Global| Oct 15 2008

Global| Oct 15 2008U.S. Budget Deficit Widens to Record in Fiscal 2008

Summary

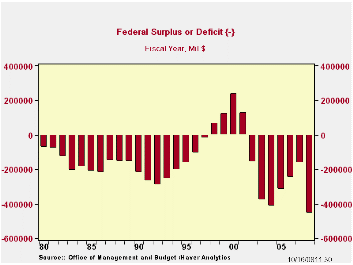

The U.S. government's budget deficit for fiscal year 2008 widened sharply to $454.8B versus a deficit during FY 2007 of $161.5B. Reversing recent trends of strengthening revenues, the deficit spread resulted from an outright decline [...]

The U.S. government's budget deficit for fiscal year 2008 widened sharply to $454.8B versus a deficit during FY 2007 of $161.5B. Reversing recent trends of strengthening revenues, the deficit spread resulted from an outright decline in revenues, while outlays picked up smartly.

As a percentage of GDP the budget deficit last year totaled roughly 3.2%, a contrast to FY07's marginal 1.2%. Receipts were 17.8% of GDP, down from 18.8% and outlays rose to 21.0%.

The Government's financial data are available in Haver's USECON database, with extensive detail available in the specialized GOVFIN.

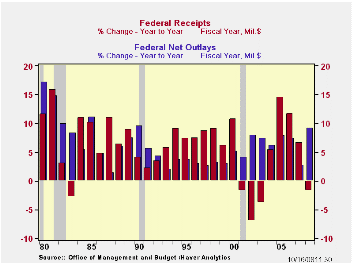

Net revenues last fiscal year fell 1.7%, reversing FY07's 6.7% increase. Both individual income taxes and corporate taxes fell, the former by 1.5% and the latter, 17.8%. The "stimulus" rebates were the main factor in the lower individual taxes, as well as weaker capital gains and less growth in wages and salaries. Corporate taxes were lowered by weakening profits. Also, during the September hurricanes, impacted companies were able to postpone their September tax installments. In contrast, various unemployment and social insurance grew 3.6%, somewhat soft, but well within recent growth ranges.

U.S. government outlays grew just 9.1% during last fiscal year, a significant pickup from 2007's 2.8% rise. Defense spending (19% of total outlays) surged by 13.2%, with both war-related and standard uses contributing. Medicare expenditures (12% of outlays) slowed to "just" a 4.1% increase after the prior 13.8% increase. Social security spending (21% of outlays) also slowed, rising 5.3% from 6.9% in FY07. Net interest payments increased 4.6% in FY08, similar to the previous 5.0%.

| US Government Finance | September | August | Y/Y | FY 2008 | FY 2007 | FY 2006 |

|---|---|---|---|---|---|---|

| Budget Balance | +$45.7B | $-111.9B | +$112.9B (9/07) |

-$454.8B | -$162.8B | -$248.2B |

| Net Revenues | $272.4B | $157.0B | -4.5% | -1.7% | 6.7% | 11.8% |

| Net Outlays | $226.7B | $268.9B | 31.4% | 9.1% | 2.8% | 7.4% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.