Global| Sep 04 2014

Global| Sep 04 2014U.S. ADP Employment Increase Eases Slightly

Summary

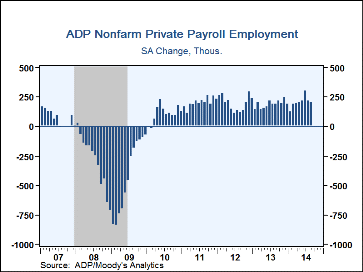

Private sector employment growth eased a bit more last month, but at 204,000 in the ADP/Moody's National Employment Report, it held to the moderate growth range of the last six months. The y/y increase was 2.2%, extending a steady [...]

Private sector employment growth eased a bit more last month, but at 204,000 in the ADP/Moody's National Employment Report, it held to the moderate growth range of the last six months. The y/y increase was 2.2%, extending a steady pace that has prevailed since the middle of 2012. The July jobs gain was revised to 212,000 from 218,000 reported before. The Action Economics Forecast Survey had expected 215,000 net new jobs in August.

The ADP survey is based on ADP's business payroll transaction system covering 411,000 companies and nearly 24 million employees. The data are processed by Moody's Analytics Inc., then calibrated and aligned with the BLS establishment survey data. Extensive information on the methodology is available here.

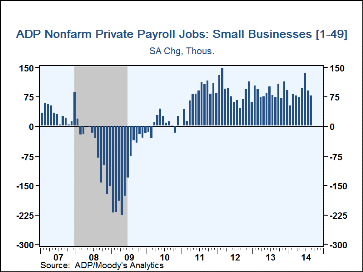

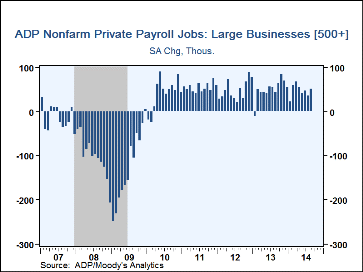

Hiring patterns were mixed by business size. Small businesses' payrolls rose 78,000 in August (+2.2% y/y) after 89,000 in July. Medium-sized firms added 75,000 (1.9% y/y) following 88,000. But large-size company payrolls picked up to a 52,000 increase in August (+2.5% y/y) after 35,000 in July.

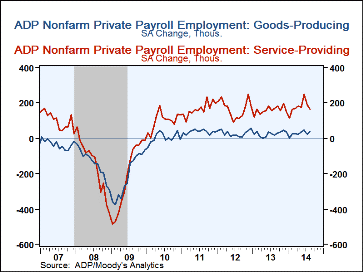

By sector, goods-producing payrolls firmed, gaining 41,000 last month (2.0% y/y), better than July's 23,000. Manufacturing payrolls rose 23,000 (1.0% y/y) after 8,000 in July. Construction industry jobs increased 15,000 (3.9% y/y), just above July's 13,000.

Service-providing payrolls slowed to a 164,000 increase in August (2.2% y/y) from July's 190,000. All three reported industry groups' payrolls had smaller gains than in July: trade, transportation and utilities had 28,000 more jobs in August (2.0%) versus a 41,000 gain in July. Financial activities jobs increased a mere 5,000 in August (0.7% y/y) after 9,000 in July. Professional and business services added 51,000 jobs last month (3.4% y/y) after 60,000 in July.

The ADP National Employment Report data are maintained in Haver's USECON database; historical figures date back to April 2001. The figures in this report cover jobs only in the private sector. The expectation figure is available in Haver's AS1REPNA database.

| ADP/Moody's National Employment Report | Aug | Jul | Jun | Y/Y | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|

| Nonfarm Private Payroll Employment (m/m chg, 000s) | 204 | 212 | 297 | 2.2% | 2.0% | 2.3% | 1.8% |

| Small Payroll (1-49) | 78 | 89 | 133 | 2.2 | 2.1 | 2.5 | 1.1 |

| Medium Payroll (50-499) | 75 | 88 | 117 | 1.9 | 1.6 | 2.0 | 2.0 |

| Large Payroll (>500) | 52 | 35 | 47 | 2.5 | 2.3 | 2.4 | 2.7 |

| Goods-Producing | 41 | 16 | 47 | 2.0 | 1.6 | 2.2 | 1.7 |

| Manufacturing | 23 | 8 | 14 | 1.0 | 0.6 | 1.6 | 1.9 |

| Service-Producing | 164 | 190 | 250 | 2.2 | 2.0 | 2.3 | 1.8 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates