Global| Jul 13 2015

Global| Jul 13 2015U.S. Budget Surplus Lowers the Deficit Year-to-Date

by:Tom Moeller

|in:Economy in Brief

Summary

The Federal Government reported a $51.8 billion budget surplus during June compared to a $70.5 billion surplus during June of 2014. A $41.0 billion surplus had been expected in the Action Economics Forecast Survey. For the first nine [...]

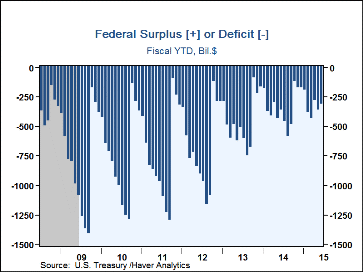

The Federal Government reported a $51.8 billion budget surplus during June compared to a $70.5 billion surplus during June of 2014. A $41.0 billion surplus had been expected in the Action Economics Forecast Survey. For the first nine months of Fiscal Year 2015, the budget deficit eased to $313.4 billion compared to a $365.9 billion deficit in the first nine months of FY 2014. Projections from the Congressional Budget Office call for a budget deficit of $486 billion in FY 2015 compared to $483.4 billion last year, then a $455 billion deficit in FY 2016.

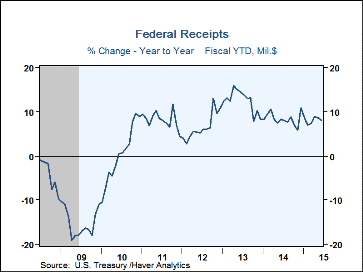

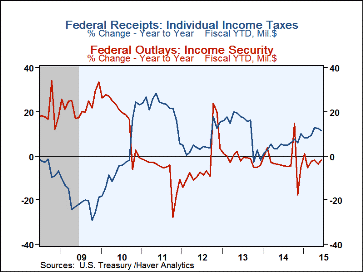

The easing of the budget deficit so far this fiscal year versus FY'14 occurred as June revenues rose 6.0% y/y, leaving overall fiscal year-to-date receipts up 8.3% y/y. So far this fiscal year, individual income taxes increased 11.6% y/y. Growth in corporate income taxes remained strong at 8.7% y/y. Improved labor markets left social insurance taxes & contributions growing 4.0% y/y while excise taxes improved 3.6% y/y.

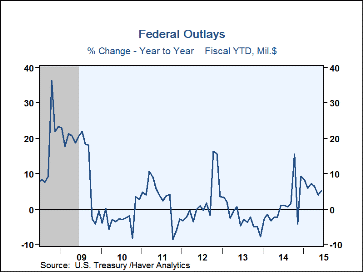

Government spending growth so far this fiscal year decelerated to 5.1% y/y as defense outlays fell 1.7% y/y. Growth in spending on health programs, however, remained firm at 18.4% y/y with the Patient Protection and Affordable Care Act. Spending growth for Education, Training, Employment & Social Services also remained strong at 19.7% y/y. Medicare spending growth recovered 8.0% y/y. Veterans benefits growth picked to 6.1% y/y while Social Security payments growth was steady at 4.4% y/y. Interest payments declined 5.2% y/y.

Haver's basic data on Federal Government outlays and receipts are contained in USECON. Considerable detail is given in the separate GOVFIN database. The Action Economics Forecast Survey numbers are in the AS1REPNA database.

| US Government Finance | Jun | FY'14 | FY'13 | FY'12 | FY'11 | |

|---|---|---|---|---|---|---|

| Budget Balance | -- | $51.8 bil. | $483.4 bil. | $-680.2 bil. | $-1,089.2 bil. | $-1,296.8 bil. |

| As a percent of GDP | -- | -- | 2.8 | 4.1 | 6.8 | 8.4 |

| % of Total | FY'15 YTD | |||||

| Net Revenues (Y/Y % Change) | 100 | 8.3% | 8.9% | 13.3% | 6.4% | 6.5% |

| Individual Income Taxes | 47 | 11.6 | 5.9 | 16.3 | 3.7 | 21.5 |

| Corporate Income Taxes | 10 | 8.7 | 17.3 | 12.9 | 33.8 | -5.4 |

| Social Insurance Taxes | 34 | 4.0 | 8.0 | 12.1 | 3.2 | -5.3 |

| Excise Taxes | 3 | 3.6 | 11.1 | 6.3 | 9.2 | 8.2 |

| Net Outlays (Y/Y % Change) | 100 | 5.1 | 1.4 | -2.4 | -1.7 | 4.1 |

| National Defense | 18 | -1.7 | -4.7 | -6.3 | -3.9 | 1.7 |

| Health | 10 | 18.4 | 14.2 | 3.1 | -7.0 | 1.0 |

| Medicare | 14 | 8.0 | 2.8 | 5.5 | -2.8 | 7.5 |

| Income Security | 16 | - 1.8 | -4.3 | -1.1 | -9.1 | -4.1 |

| Social Security | 24 | 4.4 | 4.6 | 5.2 | 5.8 | 3.4 |

| Veterans Benefits & Services | 4 | 6.1 | 7.7 | 11.5 | -2.0 | 17.3 |

| Education, Training, Employment & Social Services | 3 | 19.7 | 25.9 | -21.9 | -10.3 | -20.6 |

| Interest | 6 | -5.2 | 3.0 | 0.4 | -3.0 | 15.8 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.