Global| Mar 16 2021

Global| Mar 16 2021U.S. Business Inventories Rise for the Seventh Straight Month in January, but at a Decelerating Rate

Summary

• Total business sales jump in January. • Total business inventory-to-sales ratio resumes its downward correction. Total business inventories rose 0.3% during January (-1.8% y/y) following an upwardly revised 0.8% in December (from [...]

• Total business sales jump in January.

• Total business inventory-to-sales ratio resumes its downward correction.

Total business inventories rose 0.3% during January (-1.8% y/y) following an upwardly revised 0.8% in December (from 0.6%). Total business sales jumped 4.7% (7.1% y/y) after a 1.0% (2.7% y/y) rise in December.

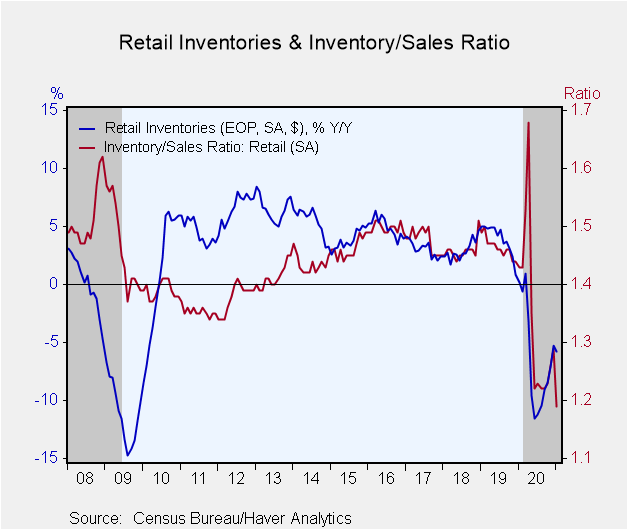

Retail inventories dropped 0.5% in January (-5.8% y/y).

- Auto inventories, which comprise roughly 30% of retail inventories, declined by 1.5% (-17.9% y/y).

- Non-auto retail inventories fell ever so slightly, by 0.1% (+0.7% y/y), the first monthly decline since June of last year.

- General merchandise store inventories, the second largest retail sector, dropped 1.5% but rose 1.1% y/y.

- Department store inventories rose 0.6% (-9.2% y/y). Clothing store inventories were close to unchanged over the month (0.04% but -9.8%% y/y), while furniture inventories gained 2.1% (-5% y/y). Food & beverage store inventories dropped 0.8% (+1.6% y/y).

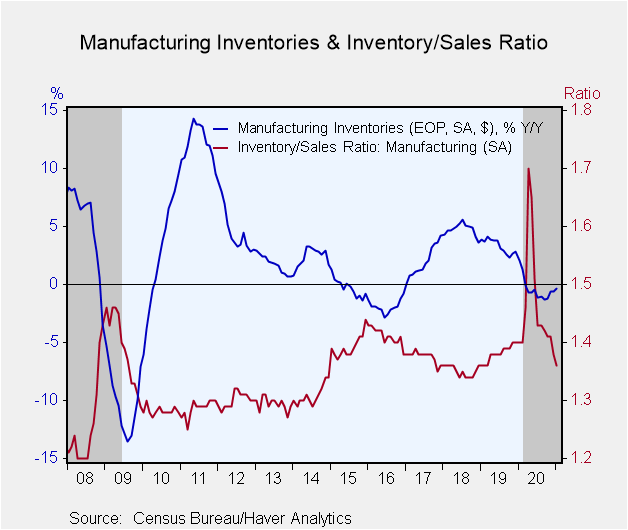

Wholesale inventories rose 1.3% (+0.6% y/y) while factory sector inventories rose 0.1% (-0.4% y/y).

January retail sales jumped 7.4% (+13% y/y) but declined 3.1% m/m (+9.6% y/y) in February.

- Non-auto sales rose 8.2% (12.5% y/y) in January but declined 2.7% (+9.7% y/y) in February.

