Global| Jan 31 2014

Global| Jan 31 2014U.S. Consumer Spending Continues To Drain Savings

by:Tom Moeller

|in:Economy in Brief

Summary

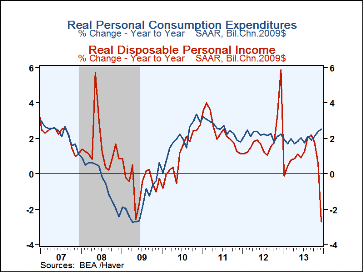

Personal consumption expenditures increased 0.4% (3.6% y/y) last month following an upwardly revised 0.6% November gain. A 0.2% rise had been expected in the Action Economics forecast survey. During all of 2013, spending rose 3.1% [...]

Personal consumption expenditures increased 0.4% (3.6% y/y) last

month following an upwardly revised 0.6% November gain. A 0.2% rise

had been expected in the Action Economics forecast survey. During all of

2013, spending rose 3.1% after a 4.0% gain in 2012. It was the weakest

annual rise of the economic recovery. Motor vehicle purchases declined 4.9%

(+0.2% y/y) while spending on furnishings and household equipment posted a

0.4% decline (3.7% y/y). Clothing purchases jumped 1.2% (3.9% y/y) but

gasoline expenditures increased 4.1% (3.5% y/y) with higher prices.

Services outlays improved 0.4% (3.6% y/y) led by a 0.9% rise (5.1% y/y) in

spending on food services & accommodations. Adjusted for inflation PCE

gained 0.2% (2.5% y/y).

Personal consumption expenditures increased 0.4% (3.6% y/y) last

month following an upwardly revised 0.6% November gain. A 0.2% rise

had been expected in the Action Economics forecast survey. During all of

2013, spending rose 3.1% after a 4.0% gain in 2012. It was the weakest

annual rise of the economic recovery. Motor vehicle purchases declined 4.9%

(+0.2% y/y) while spending on furnishings and household equipment posted a

0.4% decline (3.7% y/y). Clothing purchases jumped 1.2% (3.9% y/y) but

gasoline expenditures increased 4.1% (3.5% y/y) with higher prices.

Services outlays improved 0.4% (3.6% y/y) led by a 0.9% rise (5.1% y/y) in

spending on food services & accommodations. Adjusted for inflation PCE

gained 0.2% (2.5% y/y).

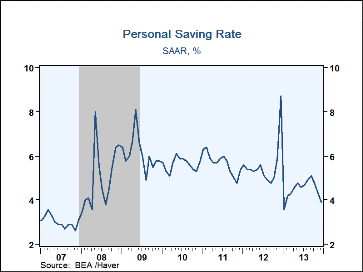

Individuals dipped further into savings to maintain spending. The personal savings rate fell to 3.9% in December from an upwardly revised 4.3% in November. It was the lowest saving rate since January and nearly the lowest since January 2008. The total amount of personal saving was down by more than one-half year-to-year after it spiked late in 2012.

Personal income was unchanged (-0.8% y/y) after a 0.2% November rise. The latest disappointed expectations for another 0.2% rise. Disposable personal income was similarly little changed (-2.7% y/y). Wages & salaries held steady and the 0.6% year-to-year increase was the weakest since December 2008. Rental earnings rose 0.3% (8.4% y/y), interest income gained 0.2% (0.1% y/y) and dividend income ticked up 0.1% (-23.1% y/y). Transfer receipts also nudged up 0.1% (2.4% y/y). These increases were countered by a 0.6% decline (+6.9% y/y) in proprietors' income. Adjusted for price inflation disposable income declined 0.2% (-2.7% y/y).

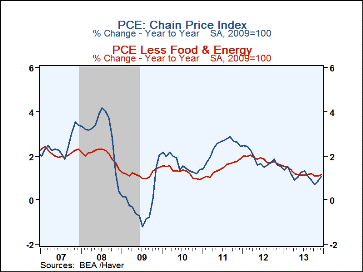

The PCE chain price index increased 0.2% (1.1% y/y) in December, the strongest showing in six months. For all of last year, however, prices increased 1.1%, the weakest rise since a 0.1% slip in 2009. Less food & energy, the chain price index rose a steady 0.1% (1.2% y/y). Here again, it was the weakest annual gain since 2009. Durable goods prices fell 0.4% (-2.1% y/y) led lower by a 0.6% decline (-3.3 y/y) in home furnishings prices. Recreational goods costs were off 0.7% (-5.1% y/y) while motor vehicles prices slipped 0.1% (+0.6% y/y). Nondurable goods prices jumped 0.5% (0.2% y/y) led higher by a 3.3% jump (-1.0% y/y) in gasoline prices. Prices for services gained 0.2% (1.9% y/y).

The personal income & consumption figures are available in Haver's USECON and USNA databases. The consensus expectation figure is in the AS1REPNA database.

| Personal Income & Outlays (%) | Dec | Nov | Oct | Y/Y | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|

| Personal Income | 0.0 | 0.2 | -0.1 | -0.8 | 2.8 | 4.2 | 6.1 |

| Wages & Salaries | 0.0 | 0.5 | 0.1 | 0.6 | 3.0 | 4.3 | 4.1 |

| Disposable Personal Income | -0.0 | 0.1 | -0.2 | -1.7 | 1.9 | 3.9 | 4.8 |

| Personal Consumption Expenditures | 0.4 | 0.6 | 0.1 | 3.6 | 3.1 | 4.1 | 5.0 |

| Personal Saving Rate | 3.9 | 4.3 | 4.8 | 8.7 (Dec'12) |

4.5 | 5.6 | 5.7 |

| PCE Chain Price Index | 0.2 | 0.0 | -0.0 | 1.1 | 1.1 | 1.8 | 2.4 |

| Less Food & Energy | 0.1 | 0.1 | 0.1 | 1.2 | 1.2 | 1.8 | 1.4 |

| Real Disposable Income | -0.2 | 0.1 | -0.2 | -2.7 | 0.7 | 2.0 | 2.4 |

| Real Personal Consumption Expenditures | 0.2 | 0.6 | 0.1 | 2.5 | 2.0 | 2.2 | 2.5 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates