Global| Nov 09 2009

Global| Nov 09 2009U.S. Consumer Credit Outstanding Continues To Fall

by:Tom Moeller

|in:Economy in Brief

Summary

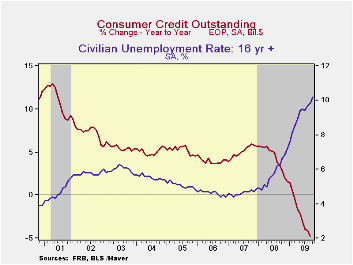

Consumers continue to deleverage as the prospects for employment remain uncertain. The Federal Reserve reported late Friday that consumer credit outstanding fell for the eighth consecutive month during September. It also was the [...]

Consumers

continue to deleverage as the prospects for employment remain

uncertain. The Federal Reserve reported late Friday that consumer

credit outstanding fell for the eighth consecutive month during

September. It also was the twelfth monthly decline since summer, 2008.

The $14.9B drop from August followed declines during the prior two

months which were revised shallower, but the y/y change amounted to a

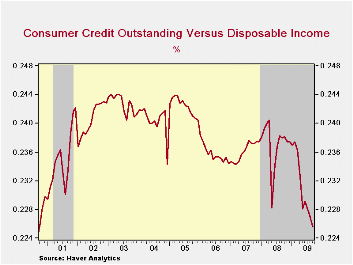

record 4.8% drop. With these declines, consumers have reduced

credit outstanding as a percentage of disposable income to 22.6% from

its 2005 high of 24.4%. This compares to the low near 16% in the

early-1990s.

Consumers

continue to deleverage as the prospects for employment remain

uncertain. The Federal Reserve reported late Friday that consumer

credit outstanding fell for the eighth consecutive month during

September. It also was the twelfth monthly decline since summer, 2008.

The $14.9B drop from August followed declines during the prior two

months which were revised shallower, but the y/y change amounted to a

record 4.8% drop. With these declines, consumers have reduced

credit outstanding as a percentage of disposable income to 22.6% from

its 2005 high of 24.4%. This compares to the low near 16% in the

early-1990s.

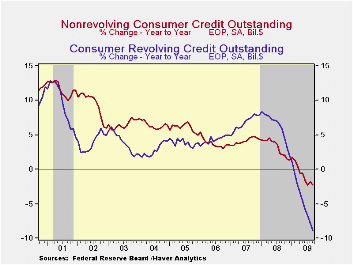

Usage of non-revolving credit (autos &

other consumer durables), which accounts for nearly two-thirds of the

total, fell $4.9B after a slight August increase. The 2.3% y/y decline

was a record. Consumers continued also to cut back on revolving credit

usage. During September it fell a near-record $9.9B for the twelfth

consecutive monthly drop. Year-to-year the 8.8% decline is by far the

record as consumers continued to shy away from liberal spending.

Usage of non-revolving credit (autos &

other consumer durables), which accounts for nearly two-thirds of the

total, fell $4.9B after a slight August increase. The 2.3% y/y decline

was a record. Consumers continued also to cut back on revolving credit

usage. During September it fell a near-record $9.9B for the twelfth

consecutive monthly drop. Year-to-year the 8.8% decline is by far the

record as consumers continued to shy away from liberal spending.

Finance companies (-12.3% y/y), savings institutions (-9.8% y/y),

nonfinancial businesses (-6.4%) and commercial banks (-1.5% y/y have

seen the largest pullbacks in credit extension while credit unions

continue to see positive growth (1.9% y/y).  The Federal government and

Sallie Mae also continued to lend during September and raised credit

outstanding by 23.9% y/y which was the strongest growth rate since

early-2001.· These figures are the major input to the Fed's quarterly

Flow of Funds accounts for the household sector.

The Federal government and

Sallie Mae also continued to lend during September and raised credit

outstanding by 23.9% y/y which was the strongest growth rate since

early-2001.· These figures are the major input to the Fed's quarterly

Flow of Funds accounts for the household sector.

Credit data are available in Haver's USECON database. The Flow of Funds data are in Haver's FFUNDS database.

Monetary Policy Stance: The View From Consumption Spending from the Federal Reserve Bank of St. Louis is available here

| Consumer Credit Outstanding (m/m Chg, SAAR) | September | August | Y/Y | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|

| Total | $-14.8B | $-9.9B | -4.8% | 1.6% | 5.6% | 4.1% |

| Revolving | $-9.9B | $-10.1B | -8.8% | 1.9% | 7.8% | 5.0% |

| Non-revolving | $-4.9B | $0.2B | -2.3% | 1.4% | 4.4% | 3.6% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates