Global| Apr 15 2021

Global| Apr 15 2021U.S. Business Inventories Rose Again in February, Sales Fell

by:Sandy Batten

|in:Economy in Brief

Summary

• Total business sales fell back in February after jump in January. • Total inventories continued to rise. • Total business inventory-to-sales ratio rose in February after outsized fall in January. Total business inventories rose 0.5% [...]

• Total business sales fell back in February after jump in January.

• Total inventories continued to rise.

• Total business inventory-to-sales ratio rose in February after outsized fall in January.

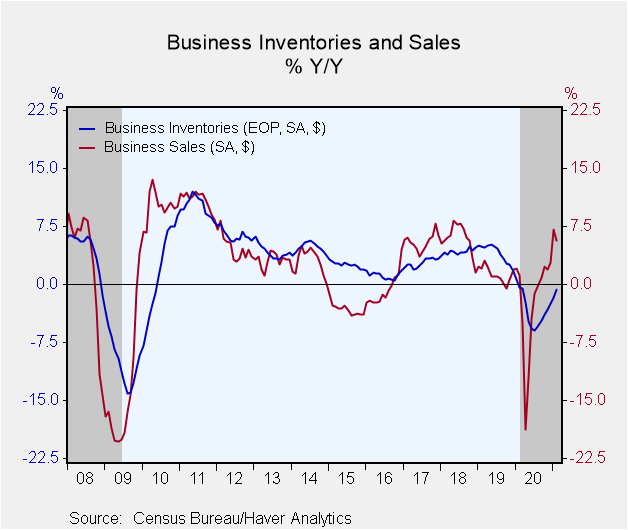

Total business inventories rose 0.5% m/m (-0.7% y/y) in February, their eighth consecutive monthly increase, following a 0.4% m/m gain in January. Total business sales receded 1.9% m/m (+5.7% y/y) in February after having jumped 4.5% m/m in January. This was their first monthly decline in ten months.