- Wholesale sector sales rose 4.9% (5.9% y/y) while factory shipments increased 1.9% (2.7% y/y).

The inventory-to-sales (I/S) ratio fell to 1.26 after holding steady at 1.32 for five straight months.

- The inventory-to-sales ratio in the retail sector declined to 1.19 in January from December's 1.29. In April 2020, the retail I/S ratio hit a 26-year high of 1.68.

- The non-auto I/S ratio declined noticeably to 1.08, from 1.17 in December.

- The wholesale sector I/S ratio fell to 1.24, its lowest point since June 2018, and the factory ratio fell to 1.36.

The manufacturing and trade, industrial production and international trade data are in Haver's USECON database (NTI and NTS@USECON).

| Manufacturing & Trade | Jan | Dec | Nov | Jan Y/Y | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Business Inventories (% chg) | 0.3 | 0.8 | 0.5 | -1.8 | -2.4 | 1.7 | 4.9 |

| Retail | -0.5 | 1.7 | 0.7 | -5.8 | -5.3 | 0.9 | 4.6 |

| Retail excl. Motor Vehicles | -0.1 | 1.9 | 0.3 | 0.7 | 1.1 | 1.7 | 3.7 |

| Merchant Wholesalers | 1.3 | 0.6 | 0.0 | 0.6 | -1.4 | 1.4 | 6.5 |

| Manufacturing | 0.1 | 0.3 | 0.8 | -0.4 | -0.6 | 2.8 | 3.6 |

| Business Sales (% chg) | |||||||

| Total | 4.7 | 1.0 | 0.0 | 7.1 | -2.5 | 1.5 | 5.9 |

| Retail | 7.4 | -0.9 | -1.0 | 13.0 | 3.2 | 3.4 | 4.2 |

| Retail excl. Motor Vehicle | 8.1 | -1.7 | -0.8 | 12.5 | 3.8 | 3.3 | 5.1 |

| Merchant Wholesalers | 4.9 | 1.9 | 0.3 | 5.9 | -4.3 | 0.5 | 6.8 |

| Manufacturing | 1.9 | 2.1 | 0.8 | 2.7 | -5.7 | 1.0 | 6.6 |

| I/S Ratio | |||||||

| Total | 1.26 | 1.32 | 1.32 | 1.38 | 1.39 | 1.39 | 1.36 |

| Retail | 1.19 | 1.29 | 1.26 | 1.43 | 1.34 | 1.46 | 1.46 |

| Retail excl. Motor Vehicles | 1.08 | 1.17 | 1.13 | 1.21 | 1.17 | 1.23 | 1.22 |

| Merchant Wholesalers | 1.24 | 1.29 | 1.31 | 1.31 | 1.37 | 1.34 | 1.28 |

| Manufacturing | 1.36 | 1.38 | 1.41 | 1.40 | 1.47 | 1.38 | 1.35 |

Kathleen Stephansen, CBE

AuthorMore in Author Profile »Kathleen Stephansen is a Senior Economist for Haver Analytics and an Independent Trustee for the EQAT/VIP/1290 Trust Funds, encompassing the US mutual funds sponsored by the Equitable Life Insurance Company. She is a former Chief Economist of Huawei Technologies USA, Senior Economic Advisor to the Boston Consulting Group, Chief Economist of the American International Group (AIG) and AIG Asset Management’s Senior Strategist and Global Head of Sovereign Research. Prior to joining AIG in 2010, Kathleen held various positions as Chief Economist or Head of Global Research at Aladdin Capital Holdings, Credit Suisse and Donaldson, Lufkin and Jenrette Securities Corporation.

Kathleen serves on the boards of the Global Interdependence Center (GIC), as Vice-Chair of the GIC College of Central Bankers, is the Treasurer for Economists for Peace and Security (EPS) and is a former board member of the National Association of Business Economics (NABE). She is a member of Chatham House and the Economic Club of New York. She holds an undergraduate degree in economics from the Universite Catholique de Louvain and graduate degrees in economics from the University of New Hampshire (MA) and the London School of Economics (PhD abd).