Global| Jan 22 2008

Global| Jan 22 2008Turmoil in Stock Markets Around the World Leads to a 75 Point Cut in FED'S Benchmark Interest Rate

Summary

After a day of record declines in stock markets around the world, the Fed announced, in an emergency move, a 75 basis points cut in its benchmark interest rate from 4.25% to 3.50% today. This is the largest cut since the Fed began, in [...]

After a day of record declines in stock markets around the world, the Fed announced, in an emergency move, a 75 basis points cut in its benchmark interest rate from 4.25% to 3.50% today. This is the largest cut since the Fed began, in 1990, to use this rate as its principal tool of monetary policy.

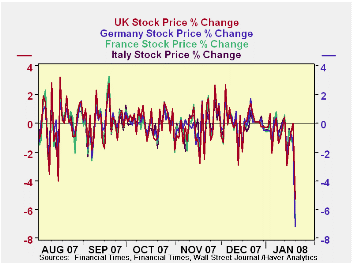

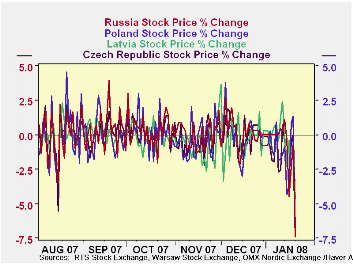

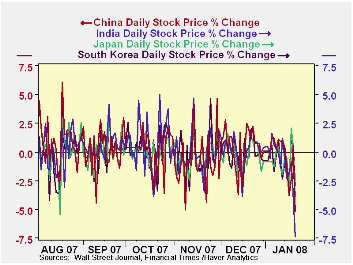

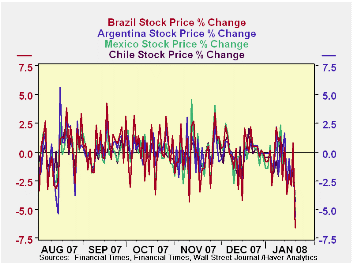

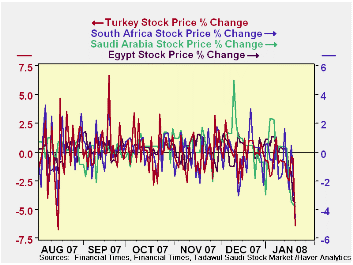

Daily prices of many of the stock markets of the world can be

found in the Haver data base, INTDAILY. We have

attached five charts showing daily stock price changes in selected

countries in five areas of the world: Western Europe, Eastern Europe,

Asia, South America and the Midlle East. The random nature of the day

to day stock price changes make for messy charts, but unusual movements

such as occurred yesterday do stand out. It should be noted, too that

in several countries, similar stock price declines occurred last

August, when the sub prime crisis was first surfacing.

We have

attached five charts showing daily stock price changes in selected

countries in five areas of the world: Western Europe, Eastern Europe,

Asia, South America and the Midlle East. The random nature of the day

to day stock price changes make for messy charts, but unusual movements

such as occurred yesterday do stand out. It should be noted, too that

in several countries, similar stock price declines occurred last

August, when the sub prime crisis was first surfacing.

The reaction of U.S. and foreign investors to the Fed's dramatic move can be monitored using the high frequency data in the Haver data bases, DAILY and INTDAILY. These data bases contain daily data on interest rates, exchange rates, stock markets and commodity prices

| STOCK MARKETS | Percent Decline January 21, 2008 |

|---|---|

| United Kingdom | 5.27 |

| Germany | 7.16 |

| France | 6.83 |

| Italy | 5.09 |

| China | 5.20 |

| India | 7.81 |

| Japan | 3.86 |

| South Korea | 2.95 |

| Russia | 7.38 |

| Poland | 6.73 |

| Latvia | 4.57 |

| Czech Republic | 4.62 |

| Brazil | 6.60 |

| Argentina | 5.68 |

| Mexico | 5.35 |

| Chile | 4.30 |