Global| Sep 24 2013

Global| Sep 24 2013U.S. Consumer Confidence Declines To Lowest Since May

by:Tom Moeller

|in:Economy in Brief

Summary

The Conference Board's Consumer Confidence Index fell to 79.7 this month versus 81.8 during August, last month reported as 81.5. The level of the confidence index peaked at 82.1 in June. Consensus expectations were for a decline to [...]

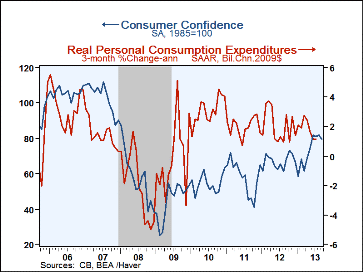

The Conference Board's Consumer Confidence Index fell to 79.7 this month versus 81.8 during August, last month reported as 81.5. The level of the confidence index peaked at 82.1 in June. Consensus expectations were for a decline to 80.0. During the last ten years, there has been a 47% correlation between the level of confidence and the three-month change in real PCE.

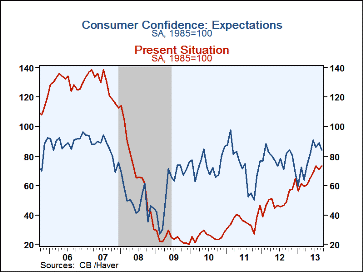

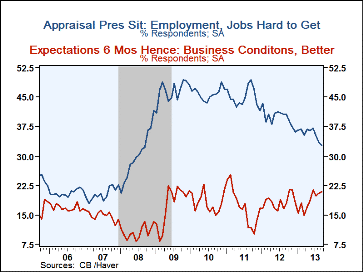

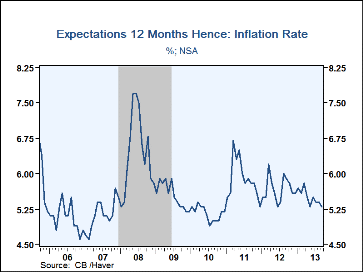

The decline in overall level of confidence was caused by a drop in the consumer expectations reading to 84.1 from 89.0. More respondents thought that income and employment gains would slow during the next six months. Expectations for the inflation rate in twelve months slipped to 5.3%, its lowest level since May. A lessened 66.6% felt interest rates would rise but that still was up sharply from the Q3'12 figure of 45.4%. Plans to buy a new home rose slightly while plans to buy major appliances slipped.

Consumer's assessment of the current economic environment made up most of its August decline with a rise to 73.2, nearly the highest level of the economic recovery. An improved percentage thought that business conditions were good. Labor market conditions also were viewed as good as just 32.7% of respondents thought that jobs were hard to get, the least in five years. However, a raised percentage thought that jobs were not so plentiful, the most also in five years.

The consumer confidence index for those over 55 years fell to its lowest level since May while the reading for those aged 35-54 years slipped moderately from last month's high. Individuals aged less than 35 years grew the most confident since just before the recession.

The Consumer Confidence data is available in Haver's CBDB database.

| Conference Board (SA, 1985=100) | Sep | Aug | Jul | Y/Y % | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|

| Consumer Confidence Index | 79.7 | 81.8 | 81.0 | 16.5 | 67.1 | 58.1 | 54.5 |

| Present Situation | 73.2 | 70.9 | 73.6 | 50.3 | 49.8 | 36.1 | 25.7 |

| Expectations | 84.1 | 89.0 | 86.0 | 3.2 | 78.6 | 72.8 | 73.7 |

| Consumer Confidence By Age Group | |||||||

| Under 35 Years | 111.0 | 104.5 | 106.0 | 20.9 | 86.5 | 77.3 | 70.4 |

| Aged 35-54 Years | 86.2 | 90.0 | 80.5 | 24.7 | 68.5 | 59.8 | 55.1 |

| Over 55 Years | 61.9 | 64.9 | 61.9 | 9.0 | 56.6 | 47.3 | 47.4 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates