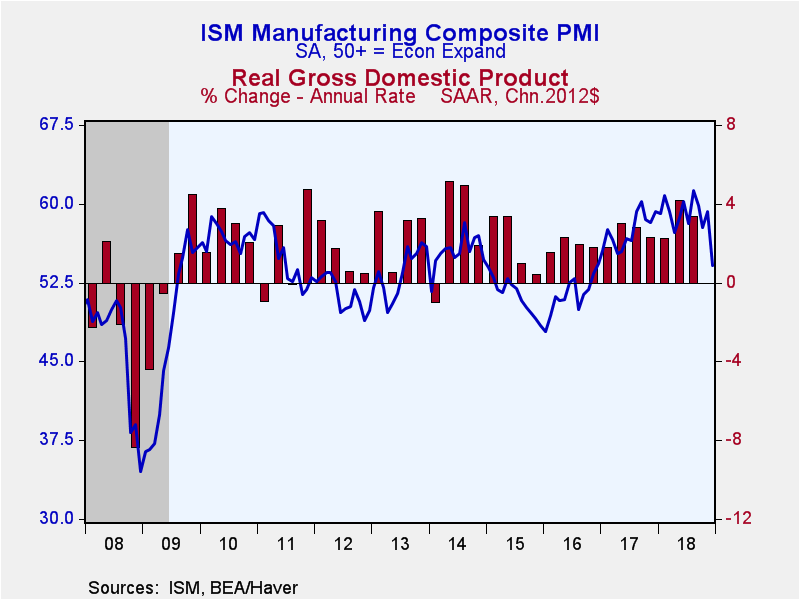

The ISM composite index of business activity in the factory sector fell to 54.1 during December after rising to 59.3 in November. It was the lowest reading since November 2016. A level of 57.8 had been expected in the Action Economics Forecast Survey. During all of 2018, the index averaged 58.8, the highest level since 2004. In the last ten years, there has been a 62% correlation between the index level and q/q growth in real GDP.

