Global| Jun 19 2020

Global| Jun 19 2020U.S. Current Account Deficit Essentially Unchanged in Q1

Summary

• Current account deficit at $104.2 billion, 1.9% of GDP. • Exports and imports of goods and services decline. • Revisions create smaller deficits in recent years, larger ones in past. • Expanded statistics on trade in services. The [...]

• Current account deficit at $104.2 billion, 1.9% of GDP.

• Exports and imports of goods and services decline.

• Revisions create smaller deficits in recent years, larger ones in past.

• Expanded statistics on trade in services.

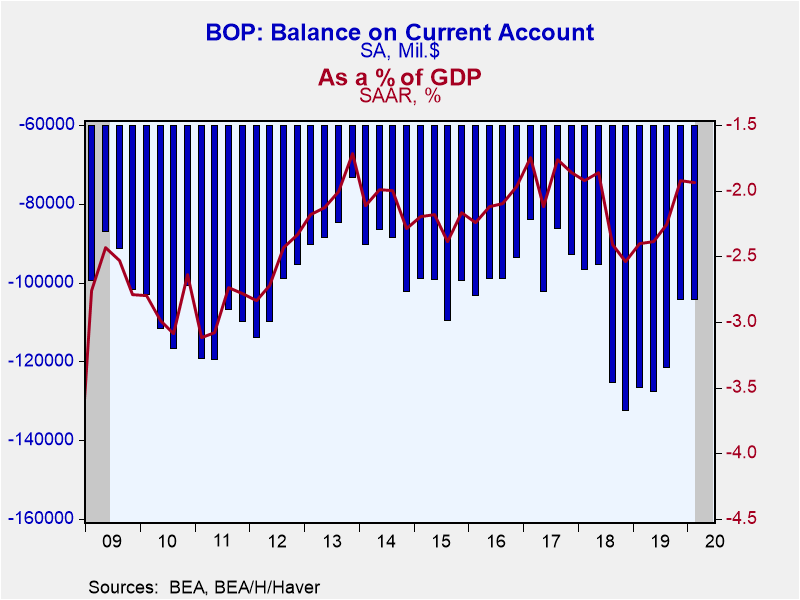

The U.S. current account deficit was relatively unchanged at 104.2 billion during Q1'20 from a downwardly-revised $104.3 billion in Q4'19 (was $109.8). The Action Economics Forecast Survey anticipated a $101.9 billion deficit. As a percent of GDP, the deficit was unchanged at 1.9%. Data was revised back to 1999 and created larger deficits from 2001 to 2011 and smaller deficits since then, with sole exception of 2014. Of particular note was the deficit in 2017 which was revised down by $74.3 billion or 0.4% of GDP.

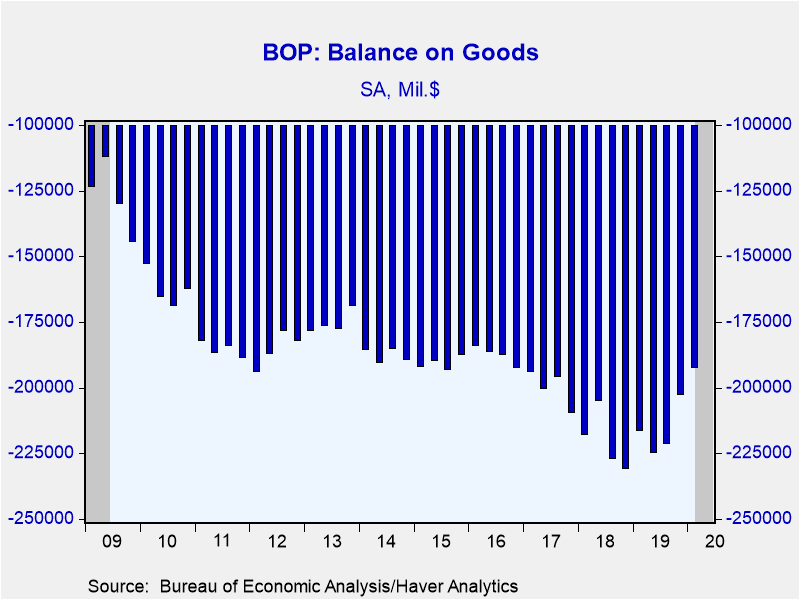

Exports and imports of goods fell by 2.0% and 3.0% respectively (-3.8% and -6.3% year-on-year), partially the result of COVID related drops in U.S. and worldwide consumption and investment; the Bureau of Economic Analysis noted the exact impact of COVID is difficult to measure. This led the goods deficit to narrow by 10.2 billion. Four out of the seven major categories of goods trade improved, led by $6.0 billion gain in the industrial supplies balance. Meanwhile, the nonmonetary gold balance worsened by $2.3 billion.