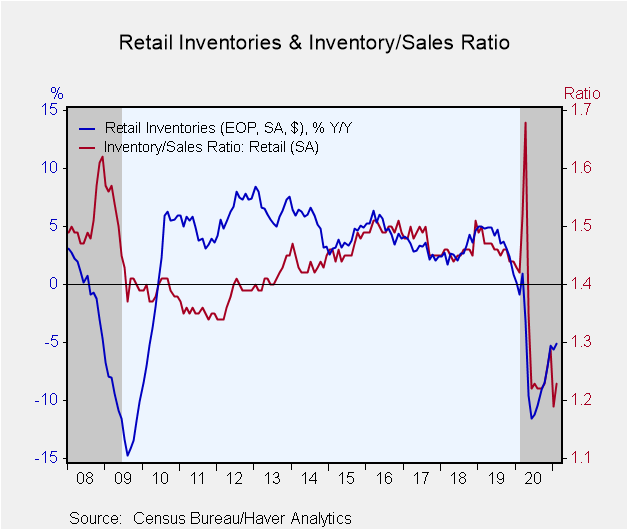

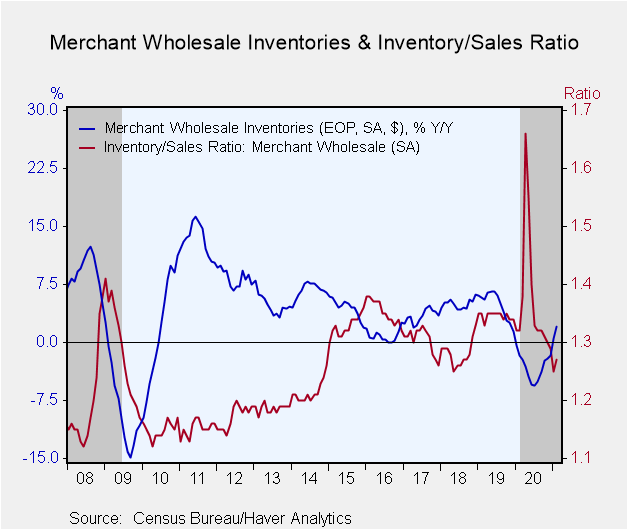

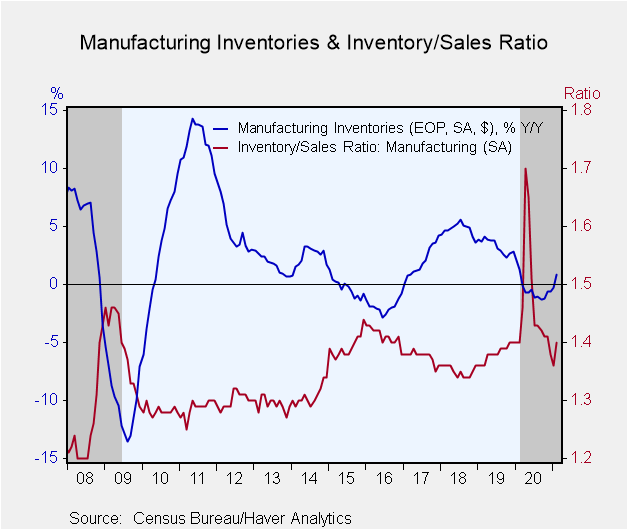

Retail inventories were unchanged in February (-5.1% y/y). This stagnation was due entirely to a 2.6% m/m decline in motor vehicle inventories, which account for about 30% of total inventories. Excluding motor vehicles, other inventories rose 1.2% m/m (2.4% y/y). Furniture inventories were up 2.4% m/m in February, and inventories of building materials and garden supplies increased 2.7% m/m. Wholesale inventories increased 0.6% m/m in February while factory inventories rose 0.8% m/m.

Sales in February were weak across all major sectors. Retails sales plunged 2.8% m/m (+9.9% y/y) in February after a 7.4% m/m jump in January. Extremely severe winter weather played a key role in the February decline. Separately this morning, retail sales were released for March. They exploded 9.8% m/m, driven by another round of government payments to individuals, more normal weather, the accelerating rollout of COVID vaccinations, and a more widespread reopening of the economy. Wholesale sales fell 0.8% m/m in February while factory sales declined 2.0%.

With sales falling while inventories continued to rise, the inventory-to-sales (I/S) ratio rebounded in February, rising to 1.30 after having falling sharply to 1.27 in January. Prior to the January decline, it had held steady at 1.32 for four of the five previous months. The I-S ratio rose in all three sectors: to 1.23 in retail; to 1.27 in wholesale; and to 1.40 in manufacturing.

The manufacturing and trade data are in Haver's USECON database.

| Manufacturing & Trade | Feb | Jan | Dec | Feb Y/Y | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Business Inventories (% chg) | 0.5 | 0.4 | 0.7 | -0.7 | -2.5 | 1.7 | 4.8 |

| Retail | 0.0 | -0.3 | 1.7 | -5.1 | -5.3 | 0.9 | 4.6 |

| Retail excl. Motor Vehicles | 1.2 | 0.2 | 1.9 | 2.4 | 1.1 | 1.7 | 3.7 |

| Merchant Wholesalers | 0.6 | 1.4 | 0.3 | 2.0 | -1.7 | 1.4 | 6.2 |

| Manufacturing | 0.8 | 0.2 | 0.3 | 0.9 | -0.6 | 2.8 | 3.6 |

| Business Sales (% chg) | |||||||

| Total | -1.9 | 4.5 | 0.9 | 5.7 | -2.6 | 1.3 | 5.9 |

| Retail | -2.8 | 7.4 | -0.9 | 9.9 | 3.2 | 3.4 | 4.2 |

| Retail excl. Motor Vehicle | -2.6 | 8.2 | -1.7 | 9.8 | 3.8 | 3.3 | 5.1 |

| Merchant Wholesalers | -0.8 | 4.4 | 1.4 | 6.4 | -4.6 | -0.2 | 6.7 |

| Manufacturing | -2.0 | 1.8 | 2.1 | 1.0 | -5.7 | 1.0 | 6.6 |

| I/S Ratio | |||||||

| Total | 1.30 | 1.27 | 1.32 | 1.38 | 1.39 | 1.40 | 1.36 |

| Retail | 1.23 | 1.19 | 1.29 | 1.42 | 1.34 | 1.46 | 1.46 |

| Retail excl. Motor Vehicles | 1.12 | 1.08 | 1.17 | 1.21 | 1.17 | 1.23 | 1.22 |

| Merchant Wholesalers | 1.27 | 1.25 | 1.29 | 1.32 | 1.38 | 1.35 | 1.28 |

| Manufacturing | 1.40 | 1.36 | 1.38 | 1.40 | 1.47 | 1.38 | 1.35 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.