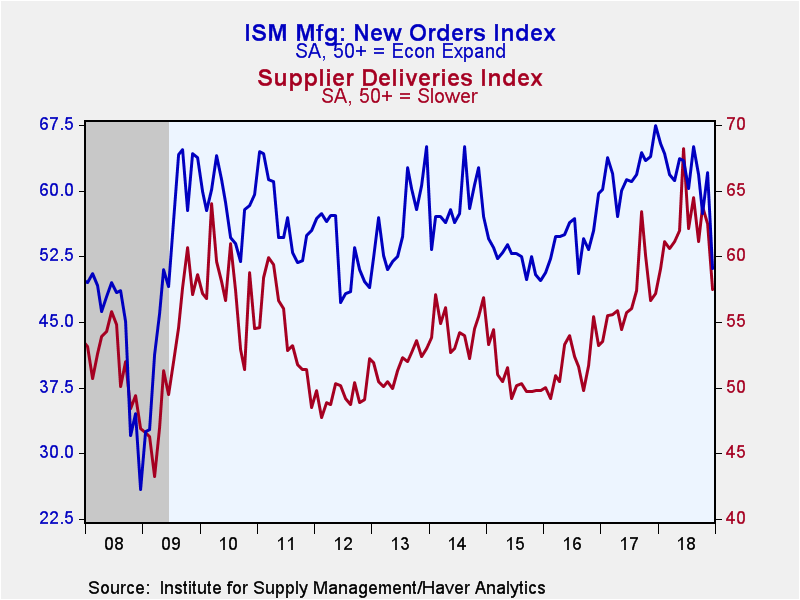

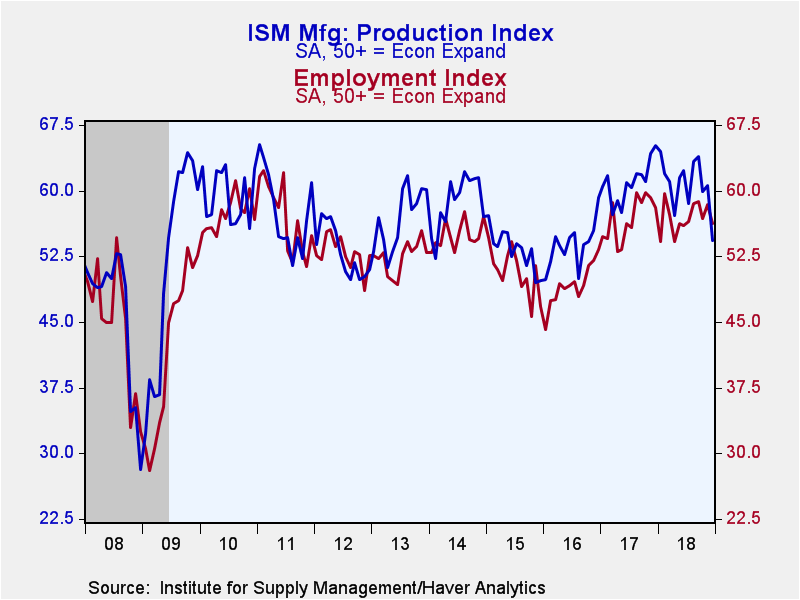

The decline in the overall index was broad-based amongst the component series. The new orders index fell to 51.1. It was the lowest level since August 2016 and down from the December 2017 peak of 67.4. The production component also approximated the 2016 low with a decline to 54.3. The index peaked at 65.2 in December 2017. The supplier delivery index fell sharply to 57.5 and indicated the quickest rate of order fulfillment in twelve months. The inventories index eased to 51.2 and showed a lessened rate of accumulation.

The employment index declined to 56.2, its lowest level in six months. A greatly reduced 19% of respondents reported an increased level of hiring while a fairly steady 11% reported a decline. During the last ten years, there has been an 82% correlation between the index level and the m/m change in factory sector payrolls.

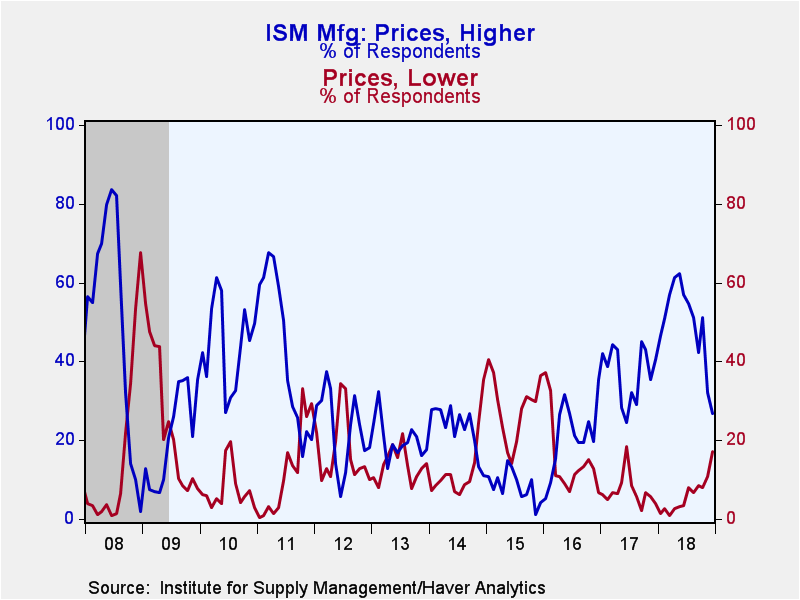

The prices paid index declined to 54.9. That was down from the May high of 79.5 and stood at its lowest level since June 2017. Twenty-seven percent of respondents reported higher prices, roughly half the percentage this past spring. A greatly increased 17% reported paying lower prices.

In the separate indexes of factory sector activity, the export order index was fairly steady m/m at 52.8. That was down, however, from the February high of 62.8. The imports index weakened to the lowest level in just over a year. The order backlog measure declined from its May high to the lowest point in roughly two years.

The ISM figures are diffusion indexes where a reading above 50 indicates expansion. The figures from the Institute for Supply Management can be found in Haver's USECON database; further detail is found in the SURVEYS database. The expectations number is available in Haver's AS1REPNA database.

| ISM Mfg (SA) | Dec | Nov | Oct | Dec'17 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Headline Index | 54.1 | 59.3 | 57.7 | 59.3 | 58.8 | 57.4 | 51.4 |

| New Orders | 51.1 | 62.1 | 57.4 | 67.4 | 61.5 | 62.2 | 54.5 |

| Production | 54.3 | 60.6 | 59.9 | 65.2 | 60.8 | 61.0 | 53.8 |

| Employment | 56.2 | 58.4 | 56.8 | 58.1 | 56.9 | 56.8 | 49.2 |

| Supplier Deliveries | 57.5 | 62.5 | 63.8 | 57.2 | 62.0 | 56.8 | 51.8 |

| Inventories | 51.2 | 52.9 | 50.7 | 48.5 | 52.9 | 50.4 | 47.5 |

| Prices Paid Index (NSA) | 54.9 | 60.7 | 71.6 | 68.3 | 71.7 | 65.0 | 53.1 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates