Global| Jun 12 2014

Global| Jun 12 2014U.S. Business Inventory Increase Again Paced by Wholesale

by:Tom Moeller

|in:Economy in Brief

Summary

Total business inventories increased 0.6% in April (5.0% y/y) after a 0.4% rise during March. It was the firmest monthly increase in six months. Merchant wholesale inventories jumped another 1.1% (6.7% y/y). Inventories in the factory [...]

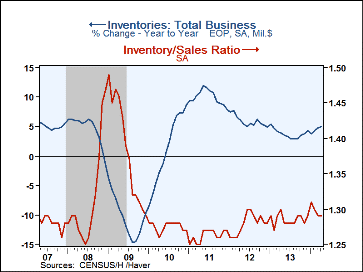

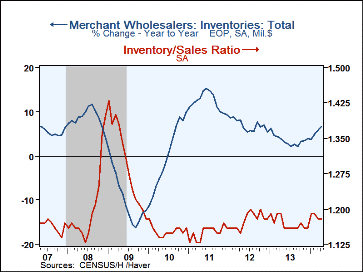

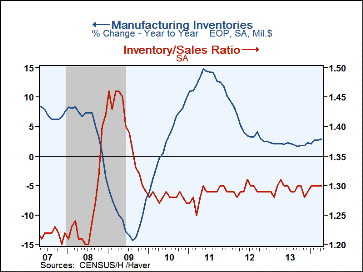

Total business inventories increased 0.6% in April (5.0% y/y) after a 0.4% rise during March. It was the firmest monthly increase in six months. Merchant wholesale inventories jumped another 1.1% (6.7% y/y). Inventories in the factory sector rose 0.4% (2.8%), twice the March increase.

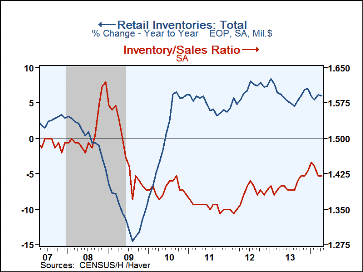

Retail inventories gained 0.5% (6.1% y/y) after a two months of being roughly unchanged. The increase was powered by a 1.2% jump (11.6% y/y) in auto inventories. Nonauto inventories rose 0.2% (3.6% y/y) following a 0.1% March uptick. Inventories of furniture, electronics and appliances jumped 2.5% (5.4% y/y). Food & beverage store inventories gained 0.6% (3.7% y/y) while building materials inventories were roughly unchanged (2.9% y/y). Clothing inventories declined 0.3% (+1.;1% y/y) as general merchandise stockpiles fell 0.4% (3.0% y/y).

The latest inventory gains were accompanied by a firm 0.7% increase (5.4% y/y) in business sales which followed a 1.1% rise during March. Merchant wholesale sales gained 1.3% (7.8% y/y). Retail sales increased a lessened 0.6% (4.7% y/y) and excluding autos sales increased 0.5% (3.1% y/y). Shipments from the factory sector edged 0.3% higher 3.9% y/y).

The overall inventory-to-sales ratio held steady at 1.29, down a bit from the 1.31 January high. The I/S ratio in the wholesale sector was unchanged at 1.18 and in the factory sector it held at 1.30 for the fourth straight month. In the retail sector, the inventory-to-sales ratio held at a lessened 1.42 while the nonauto retail ratio held at 1.23.

The manufacturing and trade data are in Haver's USECON database.

| Manufacturing & Trade (%) | Apr | Mar | Feb | Apr Y/Y | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|

| Business Inventories | 0.6 | 0.4 | 0.5 | 5.0 | 4.3 | 4.9 | 7.9 |

| Retail | 0.5 | 0.1 | -0.1 | 6.1 | 7.1 | 7.4 | 3.7 |

| Retail excl. Motor Vehicles | 0.2 | 0.1 | 0.3 | 3.6 | 3.8 | 3.2 | 3.5 |

| Merchant Wholesalers | 1.1 | 1.1 | 0.7 | 6.7 | 4.0 | 5.5 | 9.2 |

| Manufacturing | 0.4 | 0.2 | 0.7 | 2.8 | 2.3 | 2.4 | 10.2 |

| Business Sales (%) | |||||||

| Total | 0.7 | 1.1 | 0.9 | 5.4 | 3.4 | 4.5 | 10.9 |

| Retail | 0.6 | 1.5 | 0.9 | 4.7 | 4.3 | 5.0 | 7.7 |

| Retail excl. Motor Vehicles | 0.5 | 0.8 | 0.4 | 3.1 | 3.0 | 4.0 | 7.1 |

| Merchant Wholesalers | 1.3 | 1.6 | 0.9 | 7.8 | 4.3 | 4.8 | 12.4 |

| Manufacturing | 0.3 | 0.4 | 1.0 | 3.9 | 2.0 | 4.0 | 12.1 |

| I/S Ratio | |||||||

| Total | 1.29 | 1.29 | 1.30 | 1.30 | 1.28 | 1.28 | 1.26 |

| Retail | 1.42 | 1.42 | 1.44 | 1.40 | 1.40 | 1.38 | 1.36 |

| Retail Excl. Motor Vehicles | 1.23 | 1.23 | 1.24 | 1.22 | 1.22 | 1.21 | 1.23 |

| Merchant Wholesalers | 1.18 | 1.18 | 1.19 | 1.19 | 1.17 | 1.18 | 1.15 |

| Manufacturing | 1.30 | 1.30 | 1.30 | 1.31 | 1.29 | 1.29 | 1.29 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.