Global| Dec 31 2013

Global| Dec 31 2013U.S. Consumer Confidence Rebounds in December

Summary

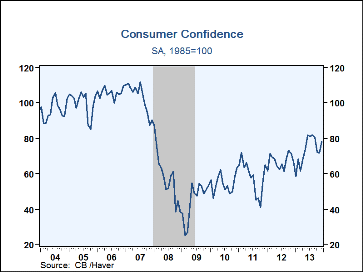

After falling in October and November, consumer confidence recovered in December, picking up to 78.1 (SA, 1985=100) from November's 72.0, which is modestly revised from 70.4 reported initially. The Action Economics consensus expected [...]

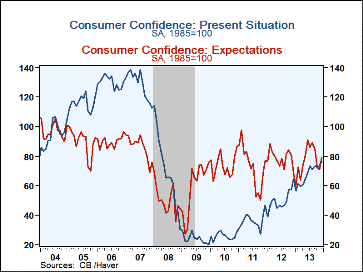

After falling in October and November, consumer confidence recovered in December, picking up to 78.1 (SA, 1985=100) from November's 72.0, which is modestly revised from 70.4 reported initially. The Action Economics consensus expected a comeback to 76.0 in December. Readings improved on both the present situation and expectations, the former up to 76.2 from November's 73.5 with more in expectations, to 79.4 from 71.1 the prior month.

Historically, changes in consumer confidence have been linked to changes in personal consumption. Sure enough, the strengthening in confidence was reflected in more consumers who told the Conference Board they intend to buy homes and appliances in the next six months, a reversal of the drops in those items in November. Plans to buy cars actually edged marginally lower in December, but they had basically held steady in November, so there was no visible whipsaw in that market.

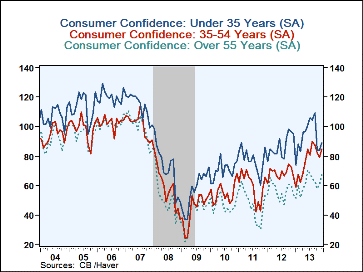

By age group, confidence improved in all three ranges, under 35, 35 to 54 and over 55. The year-on-year comparisons continue to show weakness in the youngest group, still down from December 2012, while the two older age-spans show considerably more optimism than a year ago.

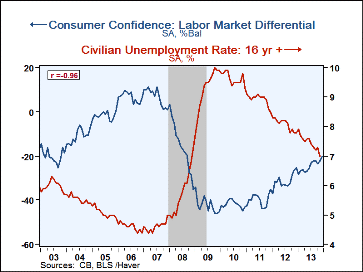

The labor market differential (the difference between respondents' appraisals of jobs plentiful and jobs hard to get) continued to edge up, as fewer people see that jobs are hard to get. Historically, the differential has had a close relationship with the unemployment rate. So, while still well down in negative territory, its continued improvement suggests further improvement in the unemployment rate.

The Consumer Confidence data is available in Haver's CBDB database. The total indexes appear in USECON and the market expectations are in AS1REPNA.

| Conference Board (SA, 1985=100) | Dec | Nov | Oct | Y/Y % | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|

| Consumer Confidence Index | 78.1 | 72.0 | 72.4 | 17.1 | 67.1 | 58.1 | 54.5 |

| Present Situation | 76.2 | 73.5 | 72.6 | 18.0 | 49.8 | 36.1 | 25.7 |

| Expectations | 79.4 | 71.1 | 72.2 | 16.6 | 78.6 | 72.8 | 73.7 |

| Consumer Confidence By Age Group | |||||||

| Under 35 Years | 89.2 | 84.2 | 83.7 | -5.9 | 86.5 | 77.3 | 70.4 |

| Aged 35-54 Years | 84.8 | 79.4 | 82.0 | 28.7 | 68.5 | 59.8 | 55.1 |

| Over 55 Years | 67.3 | 61.0 | 57.9 | 25.6 | 56.7 | 47.3 | 47.4 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates