Global| May 01 2006

Global| May 01 2006U.S. Construction Again Firm

by:Tom Moeller

|in:Economy in Brief

Summary

The March value of construction put in place increased another 0.9% on top of the 1.0% rise during February and for the second month, the gain was double the Consensus expectation for a 0.4% increase. Residential building jumped 1.6% [...]

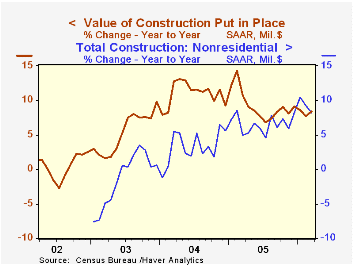

The March value of construction put in place increased another 0.9% on top of the 1.0% rise during February and for the second month, the gain was double the Consensus expectation for a 0.4% increase.

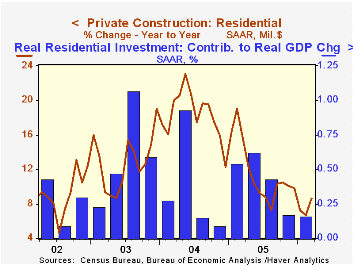

Residential building jumped 1.6% after an unrevised 1.3% February surge. Strength was most pronounced in the value of improvements which jumped 4.5% (-7.0% y/y) while new single family building rose 0.5% (13.5% y/y).

Nonresidential building fell 0.1%, the first decline since last October, and it was led by a 1.7% (+11.2% y/y) drop in office construction. Commercial building rose 0.6% (8.7% y/y) after a huge 3.3% February drop.

Public construction spending rose 0.2% for the second month though construction activity on highways & streets, nearly one third of the value of public construction spending, slipped 0.4% (4.9% y/y).

These more detailed categories represent the Census Bureau’s reclassification of construction activity into end-use groups. Finer detail is available for many of the categories; for instance, commercial construction is shown for Automotive sales and parking facilities, drugstores, building supply stores, and both commercial warehouses and mini-storage facilities. Note that start dates vary for some seasonally adjusted line items in 2000 and 2002 and that constant-dollar data are no longer computed.

| Construction Put-in-place | Mar | Feb | Y/Y | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|

| Total | 0.9% | 1.0% | 8.4% | 9.2% | 10.9% | 5.4% |

| Private | 1.1% | 1.2% | 8.9% | 9.7% | 13.6% | 6.3% |

| Residential | 1.6% | 1.3% | 8.6% | 11.5% | 18.2% | 12.9% |

| Nonresidential | -0.1% | 1.1% | 9.6% | 5.4% | 3.9% | -5.4% |

| Public | 0.2% | 0.2% | 6.6% | 7.6% | 2.5% | 2.7% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.