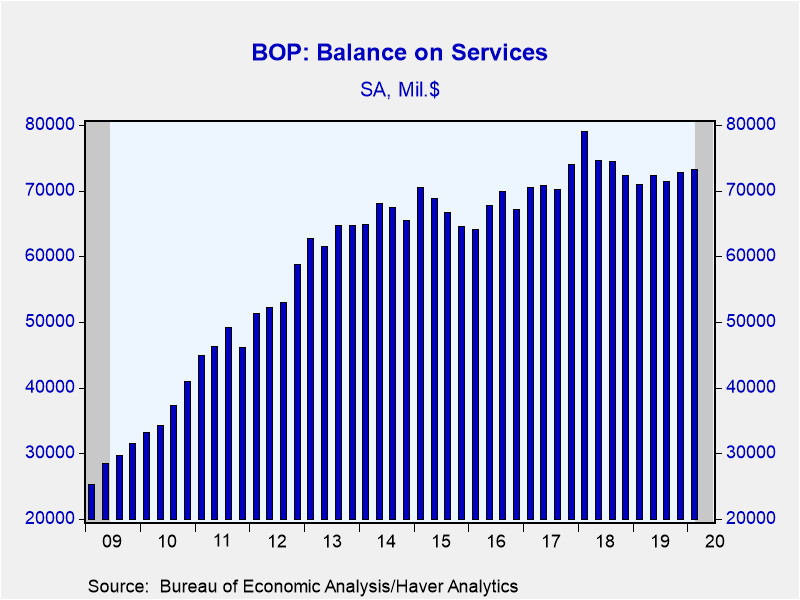

Services exports and imports dropped by 5.3% and 8.3% respectively (-2.7% and -5.6% y/y respectively). This results in a $0.5 billion improvement in the service balance. The role of COVID-19 was most evident in the transport and travel sectors which saw exports drop 10.6% and 19.1% respectively and imports fall 14.5% and 26.3%. Half of the now expanded 12 major categories of service trade improved, led by a $1.5 billion increase in the transport sector. The financial services surplus declined by $931 million. This release included three new major categories of service trade: manufacturing services, construction services, and personal cultural and recreational services. It also expanded the quarterly geographic detail on trade in services from 38 to 90 countries and geographic areas.

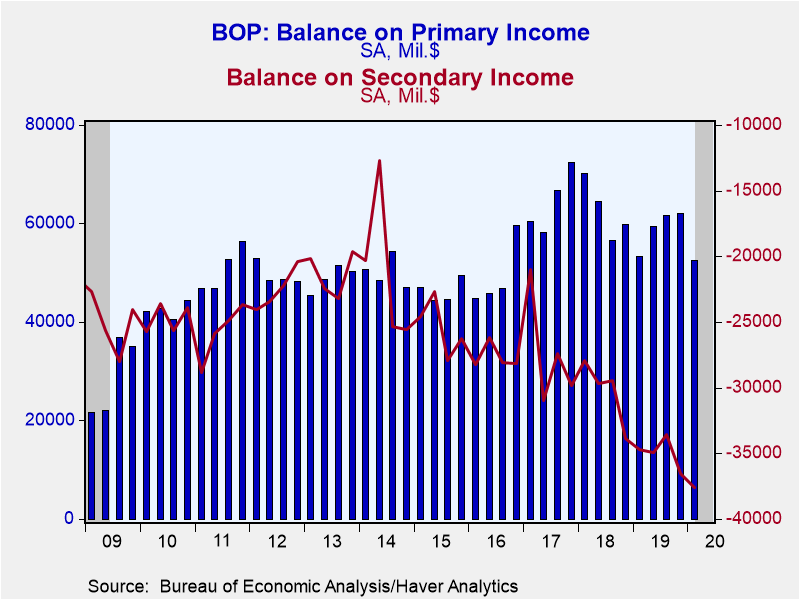

The surplus on primary income fell $9.5 billion to $52.5 billion or 0.24% of GDP; the lower end of the range it's been in for the last ten years. This was the result of a $9.6 billion drop in the investment income balance, which still remains at a healthy $55.5 billion. The deficit on secondary income increased to a record $37.6 billion.

Balance of Payments data are in Haver's USINT database, with summaries available in USECON. The expectations figure is in the AS1REPNA database.

| US Balance of Payments SA | Q1'20 | Q4'19 | Q3'19 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|

| Current Account Balance ($ Billion) | -104.2 | -104.3 | -121.6 | -480.2 | -449.7 | -365.3 |

| Deficit % of GDP | -1.9 | -1.9 | -2.3 | -2.2 | -2.2 | -1.9 |

| Balance on Goods ($ Billion) | -192.3 | -202.5 | -221.1 | -864.3 | -880.3 | -799.3 |

| Exports (% Chg) | -2.0 | 0.1 | 0.0 | -1.5 | 7.7 | 6.8 |

| Imports (% Chg) | -3.0 | -2.9 | -0.6 | -1.6 | 8.5 | 6.8 |

| Balance on Services ($ Billion) | 73.3 | 72.7 | 71.5 | 287.5 | 300.4 | 285.6 |

| Exports (% Chg) | -5.3 | 0.8 | -0.5 | 1.6 | 3.9 | 6.4 |

| Imports (% Chg) | -8.2 | 0.4 | -0.1 | 4.7 | 3.2 | 6.4 |

| Balance on Primary Income ($ Billion) | 52.5 | 62.0 | 61.6 | 236.3 | 251.2 | 257.8 |

| Balance on Secondary Income ($ Billion) | -37.6 | -36.5 | -33.6 | -139.7 | -120.9 | -109.3 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates